Here's Why Investors Should Retain Domino's (DPZ) Stock for Now

Domino's Pizza, Inc. DPZ is benefiting from solid comps growth, expansion efforts and menu innovation. Also, the emphasis on strategic partnerships and initiatives bodes well. However, uncertain macroeconomic environments are a concern.

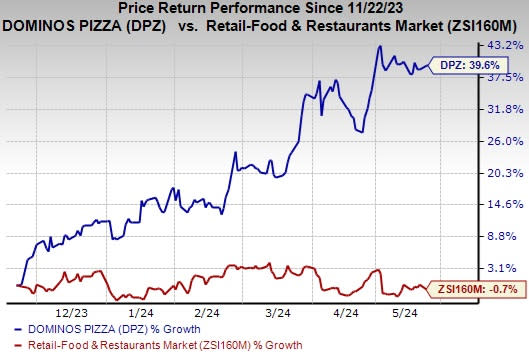

Shares of DPZ have increased 39.6% in the past six months against the Zacks Retail - Restaurants industry’s 0.7% decline. The Zacks Consensus Estimate for this currently Zacks Rank #3 (Hold) company's fiscal 2024 earnings has increased to $16.00 per share from $15.72 in the past 30 days, solidifying the growth trend.

The upside is supported by its solid VGM Score of B, contributed by a Growth Score of A, a Momentum Score of B and a Value Score of D. The positive trend signifies bullish analysts’ sentiments, robust fundamentals and the continuation of outperformance in the near term.

Image Source: Zacks Investment Research

What Makes the Stock Attractive

Solid Comps Growth: Domino's continues to impress investors with solid global comps growth. During the fiscal first quarter, global retail sales (including total franchise and company-owned units) rose 7.3% on a year-over-year basis. The upside can be attributed to higher international store sales (up 6.8% year over year) and global net store growth.

Meanwhile, U.S. store sales increased 7.3% year over year. At domestic company-owned stores, Domino’s comps gained 8.5% year over year. Domestic franchise store comps rose 5.5% year over year as well. Comps at international stores, excluding foreign currency translation, inched up 0.9% year over year compared with 1.2% in the prior-year quarter.

Focus on Expansion: The company’s international growth continues to be strong and diversified across markets, courtesy of exceptional unit-level economics. In the fiscal first quarter, the company added 20 net new stores in the United States, thereby bringing the total U.S. system store count to 6,874 stores. During the quarter, its international business added 114 net new stores. Looking at the long-term outlook (2024-2028), DPZ anticipates adding more than 1,100 net new stores, with 175 in the United States and 925 internationally.

Strategic Initiatives to Drive Growth: The company's fiscal first-quarter performance highlighted its Hungry for MORE strategy, with a focus on showcasing the most delicious food (M), driving operational excellence (O), delivering renowned value (R) and engaging best-in-class franchisees (E). The company is optimistic about its Hungry for MORE strategy and believes that it will drive significant value creation for shareholders in 2024 and beyond.

Collaboration With Delivery Channels: To drive sales, Domino's entered into a global agreement with Uber Technologies in the fiscal 2023. This partnership was considered as Domino’s believed this could help increase orders from Uber Eats to 70% of its stores around the globe.

During first-quarter fiscal 2024, DPZ's same-store sales for the U.S. also benefited from 0.9% of pricing and a 1.4% sales mix from Uber. There's a higher percentage of single-user transactions on Uber compared with DPZ's channels, with the Uber platform becoming increasingly promotional.

DPZ is prioritizing its marketing efforts on Uber Eats, aiming to achieve 3% or more of sales through this platform by the end of 2024. The focus remains on driving profitable transactions through Uber Eats while maintaining the best values for customers on DPZ's channels.

Concerns

The persistent inflationary pressures on commodity and labor expenses are challenges for the company. Industry peers anticipate prolonged periods of elevated costs due to labor shortages. The company has been witnessing labor challenges in a handful of markets. During the fiscal first quarter, the general and administrative expenses increased 6.1% year over year to $101 million, driven by higher labor costs.

The company anticipates a high inflationary environment for food and labor to persist for some time. For 2024, the company expects supply chain margins to be nearly flat year over year, factoring in an inflationary food basket for the rest of the year, with a full-year range of up 1-3%.

Key Picks

Some better-ranked stocks in the Zacks Retail-Wholesale sector are discussed below.

Wingstop Inc. WING sports a Zacks Rank #1 (Strong Buy) at present. It has a trailing four-quarter earnings surprise of 21.4% on average. Shares of WING have rallied 87.2% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for WING’s 2024 sales and EPS indicates 27.5% and 36.7% growth, respectively, from the year-ago levels.

Brinker International, Inc. EAT sports a Zacks Rank #2 (Buy) at present. It has a trailing four-quarter earnings surprise of 213.4% on average. Shares of EAT have rallied 65.3% in the past year.

The Zacks Consensus Estimate for EAT’s 2024 sales and EPS indicates 5% and 39.2% growth, respectively, from the year-ago levels.

Texas Roadhouse, Inc. TXRH currently carries a Zacks Rank of 2. It has a trailing four-quarter negative earnings surprise of 1.3%, on average. The stock has risen 49.8% in the past year.

The Zacks Consensus Estimate for TXRH’s 2024 sales and EPS suggests a rise of 14.9% and 31.3%, respectively, from the year-ago levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Domino's Pizza Inc (DPZ) : Free Stock Analysis Report

Brinker International, Inc. (EAT) : Free Stock Analysis Report

Texas Roadhouse, Inc. (TXRH) : Free Stock Analysis Report

Wingstop Inc. (WING) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance