Here's Why Investors Should Retain Paychex (PAYX) Stock

Paychex, Inc. PAYX has an impressive Growth Score of B. This style score condenses all the essential metrics from the company’s financial statements to get a true sense of quality and sustainability of its growth.

PAYX’s earnings are anticipated to grow 13.8% and 8.1% in fiscal 2023 and 2024, respectively. Paychex has a long-term earnings growth expectation of 7.5%.

Factors That Augur Well

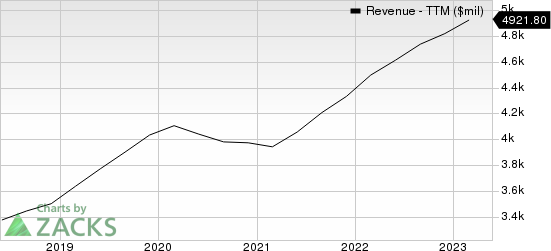

Paychexhas grown significantly over the years by providing industry-leading services and technology solutions to its clients and their employees. Its solid business model, diversified products and services and strategic acquisitions have boosted its top-line growth. Revenues grew at a five-year (2017-2022) CAGR of 7.9%. Higher revenues are likely to expand margins and increase profitability in the long run.

Paychex, Inc. Revenue (TTM)

Paychex, Inc. revenue-ttm | Paychex, Inc. Quote

The company puts consistent efforts to reward its shareholders through dividends and share repurchases. The company paid dividends of $999.6 million, $908.7 million and $889.4 million, and repurchased shares worth $145.2 million, $155.7 million and $171.9 million, respectively, in fiscal 2022, 2021 and 2020. Such initiatives not only instil investors’ confidence but also positively impact earnings per share.

A Key Risk

Paychex is seeing an increase in expenses as it continues to invest in sales, marketing, product development and supporting technology. Total expenses of $2.7 billion increased 7% year over year in fiscal 2022. These expenses increased 1% year over year in fiscal 2021, 7% in fiscal 2020 and 15% in fiscal 2019.

Zacks Rank and Stocks to Consider

Paychex currently carries a Zacks Rank #3 (Hold).

Investors interested in the Zacks Business Services sector can consider the following stocks:

Green Dot GDOT: GDOT currently sports a Zacks Rank #1 (Strong Buy) and has a VGM score of A. You can see the complete list of today’s Zacks #1 Rank stocks here.

The company has an impressive earning surprise history, beating the Zacks Consensus Estimate in each of the trailing four quarters. The company has an average surprise of 37.3%.

Maximus MMS: MMS also has a VGM score of A and sports a Zacks Rank of 1.

The company has an impressive earning surprise history, beating the consensus mark in three instances and missing on one occasion, the average surprise being 9.6%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Paychex, Inc. (PAYX) : Free Stock Analysis Report

Green Dot Corporation (GDOT) : Free Stock Analysis Report

Maximus, Inc. (MMS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance