Here's Why I Think Genie Energy (NYSE:GNE) Is An Interesting Stock

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

So if you're like me, you might be more interested in profitable, growing companies, like Genie Energy (NYSE:GNE). While profit is not necessarily a social good, it's easy to admire a business than can consistently produce it. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

View our latest analysis for Genie Energy

Genie Energy's Earnings Per Share Are Growing.

As one of my mentors once told me, share price follows earnings per share (EPS). That makes EPS growth an attractive quality for any company. As a tree reaches steadily for the sky, Genie Energy's EPS has grown 31% each year, compound, over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

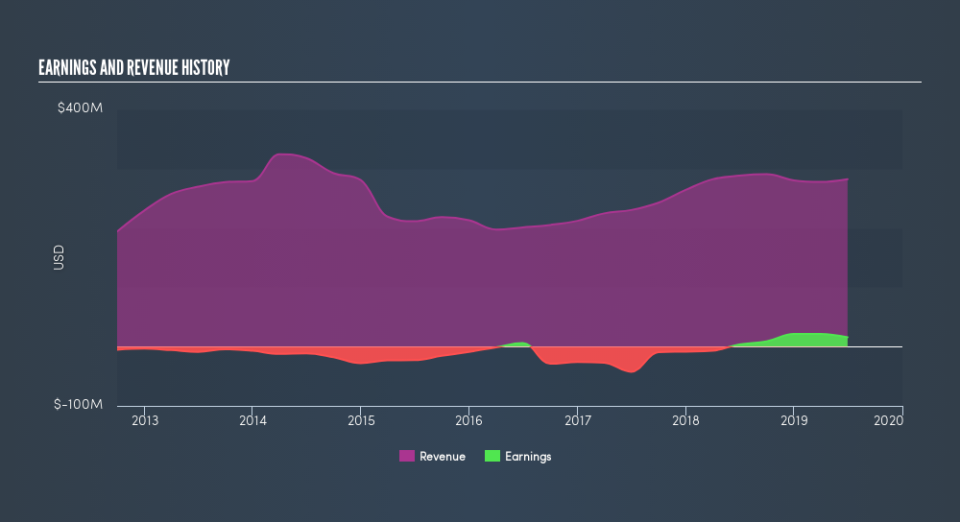

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. I note that Genie Energy's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. To cut to the chase Genie Energy's EBIT margins dropped last year, and so did its revenue. That is, not a hint of euphemism here, suboptimal.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Since Genie Energy is no giant, with a market capitalization of US$197m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Genie Energy Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

First things first; I didn't see insiders sell Genie Energy shares in the last year. But the really good news is that Vice Chairman of the Board James Courter spent US$397k buying stock stock, at an average price of around US$7.01. To me that means at least one insider thinks that the company is doing well - and they are backing that view with cash.

On top of the insider buying, we can also see that Genie Energy insiders own a large chunk of the company. In fact, they own 44% of the shares, making insiders a very influential shareholder group. I'm always comforted by solid insider ownership like this, as it implies that those running the business are genuinely motivated to create shareholder value. With that sort of holding, insiders have about US$86m riding on the stock, at current prices. That's nothing to sneeze at!

Should You Add Genie Energy To Your Watchlist?

You can't deny that Genie Energy has grown its earnings per share at a very impressive rate. That's attractive. Better still, insiders own a large chunk of the company and one has even been buying more shares. So it's fair to say I think this stock may well deserve a spot on your watchlist. Now, you could try to make up your mind on Genie Energy by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Genie Energy, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance