Hertz Global Holdings Inc (HTZ) Faces Financial Headwinds in Q1 2024, Misses Analyst Estimates

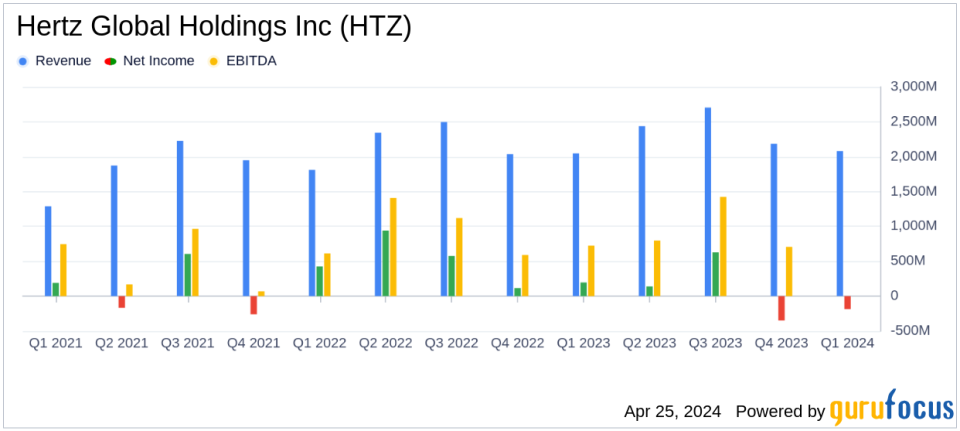

Revenue: Reported at $2.1 billion, up 2% year-over-year, slightly exceeding estimates of $2038.99 million.

Net Loss: Posted a GAAP net loss of $186 million, compared to a net income of $196 million in the previous year, falling significantly below the estimated net loss of $147.20 million.

Earnings Per Share (EPS): Recorded a loss of $0.61 per diluted share, underperforming against the estimated loss of $0.44 per share.

Adjusted Net Loss: Deepened to $392 million from an adjusted net income of $126 million in the prior year, indicating a substantial downturn in profitability.

Corporate EBITDA: Adjusted Corporate EBITDA turned negative at $567 million, a stark contrast to a positive $237 million last year, reflecting increased operational challenges.

Operating Cash Flow: GAAP operating cash flow was $370 million, but adjusted operating cash outflow expanded to $697 million, highlighting increased cash burn in operations.

Liquidity: Corporate liquidity stood at $1.3 billion as of March 31, 2024, crucial for navigating through current financial strains.

Hertz Global Holdings Inc (NASDAQ:HTZ) disclosed its financial results for the first quarter of 2024 on April 25, 2024, revealing a challenging period for the company. The detailed earnings can be accessed through their 8-K filing. The company, a prominent player in the vehicle rental and leasing industry operating under the Hertz, Dollar, Thrifty, and Firefly brands, reported a net loss significantly diverging from analyst expectations.

Financial Performance Overview

For Q1 2024, Hertz reported revenues of $2.1 billion, a slight increase from $2.047 billion in the same quarter the previous year, aligning with an estimated revenue of $2038.99 million. However, the company faced a substantial net loss of $186 million compared to a net income of $196 million in Q1 2023. This result was far below the estimated net income loss of $147.20 million. The earnings per share (EPS) stood at -$0.61, missing the forecast of -$0.44.

Adjusted net loss was reported at $392 million, and adjusted EPS was -$1.28. The adjusted Corporate EBITDA also reflected significant challenges, recording a negative $567 million, influenced heavily by a $588 million increase in vehicle depreciation, including a $195 million charge related to Electric Vehicles (EVs) held for sale.

Operational Challenges and Strategic Adjustments

Hertz's CEO, Gil West, highlighted the operational difficulties faced during the quarter, primarily attributed to fleet and direct operating costs. West emphasized the company's strategic focus on optimizing vehicle supply at sustainable capital costs and enhancing productivity to counteract operating cost pressures. The company is also aiming to improve customer experience amidst robust travel demand.

We're tackling both issues - getting to the right supply of vehicles at an acceptable capital cost while at the same time driving productivity up and operating costs down. These, along with creating a superior customer experience, will be our focus as we position ourselves to take advantage of strong travel demand in this transition year. We've put the right strategy in place, and I see a clear path for Hertz to generate sustainable and higher earnings for our shareholders," said Gil West.

Segment Performance and Future Outlook

The Americas RAC segment, Hertz's primary revenue generator, experienced a modest revenue increase to $1.739 billion from $1.730 billion year-over-year. However, adjusted EBITDA in this segment turned negative, reflecting broader operational challenges. The International RAC segment saw an 8% increase in revenue, yet also faced a downturn in adjusted EBITDA.

Looking ahead, Hertz plans to continue its fleet refresh initiatives and implement revenue and cost strategies aimed at bolstering future profitability. The company's focus remains on navigating the current economic pressures while preparing for an upturn in travel activities.

Investor and Analyst Perspectives

Investors and analysts may have concerns about the near-term challenges Hertz faces, particularly around vehicle depreciation costs and the impact on profitability. However, the strategic measures outlined by management to address these issues could set the stage for recovery as market conditions improve.

For further details on Hertz's financial strategies and operational adjustments, interested parties can access the earnings webcast and conference call held on April 25, 2024, through the company's investor relations website.

Hertz's Q1 2024 results underscore the volatile nature of the rental and leasing market, influenced by economic factors and consumer trends. Stakeholders will likely monitor the company's progress closely in the coming quarters to assess the effectiveness of its strategic initiatives in reversing the current downturn.

Explore the complete 8-K earnings release (here) from Hertz Global Holdings Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance