Here's Why We Think Cheniere Energy (NYSEMKT:LNG) Is Well Worth Watching

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Cheniere Energy (NYSEMKT:LNG). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

See our latest analysis for Cheniere Energy

How Fast Is Cheniere Energy Growing Its Earnings Per Share?

In a capitalist society capital chases profits, and that means share prices tend rise with earnings per share (EPS). So like a ray of sunshine through a gap in the clouds, improving EPS is considered a good sign. It is therefore awe-striking that Cheniere Energy's EPS went from US$1.01 to US$3.46 in just one year. Even though that growth rate is unlikely to be repeated, that looks like a breakout improvement. But the key is discerning whether something profound has changed, or if this is a just a one-off boost.

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. I note that Cheniere Energy's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. Cheniere Energy shareholders can take confidence from the fact that EBIT margins are up from 23% to 32%, and revenue is growing. That's great to see, on both counts.

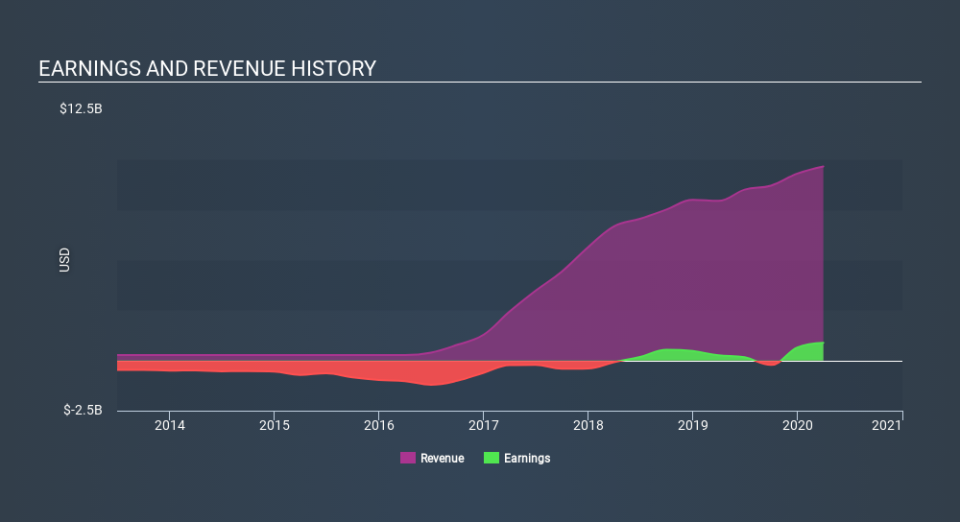

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Cheniere Energy.

Are Cheniere Energy Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We do note that, in the last year, insiders sold -US$120.4k worth of shares. But that's far less than the US$2.4m insiders spend purchasing stock. I find this encouraging because it suggests they are optimistic about the Cheniere Energy's future. We also note that it was the President, Jack Fusco, who made the biggest single acquisition, paying US$994k for shares at about US$47.40 each.

On top of the insider buying, it's good to see that Cheniere Energy insiders have a valuable investment in the business. Notably, they have an enormous stake in the company, worth US$100m. This suggests to me that leadership will be very mindful of shareholders' interests when making decisions!

Is Cheniere Energy Worth Keeping An Eye On?

Cheniere Energy's earnings per share have taken off like a rocket aimed right at the moon. What's more insiders own a significant stake in the company and have been buying more shares. Because of the potential that it has reached an inflection point, I'd suggest Cheniere Energy belongs on the top of your watchlist. Even so, be aware that Cheniere Energy is showing 2 warning signs in our investment analysis , and 1 of those is concerning...

The good news is that Cheniere Energy is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance