Here's Why We Think Pembina Pipeline (TSE:PPL) Is Well Worth Watching

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Pembina Pipeline (TSE:PPL). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

See our latest analysis for Pembina Pipeline

Pembina Pipeline's Earnings Per Share Are Growing.

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). It's no surprise, then, that I like to invest in companies with EPS growth. Who among us would not applaud Pembina Pipeline's stratospheric annual EPS growth of 41%, compound, over the last three years? Growth that fast may well be fleeting, but like a lotus blooming from a murky pond, it sparks joy for the wary stock pickers.

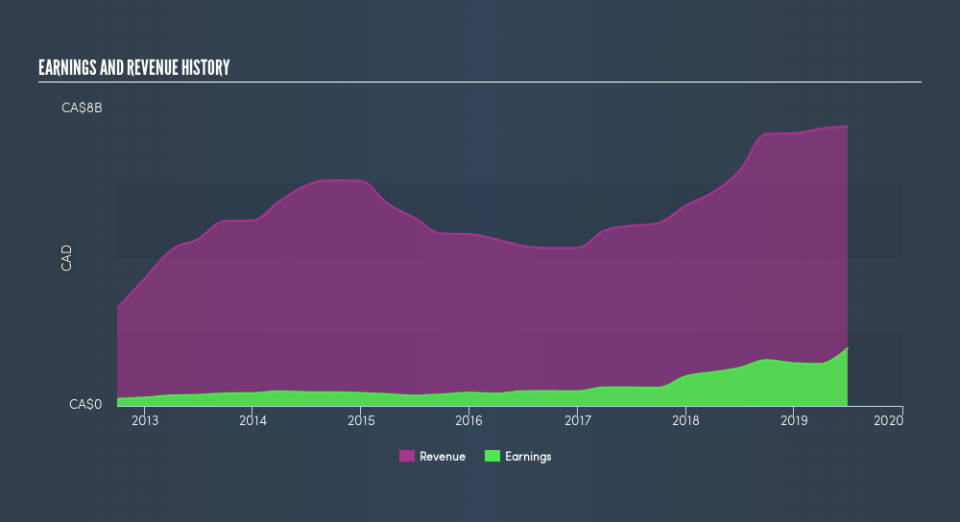

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Pembina Pipeline maintained stable EBIT margins over the last year, all while growing revenue 19% to CA$7.5b. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Fortunately, we've got access to analyst forecasts of Pembina Pipeline's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Pembina Pipeline Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

While Pembina Pipeline insiders did net -CA$2.1m selling stock over the last year, they invested CA$2.8m, a much higher figure. On balance, to me, this signals their optimism. Zooming in, we can see that the biggest insider purchase was by President Michael Dilger for CA$2.5m worth of shares, at about CA$49.22 per share.

On top of the insider buying, it's good to see that Pembina Pipeline insiders have a valuable investment in the business. To be specific, they have CA$59m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. Despite being just 0.2% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

While insiders are apparently happy to hold and accumulate shares, that is just part of the pretty picture. That's because on our analysis the CEO, Mick Dilger, is paid less than the median for similar sized companies. I discovered that the median total compensation for the CEOs of companies like Pembina Pipeline, with market caps over CA$11b, is about CA$9.0m.

Pembina Pipeline offered total compensation worth CA$7.1m to its CEO in the year to December 2018. That comes in below the average for similar sized companies, and seems pretty reasonable to me. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Should You Add Pembina Pipeline To Your Watchlist?

Pembina Pipeline's earnings have taken off like any random crypto-currency did, back in 2017. Just as heartening; insiders both own and are buying more stock. Because of the potential that it has reached an inflection point, I'd suggest Pembina Pipeline belongs on the top of your watchlist. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if Pembina Pipeline is trading on a high P/E or a low P/E, relative to its industry.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Pembina Pipeline, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance