Here's Why You Should Retain Accuray (ARAY) Stock for Now

Accuray Incorporated ARAY is well-poised for growth in the coming quarters, courtesy of continued solid demand for its products. The optimism led by solid second-quarter fiscal 2023 performance and a few positive study outcomes are expected to contribute further. However, overdependence on technologies and reimbursement uncertainties persist.

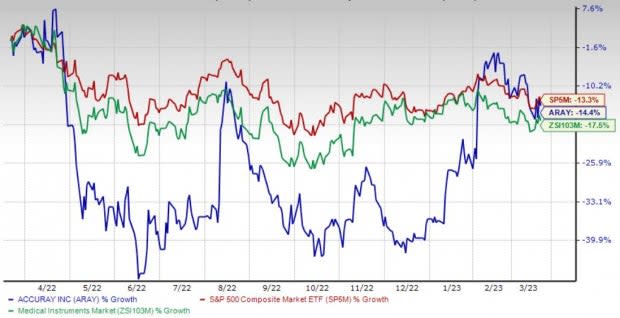

Over the past year, this Zacks Rank #3 (Hold) stock has lost 14.4% compared with 17.5% decline of the industry and 13.2% fall of the S&P 500 composite.

The renowned radiation oncology company has a market capitalization of $267.4 million. Accuray projects 283.3% growth for fiscal 2024, in which it expects to maintain its strong performance. Accuray’s P/S ratio of 0.6 is favorable to the industry’s 3.9.

Image Source: Zacks Investment Research

Let’s delve deeper.

Strong Product Demand: We are upbeat about Accuray’s products registering robust customer adoption over the past few months. On the second-quarter fiscal 2023 earnings call in February, management confirmed that the quarter’s order performance was impressive, which included 34 new systems and represented 13% sequential orders dollar growth. Management also confirmed that the Americas region registered 92% year-over-year growth in order performance driven by the adoption of Accuray’s latest innovations.

Positive Study Outcomes: Accuray has been witnessing favorable study outcomes for its products over the past few months, raising our optimism. In February, the company announced that data from the randomized, multicenter trial PACE-A (PACE - Prostate Advances in Comparative Evidence) indicated that stereotactic body radiation therapy systems, compared to surgery, better preserve urinary continence and sexual function in men with localized prostate cancer.

In October 2022, Accuray announced positive results of the PACE-B trial was published in The Lancet Oncology.

Strong Q2 Results: Accuray’s robust second-quarter fiscal 2023 results buoy optimism. The company saw solid Product revenues and geographical performances. During the fiscal second quarter, Accuray advanced key strategic partnerships, including with C-RAD, introducing the VitalHold breast package. Gross margin expansion bodes well for the stock.

Downsides

Overdependence on Technologies: Consumer and third-party payor acceptance of the CyberKnife and TomoTherapy platforms as preferred methods of tumor treatment are crucial to Accuray’s continued success. Physicians will not begin to use or increase the use of CyberKnife or TomoTherapy platforms unless they determine, based on experience, clinical data and other factors, that the two platforms are safe and effective alternatives to traditional treatment methods.

Reimbursement Uncertainties: Accuray’s customers rely significantly on reimbursement from public and private third-party payors for the CyberKnife and TomoTherapy platform procedures. The company’s ability to commercialize its products successfully and increase market acceptance will significantly depend on the extent to which public and private third-party payors provide adequate coverage and reimbursement for procedures performed with Accuray’s products.

Estimate Trend

Accuray is witnessing a negative estimate revision trend for fiscal 2023. In the past 90 days, the Zacks Consensus Estimate for its loss per share has widened from 2 cents to 6 cents.

The Zacks Consensus Estimate for the company’s third-quarter fiscal 2023 revenues is pegged at $110.9 million, suggesting a 15.4% uptick from the year-ago quarter’s reported number.

This compares to our third-quarter fiscal 2023 revenue estimate of $110.9 million, suggesting a 15.3% improvement from the year-ago quarter’s reported number.

Key Picks

Some better-ranked stocks in the broader medical space are Hologic, Inc. HOLX, Henry Schein, Inc. HSIC and Avanos Medical, Inc. AVNS.

Hologic, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 15.2%. HOLX’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average beat being 30.6%.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Hologic has gained 1.7% against the industry’s 17.5% growth in the past year.

Henry Schein, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 8.1%. HSIC’s earnings surpassed estimates in three of the trailing four quarters and matched the same in the other, the average beat being 2.9%.

Henry Schein has lost 12.4% compared with the industry’s 10.9% decline over the past year.

Avanos, carrying a Zacks Rank #2 at present, has an estimated growth rate of 1.8% for 2023. AVNS’ earnings surpassed estimates in all the trailing four quarters, the average beat being 11%.

Avanos has lost 13.7% compared with the industry’s 17.5% decline over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Accuray Incorporated (ARAY) : Free Stock Analysis Report

Hologic, Inc. (HOLX) : Free Stock Analysis Report

Henry Schein, Inc. (HSIC) : Free Stock Analysis Report

AVANOS MEDICAL, INC. (AVNS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance