Here's Why We Think Ausnutria Dairy (HKG:1717) Is Well Worth Watching

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

So if you're like me, you might be more interested in profitable, growing companies, like Ausnutria Dairy (HKG:1717). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

See our latest analysis for Ausnutria Dairy

Ausnutria Dairy's Earnings Per Share Are Growing.

As one of my mentors once told me, share price follows earnings per share (EPS). Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. I, for one, am blown away by the fact that Ausnutria Dairy has grown EPS by 55% per year, over the last three years. While that sort of growth rate isn't sustainable for long, it certainly catches my attention; like a crow with a sparkly stone.

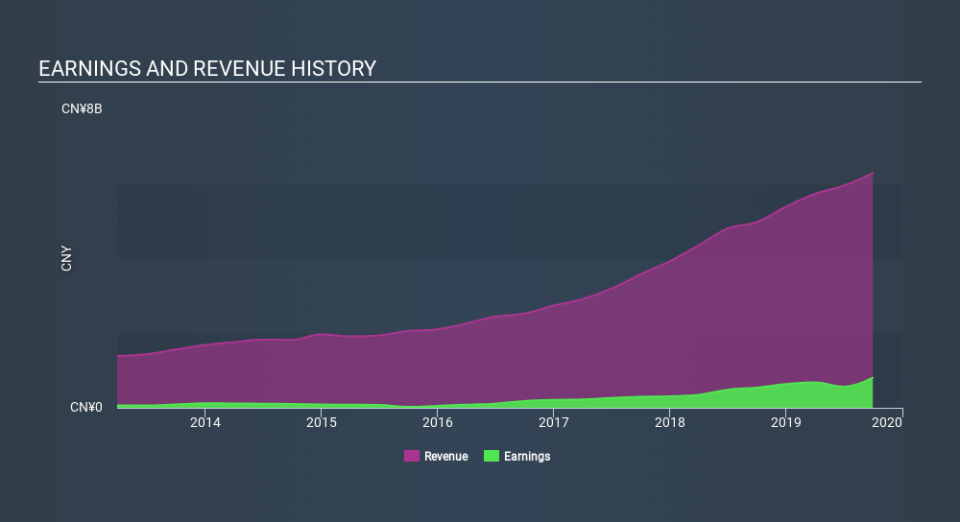

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. The good news is that Ausnutria Dairy is growing revenues, and EBIT margins improved by 6.3 percentage points to 18%, over the last year. That's great to see, on both counts.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. To that end, right now and today, you can check our visualization of consensus analyst forecasts for future Ausnutria Dairy EPS 100% free.

Are Ausnutria Dairy Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

First things first; I didn't see insiders sell Ausnutria Dairy shares in the last year. But the really good news is that Co-Founder & Executive Chairman Weibin Yan spent CN¥4.6m buying stock stock, at an average price of around CN¥11.48. Big buys like that give me a sense of opportunity; actions speak louder than words.

On top of the insider buying, it's good to see that Ausnutria Dairy insiders have a valuable investment in the business. Notably, they have an enormous stake in the company, worth CN¥1.4b. This suggests to me that leadership will be very mindful of shareholders' interests when making decisions!

While insiders are apparently happy to hold and accumulate shares, that is just part of the pretty picture. That's because on our analysis the CEO, Bart van der Meer, is paid less than the median for similar sized companies. I discovered that the median total compensation for the CEOs of companies like Ausnutria Dairy with market caps between CN¥6.9b and CN¥22b is about CN¥3.8m.

The Ausnutria Dairy CEO received total compensation of just CN¥1.7m in the year to December 2018. That's clearly well below average, so at a glance, that arrangement seems generous to shareholders, and points to a modest remuneration culture. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. I'd also argue reasonable pay levels attest to good decision making more generally.

Should You Add Ausnutria Dairy To Your Watchlist?

Ausnutria Dairy's earnings per share have taken off like a rocket aimed right at the moon. The cherry on top is that insiders own a bunch of shares, and one has been buying more. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Ausnutria Dairy deserves timely attention. Of course, just because Ausnutria Dairy is growing does not mean it is undervalued. If you're wondering about the valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

As a growth investor I do like to see insider buying. But Ausnutria Dairy isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance