Here's Why Investors Should Give J.B. Hunt (JBHT) a Miss Now

J.B. Hunt Transport Services, Inc.JBHT is mired in multiple headwinds, which, we believe, have made it an unimpressive investment option.

Let’s delve deeper.

Southward Earnings Estimate Revision:The Zacks Consensus Estimate for second-quarter 2024 earnings has been revised 19.5% downward over the past 90 days. For 2024, the consensus mark for earnings has moved 16.9% south in the same time frame. The bearish alterations in estimate revisions underscore a notable decline in brokers' confidence in the stock.

Weak Zacks Rank and Style Score: JBHT currently carries a Zacks Rank #5 (Strong Sell). The company’s current Value Score of D shows its unattractiveness.

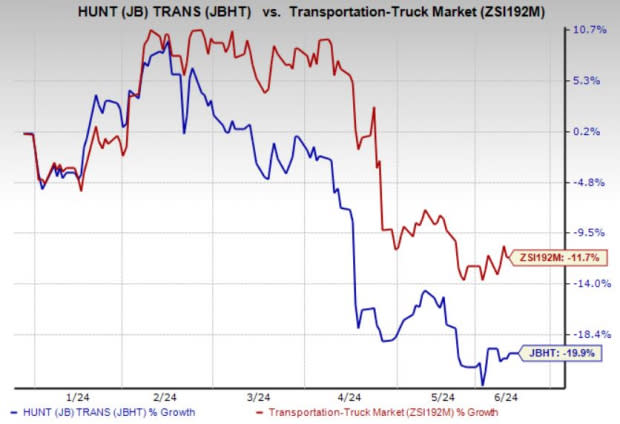

Unimpressive Price Performance: JBHT has plunged 19.9% so far this year compared with the industry’s loss of 11.7%.

Image Source: Zacks Investment Research

Negative Earnings Surprise History: JBHT has a disappointing earnings surprise history. The company’s earnings lagged the Zacks Consensus Estimate in each of the last four quarters, delivering an average miss of 11.65%.

Other Headwinds: J.B. Hunt continues to grapple with lower revenues across the majority of its business segments, mainly due to a combination of lower volume and customer rates. Higher net interest expense (owing to higher interest rates and debt issuance cost) is likely to mar J.B. Hunt’s bottom line. Net interest expense for the first quarter of 2024 increased 6% year over yeardue to higher effective interest rates and consolidated debt balance, partially offset by higher interest income.

J.B. Hunt’s weak cash position is also worrisome. JBHT's cash and cash equivalents stood at $64.18 million at the end of the first quarter of 2024, much lower than the long-term debt of $1,366.51 million. This implies that the company does not have sufficient cash to meet its debt obligations.

Stocks to Consider

Some better-ranked stocks for investors’ consideration in the Zacks Transportation sector include GATX Corporation GATX and Trinity Industries, Inc. (TRN). Each stock currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

GATX has an encouraging earnings surprise history. The company has surpassed the Zacks Consensus Estimate in three of the last four quarters (missing the mark in the other). The average beat is 7.49%.

The Zacks Consensus Estimate for 2024 earnings has been revised 3% upward over the past 90 days. GATX has an expected earnings growth rate of 6.79% for 2024. Shares of the company have rallied 18.4% in the past year.

Trinity raised 2024 earnings per share guidance to the range of $1.35 to $1.55 (which excludes items outside of the company’s core business operations) from $1.30 to $1.50 guided previously.

Over the past 30 days, the Zacks Consensus Estimate for TRN’s 2024 earnings has been revised 2.7% upward. For 2024, TRN’s earnings are expected to grow 8.70% year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

J.B. Hunt Transport Services, Inc. (JBHT) : Free Stock Analysis Report

Trinity Industries, Inc. (TRN) : Free Stock Analysis Report

GATX Corporation (GATX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance