The Heritage Cannabis Holdings (CSE:CANN) Share Price Is Up 191% And Shareholders Are Boasting About It

Heritage Cannabis Holdings Corp. (CSE:CANN) shareholders might be concerned after seeing the share price drop 22% in the last quarter. But that doesn't change the fact that the returns over the last three years have been very strong. Indeed, the share price is up a very strong 191% in that time. So the recent fall in the share price should be viewed in that context. Only time will tell if there is still too much optimism currently reflected in the share price.

View our latest analysis for Heritage Cannabis Holdings

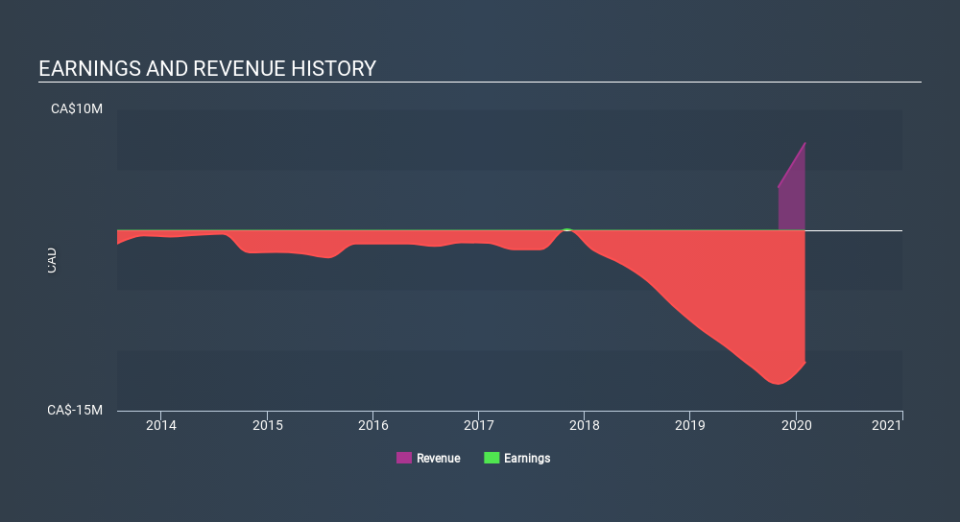

Because Heritage Cannabis Holdings made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

Heritage Cannabis Holdings shareholders are down 61% for the year, falling short of the market return. Meanwhile, the broader market slid about 8.9%, likely weighing on the stock. Fortunately the longer term story is brighter, with total returns averaging about 43% per year over three years. Sometimes when a good quality long term winner has a weak period, it's turns out to be an opportunity, but you really need to be sure that the quality is there. It's always interesting to track share price performance over the longer term. But to understand Heritage Cannabis Holdings better, we need to consider many other factors. Even so, be aware that Heritage Cannabis Holdings is showing 3 warning signs in our investment analysis , and 1 of those doesn't sit too well with us...

Heritage Cannabis Holdings is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance