Here's Why Shareholders May Want To Be Cautious With Increasing Orell Füssli AG's (VTX:OFN) CEO Pay Packet

Key Insights

Orell Füssli will host its Annual General Meeting on 10th of May

CEO Daniel Link's total compensation includes salary of CHF408.0k

Total compensation is 55% above industry average

Orell Füssli's EPS grew by 0.03% over the past three years while total shareholder loss over the past three years was 1.5%

As many shareholders of Orell Füssli AG (VTX:OFN) will be aware, they have not made a gain on their investment in the past three years. Despite positive EPS growth in the past few years, the share price hasn't tracked the fundamental performance of the company. Shareholders may want to question the board on the future direction of the company at the upcoming AGM on 10th of May. They could also try to influence management and firm direction through voting on resolutions such as executive remuneration and other company matters. Here's our take on why we think shareholders may want to be cautious of approving a raise for the CEO at the moment.

Check out our latest analysis for Orell Füssli

How Does Total Compensation For Daniel Link Compare With Other Companies In The Industry?

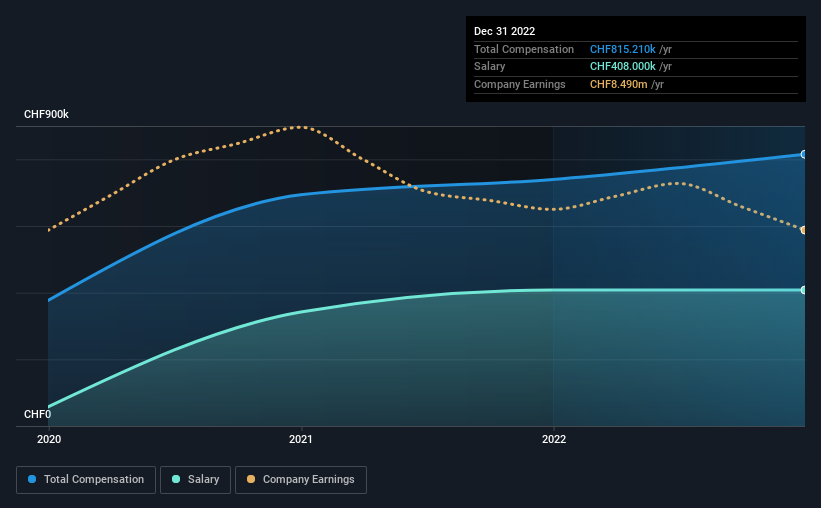

At the time of writing, our data shows that Orell Füssli AG has a market capitalization of CHF155m, and reported total annual CEO compensation of CHF815k for the year to December 2022. That's a notable increase of 10% on last year. Notably, the salary which is CHF408.0k, represents a considerable chunk of the total compensation being paid.

In comparison with other companies in the Switzerland Commercial Services industry with market capitalizations ranging from CHF89m to CHF357m, the reported median CEO total compensation was CHF527k. Hence, we can conclude that Daniel Link is remunerated higher than the industry median.

Component | 2022 | 2021 | Proportion (2022) |

Salary | CHF408k | CHF408k | 50% |

Other | CHF407k | CHF332k | 50% |

Total Compensation | CHF815k | CHF740k | 100% |

On an industry level, around 61% of total compensation represents salary and 39% is other remuneration. Orell Füssli sets aside a smaller share of compensation for salary, in comparison to the overall industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Orell Füssli AG's Growth

Orell Füssli AG saw earnings per share stay pretty flat over the last three years. Its revenue is up 3.3% over the last year.

We're not particularly impressed by the revenue growth, but we're happy with the modest EPS growth. So there are some positives here, but not enough to earn high praise. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Orell Füssli AG Been A Good Investment?

With a three year total loss of 1.5% for the shareholders, Orell Füssli AG would certainly have some dissatisfied shareholders. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

Despite the growth in its earnings, the share price decline in the past three years is certainly concerning. A huge lag in share price growth when earnings have grown may indicate there could be other issues that are affecting the company at the moment that the market is focused on. If there are some unknown variables that are influencing the stock's price, surely shareholders would have some concerns. The upcoming AGM will be a chance for shareholders to question the board on key matters, such as CEO remuneration or any other issues they might have and revisit their investment thesis with regards to the company.

CEO compensation can have a massive impact on performance, but it's just one element. We did our research and spotted 1 warning sign for Orell Füssli that investors should look into moving forward.

Important note: Orell Füssli is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance