Here's Why UMB Financial (UMBF) is a Must-Buy Stock Right Now

UMB Financial Corporation UMBF is gaining from a solid loan and deposit balance. Its capital distribution moves seem sustainable, supported by the solid liquidity position. Hence, adding the stock to your portfolio now seems a wise idea.

The Zacks Consensus Estimate for UMB Financial’s 2024 and 2025 earnings have been revised upward by 14.4% and 16.3%, respectively, over the past 60 days, indicating that analysts are optimistic regarding its earnings growth potential. UMBF currently sports a Zacks Rank #1 (Strong Buy).

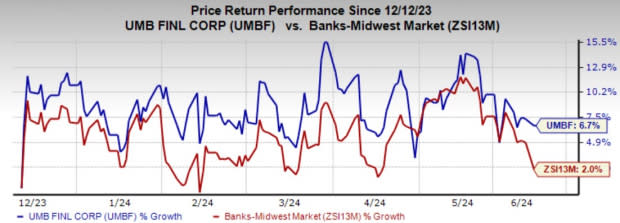

Over the past six months, the company’s shares have gained 6.7% compared with the industry’s growth of 2%.

Image Source: Zacks Investment Research

Now, let’s discuss some of the important factors that make UMBF stock worth a look.

Revenue Growth: UMB Financial has been witnessing steady revenue growth. The company’s revenues witnessed a compound annual growth rate (CAGR) of 7.6% in the last five years (2018-2023). Further, the company’s loans and deposits saw a CAGR of 13% and 9.8%, respectively, in the last three years (2019-2023). The strong loan and deposit balances are likely to support financials.

The company’s net interest income (NII) witnessed a CAGR of 8.2% over the last four years (ended 2023). The Federal Reserve’s signal to keep rates high in the coming quarters, along with decent loan demand, will support NII in the upcoming period.

UMB Financial has shifted its focus toward expanding operations into non-interest revenue streams to decrease reliance on spread income. Non-interest income witnessed a CAGR of 6.2% in the last four years (ended 2023). The company's investments in revenue-generating capabilities are expected to strengthen top-line growth. Going forward, UMBF's diverse range of business lines and verticals will continue to contribute to its non-interest income.

Earnings Growth: UMB Financial’s earnings have witnessed growth of 19.51% over the past three to five years. The company’s earnings are projected to increase 0.5% in 2024 and 9.16% in 2025.

Robust Balance Sheet: As of Mar 31, 2024, UMB Financial’s total debt was $2.18 billion, while cash and dues from the bank and interest-bearing deposits with banks were $7.03 billion. The company has a decent liquidity position and is expected to meet its debt obligations even during the current economic volatility.

Further, the company’s debt-to-equity ratio of 0.12 is below the industry average of 0.31. This reflects UMBF’s strong liquidity profile.

Impressive Capital Distribution: UMBF has an attractive capital distribution plan. Since 2002, the company has been raising dividends annually, with the most recent hike of 2.6% announced in October 2023.

UMB Financial has a share repurchase plan as well. In the first quarter of 2024, the company approved the repurchase of up to one million shares of its common stock. These can take place at any point in time until its termination, following the 2025 annual meeting of the company’s shareholders.

Given its solid liquidity and a favorable debt-to-equity ratio compared with the industry, UMBF’s capital-distribution activities seem sustainable.

Other Stocks to Consider

Some other top-ranked stocks from the finance space are First Financial Bancorp. FFBC and Northrim BanCorp, Inc. NRIM, each sporting a Zacks Rank #1 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

FFBC’s 2024 earnings estimates have increased 5.2% over the past 60 days. Shares of First Financial have lost 3.1% in the past three months.

NRIM’s 2024 earnings estimates have increased 12.2% over the past 60 days. Shares of Northrim BanCorp have gained 9.8% in the past three months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

First Financial Bancorp. (FFBC) : Free Stock Analysis Report

UMB Financial Corporation (UMBF) : Free Stock Analysis Report

Northrim BanCorp Inc (NRIM) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance