Here's Why You Should Hold on to Ecolab (ECL) Stock For Now

Ecolab Inc. ECL is well poised for growth in the coming quarters, backed by its solid product portfolio. A robust first-quarter 2022 performance, along with its strong business, is expected to contribute further. Stiff competition and compliance risks persist.

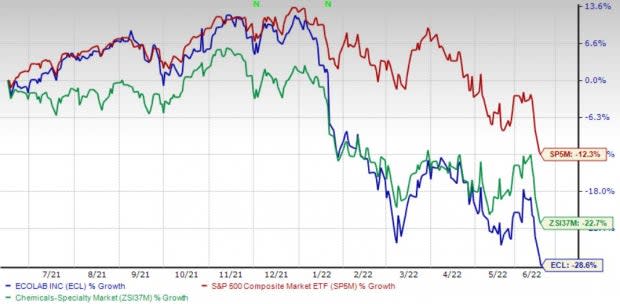

Over the past year, this Zacks Rank #3 (Hold) stock has lost 28.6% compared with 22.7% fall of the industry and 12.3% decline of the S&P 500 composite.

The renowned water, hygiene and infection prevention solutions and services provider has a market capitalization of $42.93 billion. It projects 12.7% growth for the next five years and expects to maintain its strong performance. Ecolab’s earnings surpassed the Zacks Consensus Estimate in three of the trailing four quarters and matched the same in the other, the average earnings surprise being 2.8%.

Image Source: Zacks Investment Research

Let’s delve deeper.

Product Portfolio Solid: We are upbeat about Ecolab’s solid product portfolio, which has enabled it to fortify its foothold in a niche space globally. Ecolab delivers comprehensive solutions, data-driven insights and personalized service to advance food safety, and maintain clean and safe environments. It also provides products and services that optimize water and energy use, and improve operational efficiencies and sustainability for customers in the food, healthcare, hospitality and industrial markets in more than 170 countries around the world.

Strong Business: Ecolab’s consistent delivery of considerable earnings growth despite the current challenging business environment continues to impress. Ecolab witnessed a strong first-quarter 2022, where it saw continued strong double-digit sales growth on the back of accelerating pricing and further new business wins. Additionally, the company witnessed a strengthened business portfolio and improved productivity. Ecolab, during its first-quarter earnings call, confirmed that it expects to realize continued strong top-line momentum for the full year.

Strong Q1 Results: Ecolab’s solid first-quarter results buoy our optimism. The company registered robust year-over-year uptick in its top line and solid performances across all of its segments. Strong volume and pricing momentum are also encouraging. Ecolab’s new business wins, innovation pipelines and new focus areas are well-positioned to drive growth and its global leadership. The company’s digital capabilities are also continuing to broaden by developing and adding competitive advantages, which are encouraging.

Downsides

Stiff Competition: Ecolab operates in highly competitive markets that have numerous global, national, regional and local players. The company’s ability to compete depends, in part, on providing high-quality and high value-added products, technology and service. However, there can be no assurance that the company will be able to accomplish its technology development goals or that technological developments by its competitors will not place any of its products, technologies or services at a competitive disadvantage in the future.

Compliance Risks: Ecolab’s business is subject to various laws and regulations related to the environment, including evolving climate change standards as well as to the conduct of its business generally. Compliance with these laws and regulations exposes the company to potential financial liability and increases its operating costs.

Estimate Trend

Ecolab is witnessing a negative estimate revision trend for 2022. In the past 90 days, the Zacks Consensus Estimate for its earnings has moved 2.7% south to $5.04.

The Zacks Consensus Estimate for the company’s second-quarter 2022 revenues is pegged at $3.51 billion, suggesting an 11.1% improvement from the year-ago quarter’s reported number.

Key Picks

Some better-ranked stocks in the broader medical space are AMN Healthcare Services, Inc. AMN, Omnicell, Inc. OMCL and Masimo Corporation MASI.

AMN Healthcare, sporting a Zacks Rank #1 (Strong Buy) at present, has an estimated long-term growth rate of 1.1%. AMN’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average beat being 15.6%.

You can see the complete list of today’s Zacks #1 Rank stocks here.

AMN Healthcare has gained 5.1% against the industry’s 53.9% fall in the past year.

Omnicell, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 20%. OMCL’s earnings surpassed estimates in three of the trailing four quarters and missed the same in the other, the average beat being 13.4%.

Omnicell has lost 23.9% compared with the industry’s 60.8% fall over the past year.

Masimo, carrying a Zacks Rank #2 at present, has an earnings yield of 3.8% against the industry’s negative yield. MASI’s earnings surpassed estimates in the trailing four quarters, the average beat being 4.4%.

Masimo has lost 45.2% compared with the industry’s 30.5% fall over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance