Here's Why Investors Should Invest in Copa Holdings (CPA)

Copa Holdings, S.A. (CPA) is benefiting from continued recovery in air-travel demand. Fleet modernization efforts also look encouraging.

Against this backdrop, let’s look at the factors that make this stock an attractive pick.

What Makes Copa Holdings an Attractive Pick?

Solid Rank & VGM Score: Copa Holdings currently sports a Zacks Rank #1 (Strong Buy) and has a VGM Score of A. Our research shows that stocks with a VGM Score of A or B, when combined with a Zacks Rank #1 or 2 (Buy), offer the best investment opportunities. Thus, the company seems to be an appropriate investment proposition at the moment.

Northward Estimate Revisions:The direction of estimate revisions serves as an important pointer when it comes to the price of a stock. Over the past 90 days, the Zacks Consensus Estimate for Copa Holdings’ 2024 earnings has moved up 3.3% year over year.

Positive Earnings Surprise History: CPA has an encouraging track record with respect to earnings surprise, having surpassed the Zacks Consensus Estimate in each of the last four quarters. The average beat is 20.19%.

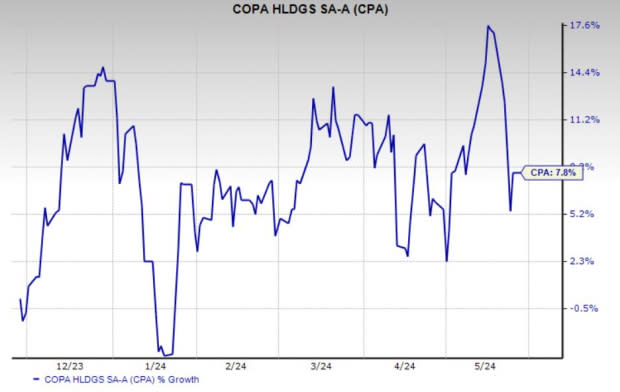

An Outperformer: A glimpse at the company’s price trend reveals that the stock has had a solid run on the bourse over the past six months. Shares of Copa Holdings have gained 7.8% over the past six months.

Image Source: Zacks Investment Research

Growth Factors: An uptick in air travel demand has been aiding Copa Holdings' revenues. As a reflection of this, first-quarter 2024 revenues of $893.5 million beat the Zacks Consensus Estimate of $846.2 million and rose 3% year over year. With more people taking to the skies, CPA’s passenger revenues (which contributed 96.1% to the top line) increased 3% from the first quarter of 2023, owing to capacity increase.

Management expects the current-year load factor (percentage of seats filled by passengers) to be around 87%, assuming the rosy traffic scenario continues. For 2024, the company suggests consolidated capacity or available seat miles to register 10% growth year over year. Operating margin is projected to be in the 21-23% band.

The carrier’s fleet modernization efforts also look encouraging. Copa Holdings anticipates to end 2024 with 115 planes in its fleet.

Other Stocks to Consider

Some other top-ranked stocks for investors’ consideration in the Zacks Transportation sector include GATX Corporation GATX and Trinity Industries, Inc. (TRN). Each stock currently carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

GATX has an encouraging earnings surprise history. The company has surpassed the Zacks Consensus Estimate in three of the last four quarters (missing the mark in the other). The average beat is 7.49%.

The Zacks Consensus Estimate for 2024 earnings has been revised 3% upward over the past 90 days. GATX has an expected earnings growth rate of 6.79% for 2024. Shares of the company have risen 18.4% in the past year.

Trinity raised 2024 earnings per share guidance to the range of $1.35 to $1.55 (which excludes items outside of the company’s core business operations) from $1.30 to $1.50 guided previously.

Over the past 30 days, the Zacks Consensus Estimate for TRN’s 2024 earnings has been revised 2.7% upward. For 2024, TRN’s earnings are expected to grow 8.70% year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Copa Holdings, S.A. (CPA) : Free Stock Analysis Report

Trinity Industries, Inc. (TRN) : Free Stock Analysis Report

GATX Corporation (GATX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance