Hershey (HSY) to Report Q3 Earnings: Things to Keep in Mind

The Hershey Company HSY is likely to register an improvement in the top and the bottom line when it reports third-quarter 2021 numbers on Oct 28. The Zacks Consensus Estimate for quarterly revenues is pegged at $2,307 million, which suggests growth of 3.9% from the figure reported in the prior-year quarter. In the last reported quarter, the company witnessed a 16.5% increase in revenues.

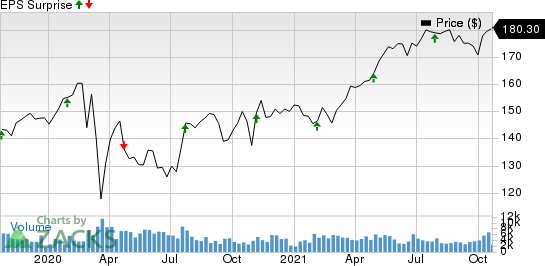

The Zacks Consensus Estimate for quarterly earnings has moved up by a cent to $2 per share in the past 30 days. The figure suggests an increase of 7.5% from the year-ago quarter’s reported number. The manufacturer and marketer of food and beverage products has a trailing four-quarter earnings surprise of 5.6%, on average. In the last reported quarter, the company delivered an earnings surprise of 3.5%.

Hershey Company The Price and EPS Surprise

Hershey Company The price-eps-surprise | Hershey Company The Quote

Things to Note

Hershey’s focus on product innovation, effective pricing initiatives and strategic buyouts has been supporting performance. The recent buyout of Lily's Sweets further strengthens the company’s position in the industry. It has been steadily expanding in the better-for-you confection category to meet consumers’ changing preferences. Cumulatively, these factors are likely to have favorably impacted the top line.

The company is also benefiting from recovery in away-from-home consumption and international markets. Along with this, sustained elevated at-home consumption has been contributing to the upside.

That said, management in its last earnings call, highlighted that it expects growth in away-from-home consumption to moderate in the second half of the year, thanks to lapping of increased mobility in the year-ago period. The company also stated that it expects Retail and Distributor inventory related tailwind to moderate during the back half of the year.

We note that Hershey has been grappling with cost inflation along with higher supply-chain expenses. Management, in its earnings call, highlighted that it expects to see increased packaging and freight costs as well as escalated labor expenses in the second half of the year.

Consequently, such high costs are likely to have hit margins. Higher selling, marketing and administrative costs are also a concern.

What the Zacks Model Unveils

Our proven model predicts an earnings beat for Hershey this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Hershey carries a Zacks Rank #2 and an Earnings ESP of +1.02%.

More Stocks With Favorable Combinations

Here are some more companies that you may want to consider as our model shows that these have the right combination of elements to post an earnings beat.

Tyson Foods, Inc. TSN currently has an Earnings ESP of +19.13% and a Zacks Rank of 3. You can see the complete list of today’s Zacks #1 Rank stocks here.

US Foods Holding Corp. USFD currently has an Earnings ESP of +5.26% and a Zacks Rank of 3.

Hormel Foods Corporation HRL currently has an Earnings ESP of +1.59% and carries a Zacks Rank #3.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hershey Company The (HSY) : Free Stock Analysis Report

Hormel Foods Corporation (HRL) : Free Stock Analysis Report

Tyson Foods, Inc. (TSN) : Free Stock Analysis Report

US Foods Holding Corp. (USFD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance