Here's Why I Think Alacer Gold (TSE:ASR) Is An Interesting Stock

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In contrast to all that, I prefer to spend time on companies like Alacer Gold (TSE:ASR), which has not only revenues, but also profits. While profit is not necessarily a social good, it's easy to admire a business than can consistently produce it. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

View our latest analysis for Alacer Gold

How Quickly Is Alacer Gold Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. Who among us would not applaud Alacer Gold's stratospheric annual EPS growth of 47%, compound, over the last three years? While that sort of growth rate isn't sustainable for long, it certainly catches my attention; like a crow with a sparkly stone.

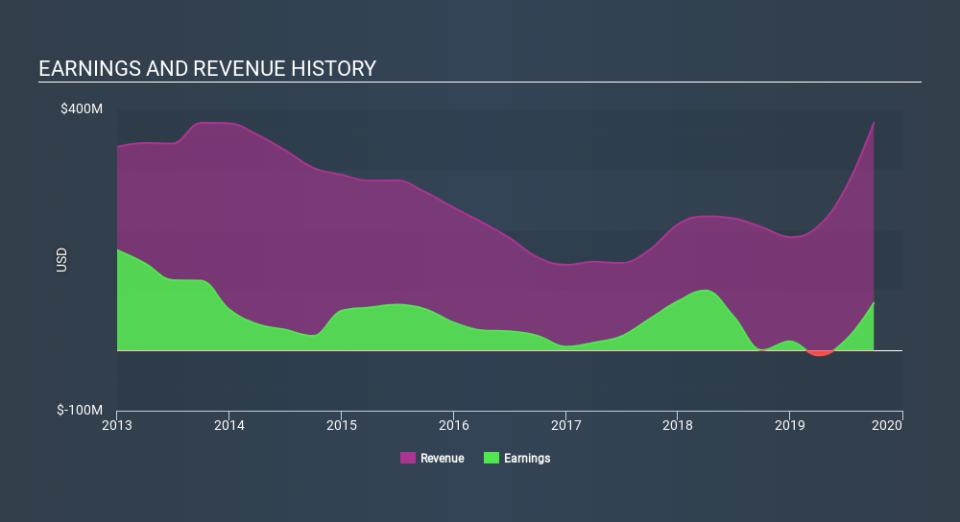

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The good news is that Alacer Gold is growing revenues, and EBIT margins improved by 2.2 percentage points to 37%, over the last year. That's great to see, on both counts.

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. To that end, right now and today, you can check our visualization of consensus analyst forecasts for future Alacer Gold EPS 100% free.

Are Alacer Gold Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Alacer Gold top brass are certainly in sync, not having sold any shares, over the last year. But the bigger deal is that the Independent Chairman of the Board, Edward Dowling, paid US$125k to buy shares at an average price of US$4.99.

The good news, alongside the insider buying, for Alacer Gold bulls is that insiders (collectively) have a meaningful investment in the stock. Indeed, they hold US$22m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. Despite being just 1.1% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Is Alacer Gold Worth Keeping An Eye On?

Alacer Gold's earnings have taken off like any random crypto-currency did, back in 2017. The incing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. Because of the potential that it has reached an inflection point, I'd suggest Alacer Gold belongs on the top of your watchlist. Now, you could try to make up your mind on Alacer Gold by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

As a growth investor I do like to see insider buying. But Alacer Gold isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance