Here's Why You Should Retain American Financial (AFG) Stock

American Financial Group, Inc. AFG is set to gain from new business opportunities, increased exposures, a better renewal rate environment, improved combined ratio, stronger underwriting profit and effective capital deployment. These, along with solid growth projections, make the stock worth retaining.

Earnings of this Zacks Rank #3 (Hold) insurer have grown 6.1% in the last five years. It has a VGM Score of A. This helps to identify stocks with the most attractive value, growth and momentum.

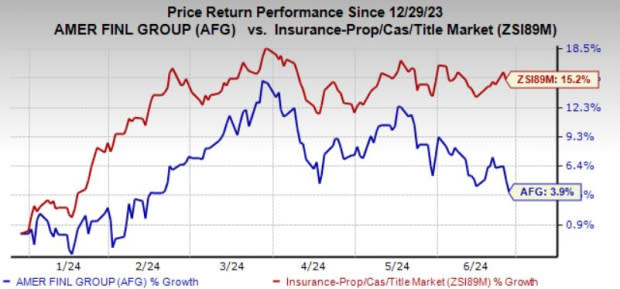

Its shares have gained 3.9% year to date, compared with the industry’s rise of 15.2%. AFG’s trailing 12-month return on equity is 21.4%, ahead of the industry average of 7.8%. Return on equity, a profitability measure, reflects how effectively a company is utilizing its shareholders.

Image Source: Zacks Investment Research

Optimistic Growth Projection

The Zacks Consensus Estimate for 2024 earnings is pegged at $10.94, indicating an increase of 3.6% on 4.1% higher revenues of $7.8 billion. The consensus estimate for 2025 earnings is pegged at $11.63, indicating an increase of 6.3% on 8.5% higher revenues of $8.5 billion.

We expect 2026 EPS to witness a three-year CAGR of 8.2.%. The company has a Growth Score of B.

Growth Drivers

New business opportunities, increased exposure and a good renewal rate environment coupled with additional crop premiums from the Crop Risk Services acquisition poise AFG well for growth.

American Financial, a niche player in the P&C market, is likely to benefit from strategic acquisitions and improved pricing. Improved industry fundamentals drive overall growth.

Its combined ratio has been better than the industry average for more than two decades. Specialty niche focus, product line diversification and underwriting discipline should help AFG consistently outperform the industry’s underwriting results.

Impressive Dividend History

AFG has increased its dividend for 18 straight years apart from paying special dividends occasionally. This reflects its financial stability, which stems from robust operating profitability at the P&C segment, stellar investment performance and effective capital management.

The insurer expects its operations to continue to generate significant excess capital throughout the remainder of 2024, thus providing ample opportunity for additional share repurchases or special dividends over the next year.

Risks

Despite the upside potential, there are a few factors that investors should keep an eye on. Its earnings have traditionally been affected by catastrophes. Even drought, which does not otherwise qualify as a catastrophe, had impacted its earnings, given its exposure to the crop business. Nonetheless, AFG maintains comprehensive property catastrophe reinsurance coverage for its property and casualty insurance operations, which limits its losses.

AFG has been experiencing an increase in expenses due to higher P&C insurance losses & expenses, annuity, life, accident & health benefits & expenses that weigh on margin expansion. We expect total costs and expenses to increase by 7.6% in 2024.

Stocks to Consider

Some top-ranked stocks from the insurance industry are HCI Group, Inc. HCI, Palomar Holdings PLMR and ProAssurance PRA. Each stock presently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

HCI Group’s earnings surpassed estimates in each of the last four quarters, the average beat being 139.15%. In the past year, shares of HCI have gained 3.4%.

The Zacks Consensus Estimate for HCI’s 2024 and 2025 earnings implies 57.6% and 4.3% year-over-year growth, respectively.

Palomar’s earnings surpassed estimates in each of the last four quarters, the average earnings surprise being 15.10%. In the past year, PLMR’s stock has surged 40.9%.

The Zacks Consensus Estimate for PLMR’s 2024 and 2025 earnings indicates 26% and 18% year-over-year growth, respectively.

ProAssurance earnings surpassed estimates in two of the last four quarters and missed in the other two. In the past year, PRA’s stock has lost 10.4%.

The Zacks Consensus Estimate for PRA’s 2024 and 2025 earnings implies 371.4% and 72.6% year-over-year growth, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ProAssurance Corporation (PRA) : Free Stock Analysis Report

American Financial Group, Inc. (AFG) : Free Stock Analysis Report

HCI Group, Inc. (HCI) : Free Stock Analysis Report

Palomar Holdings, Inc. (PLMR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance