Here's Why You Should Hold McKesson (MCK) in Your Portfolio Now

McKessonCorporation MCK is well-poised for growth, backed by strategic collaborations and strength in the Distribution Solutions segment. However, the company’s opioid-related litigation expenses are a potential threat.

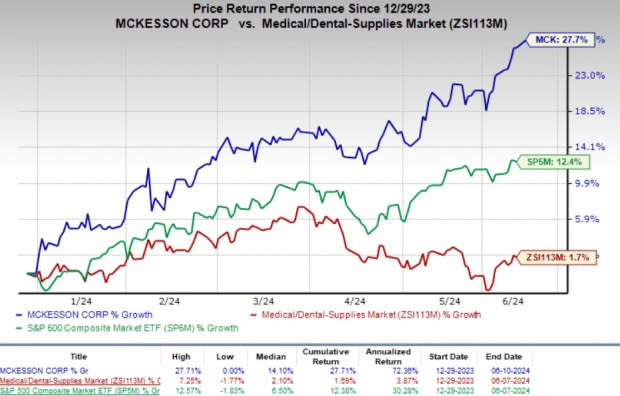

Shares of this Zacks Rank #3 (Hold) company have risen 27.7% year to date compared with the industry’s 1.7% growth. The S&P 500 Index has jumped 12.4% in the same time frame.

McKesson is a healthcare services and information technology company with a market capitalization of $76.29 billion. Its earnings are anticipated to improve 13.6% over the next five years.

The company’s earnings beat estimates in three of the trailing four quarters and missed the same in one, delivering an average surprise of 8.38%.

Image Source: Zacks Investment Research

Key Growth Drivers

Strength in Biologics: Investors are optimistic about McKesson’s robust Biologics business. Independent specialty pharmacy, Biologics by McKesson, has been making impressive progress lately. In April, Day One Biopharmaceuticals selected the pharmacy as a specialty pharmacy provider for OJEMDA (tovorafenib), which has been approved for the treatment of pediatric low-grade glioma.

Improving Demand for Healthcare: Following significant market disruption in the past three years due to COVID, the medical sector has been witnessing improving demand across several verticals, especially surgeries. McKesson is also benefiting from a recovery in demand-driving volumes, thus raising optimism. Moreover, the improving prices of products are boosting sales. The company launched Project Oasis in April, an initiative aimed at advancing health equity for at-risk populations in underserved communities. Rising demand for extended and primary care is expected to drive the top line for the Medical-Surgical business in fiscal 2025.

Strong Q4 Results: McKesson’s robust fourth-quarter results buoy optimism. The company recorded a robust uptick in its overall top line. The revenue uptick was primarily driven by growth in the U.S. Pharmaceutical segment, resulting from increased prescription volumes, including higher volumes from specialty products, retail national account customers and GLP-1 medications.

Downsides

Weak Trends: McKesson distributes generic pharmaceuticals, which are subject to price fluctuation. The Distribution Solutions segment continues to experience weak generic pharmaceutical pricing trends. Continued volatility, unfavorable pricing trends, reimbursement of generic drugs and significant fluctuations in the nature, frequency and magnitude of generic pharmaceutical launches could have an adverse impact on McKesson.

Stiff Competition: Distribution Solutions faces stiff competition in terms of price and service from various full-line, short-line and specialty wholesalers, service merchandisers, self-warehousing chains, manufacturers engaged in direct distribution, third-party logistics companies and large-payer organizations. Moreover, the company depends on a few suppliers for its products. As a result, it is not in a position to negotiate pricing.

Estimates Trend

The Zacks Consensus Estimate for fiscal 2024 revenues is pegged at $354.8 billion, indicating a 14.8% increase from the previous year's level.

McKesson Corporation Price

McKesson Corporation price | McKesson Corporation Quote

Stocks to Consider

Some better-ranked stocks in the broader medical space are DaVita Inc. DVA, Ecolab ECL and Boston Scientific BSX.

DaVita, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 13.6%. Its earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 35.6%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

DaVita’s shares have risen 35.1% year to date compared with the industry’s 10.2% growth.

Ecolab, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 14.3%. Its earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 1.30%.

ECL’s shares have risen 20.4% year to date compared with the industry’s 20.2% growth.

Boston Scientific, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 12.5%. Its earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 7.49%.

BSX’s shares have rallied 34% year to date compared with the industry’s 5.4% growth.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Boston Scientific Corporation (BSX) : Free Stock Analysis Report

Ecolab Inc. (ECL) : Free Stock Analysis Report

DaVita Inc. (DVA) : Free Stock Analysis Report

McKesson Corporation (MCK) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance