Here's Why Investors Should Consider Buying VeriSign (VRSN)

VeriSign VRSN investors may consider adding this stock to their portfolio to tackle the current macroeconomic and geopolitical uncertainties and benefit from its solid fundamentals and growth prospects.

Let’s look at the factors that make the stock an attractive pick:

Shares Outperformed: Wall Street is facing extreme volatility due to macroeconomic factors such as rising inflation and interest rate hikes by the Federal Reserve, the ongoing Russia-Ukraine war, increased crude oil prices and lingering supply-chain woes.

The above-mentioned factors are taking a toll on major U.S. indices. Year to date, the S&P 500 has declined 17.9%. In such a scenario, stocks such as VRSN can be a sound addition to one’s investment portfolio.

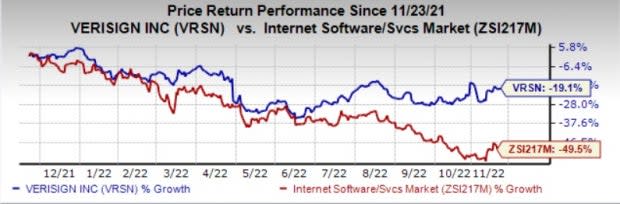

The stock is down 23.9% from its 52-week high level of $257.03 on Dec 30, 2021, making it relatively affordable for investors. VRSN has declined 19.1% in the past year against a 49.5% plunge in the Zacks sub-industry.

Image Source: Zacks Investment Research

Positive Earnings Surprise History: VRSN has an impressive surprise record. Earnings outpaced the Zacks Consensus Estimate in all the trailing four quarters, the average being 3%.

Solid Rank: VRSN has the favorable combination of a Growth Score of B and currently has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Per Zacks’ proprietary methodology, stocks with a combination of a Zacks Rank #1 or 2 and a Growth Score of A or B offer solid investment opportunities.

Robust Estimates: The Zacks Consensus Estimate of 2022 and 2023 earnings is pegged at $6.08 and $6.76, which indicates a year-over-year increase of 10% and 11.2%, respectively.

Also, revenues for 2022 and 2023 are estimated to be $1.42 billion and $1.53 billion, indicating year-over-year growth of 7.2% and 7.7%, respectively.

VeriSign reported third-quarter 2022 adjusted earnings of $1.58 per share, which beat the Zacks Consensus Estimate by 0.6% and increased 12.9% year over year. Revenues jumped 6.8% year over year to $356.9 million and came in line with the Zacks Consensus Estimate.

Strong Fundamental Drivers

Based in Reston, VA, VeriSign provides Internet infrastructure services, including domain name registration and infrastructure assurance services. Its only reportable segment includes Registry Services.

The company is well-positioned to benefit from the ongoing digitalization and growing Internet consumption globally. The company ended the reported quarter with 174.2 million .com and .net domain name registrations, up 1.2% year over year.

The company will also hike the annual registry-level wholesale fee for each new and renewal .net domain name registration to $9.92 from $9.02 from Feb 1, 2023.

The company also has a steady share repurchase program. In the third quarter, the company repurchased 1.5 million shares for $275 million. The company increased the repurchase authorization by another $803 million taking the total count to $1 billion under repurchase authorization as of Oct 27, 2022.

As of Sep 30, 2022, the company’s cash and cash equivalents (including marketable securities) were $980 million. Cash flow from operating activities was $262 million in the third quarter, while free cash flow was $255 million.

The company’s solid liquidity and cash flow make it really attractive to investors and help the company to continue its steady capital deployment. Also, the company’s time-to-interest ratio is 12.3 at the end of the third quarter, reflecting a year-over-year improvement from 9.8.

Few Headwinds

Apart from its solid fundamentals, the company is prone to several risks. The company operates in a highly competitive and capital-intensive domain name business. This is likely to negatively impact the company’s performance.

The company has tweaked its full-year guidance due to uncertainty prevailing over global macroeconomic conditions and geopolitical instability. The company expects full-year revenues between $1.418 billion and $1.426 billion compared with the earlier guided range of $1.415-$1.43 billion.

Also, the domain name base’s growth is now expected to be between 0.25% and 1% compared with the earlier expected range of 0.5-1.5%.

Other Stocks to Consider

Some other top-ranked stocks from the broader technology space are Arista Networks ANET, Plexus PLXS and Jabil JBL. Plexus, Jabil and Arista Networks currently sport a Zacks Rank #1 (Strong Buy).

The Zacks Consensus Estimate for Arista Networks 2022 earnings is pegged at $4.35 per share, up 7.7% in the past 60 days. The long-term earnings growth rate is anticipated to be 17.5%.

Arista Networks earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 12.7%. Shares of ANET have increased 5.1% in the past year.

The Zacks Consensus Estimate for Plexus 2023 earnings is pegged at $5.98 per share, rising 8.9% in the past 60 days.

Plexus’ earnings beat the Zacks Consensus Estimate in three of the last four quarters, the average being 17.5%. Shares of PLXS have increased 18.4% in the past year.

The Zacks Consensus Estimate for Jabil’s fiscal 2023 earnings is pegged at $8.18 per share, rising 4.1 in the past 60 days. The long-term earnings growth rate is anticipated to be 12%.

Jabil’s earnings beat the Zacks Consensus Estimate in three of the last four quarters, the average being 9.3%. Shares of JBL have increased 11.2% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

VeriSign, Inc. (VRSN) : Free Stock Analysis Report

Plexus Corp. (PLXS) : Free Stock Analysis Report

Jabil, Inc. (JBL) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance