Here's Why You Should Retain Starbucks (SBUX) Stock Now

Starbucks Corporation SBUX is poised to benefit from menu innovation, digital transformation and expansion initiatives. Also, a focus on store optimizations bodes well. However, macroeconomic headwinds and dismal comps performance are headwinds.

Let’s discuss the factors highlighting why investors should retain the stock for the time being.

Factors Driving Growth

Starbucks continues to focus on core coffee offerings while introducing new products that cater to evolving customer preferences. Recent successes include the Lavender platform and the rollout of the Clover Vertica brewer, which offers customers a choice of six separate coffee roasts and blends. Starbucks is also working on introducing texture-based innovations and functional beverages, along with plant-based options, to meet growing demand.

Increased focus on digital transformation bodes well. SBUX aims to double Starbucks Rewards members over the next five years by making the app more accessible and engaging for occasional customers. Planned investments include digital menu boards, enhancements to the Deep Brew AI platform and improved personalized customer offers.

Starbucks is implementing several initiatives to enhance its U.S. business and capture existing demand across various dayparts. It is focused on improving the efficiency of its peak morning operations, particularly for mobile orders, which account for a significant portion of its business. The company is improving order completion rates and reducing wait times through the rollout of the equipment-driven siren system and optimization of store processes with the help of the Toyota Production System Support Center.

The multinational chain is exploring untapped opportunities in overnight and weekend demand. During the fiscal second quarter, it reported solid feedback from the pilot programs (focusing on overnight services), doubling business during traditionally closed hours. The company plans to aggressively pursue this opportunity, aiming to build a $2 billion business over the next five years.

International growth continues to be a significant part of Starbucks' long-term strategy. During the fiscal second quarter, the company opened 230 new stores, thereby bringing the total store count to more than 20,800 outside North America. The company stated plans to operate 1,000 stores in India by 2028 and aims to reach 55,000 stores globally by 2030.

Concerns

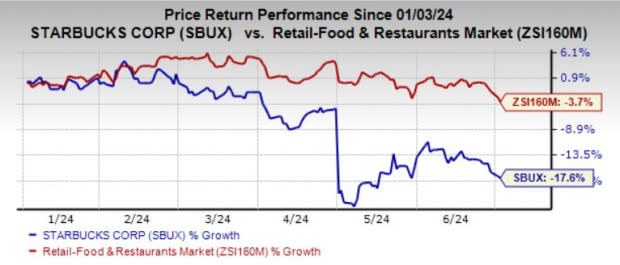

Image Source: Zacks Investment Research

The stock has lost 17.6% in the past six months compared with the industry’s 3.7% decline. The downside was caused by a challenging macroeconomic environment, a decline in consumer confidence and uncertainty in international markets.

Dismal comp performance is negatively impacting investor confidence. In second-quarter fiscal 2024, global comparable store sales declined 4% year over year. The downtick was due to a 6% drop in comparable transactions. North America and International comps declined 3% and 6% year over year, respectively. Management highlighted several factors that resulted in comparable sales falling below expectations and necessitated downward revisions. These included a more cautious spending attitude among U.S. consumers, especially among occasional customers, heightened promotional activities both domestically and internationally, ongoing economic instability in the Middle East affecting U.S. business due to boycotts and sustained macroeconomic challenges in China.

The company expects global and U.S. comps growth in the range of low-single-digit decline to flat compared with the earlier expectation of 4-6% growth. Management anticipates China's comps to decline 12% from the year-ago levels.

Our Thoughts

Given Starbucks' strategic focus on innovation, robust digital initiatives and global expansion plans, the company presents compelling long-term growth prospects. While operational efficiencies and diverse consumer offerings bolster its position, ongoing macroeconomic challenges and dismal comps performance caution against immediate buying decisions.

Investors are advised to monitor Starbucks' ability to address current market challenges and navigate economic uncertainties effectively. The stock's relative undervaluation with a forward 12-month P/E ratio of 19.55x compared to industry peers at 22.59x suggests potential upside once market conditions stabilize or strategic initiatives yield expected results. Holding positions may be prudent until clearer signals emerge regarding Starbucks' operational resilience and growth trajectory in the face of prevailing economic headwinds.

Zacks Rank & Key Picks

Starbucks currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Zacks Retail-Wholesale sector include:

Wingstop Inc. WING currently carries a Zacks Rank #2 (Buy). It has a trailing four-quarter negative earnings surprise of 21.4%, on average. The stock has surged 115.1% in the past year. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for WING’s 2024 sales and earnings per share (EPS) suggests a rise of 27.9% and 37.1%, respectively, from year-ago levels.

Brinker International, Inc. EAT currently carries a Zacks Rank #2. It has a trailing four-quarter earnings surprise of 213.4%, on average. EAT’s shares have surged 91.7% in the past year.

The Zacks Consensus Estimate for EAT’s 2024 sales and EPS indicates 5.2% and 42.1% growth, respectively, from the year-earlier actuals.

El Pollo Loco Holdings, Inc. LOCO currently carries a Zacks Rank #2. It has a trailing four-quarter earnings surprise of 19.4%, on average. LOCO’s shares have risen 20.9% in the past year.

The Zacks Consensus Estimate for LOCO’s 2025 sales and EPS indicates 3.8% and 9.9% growth, respectively, from prior-year figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Starbucks Corporation (SBUX) : Free Stock Analysis Report

Brinker International, Inc. (EAT) : Free Stock Analysis Report

El Pollo Loco Holdings, Inc. (LOCO) : Free Stock Analysis Report

Wingstop Inc. (WING) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance