Here's Why You Should Hold BD (BDX) Stock in Your Portfolio

Becton, Dickinson and Company BDX, popularly known as BD, is well-poised for growth in the coming quarters, courtesy of its series of product launches over the past few months. The optimism led by a solid first-quarter fiscal 2024 performance and a few strategic deals are expected to contribute further. However, macroeconomic concerns and stiff competition persist.

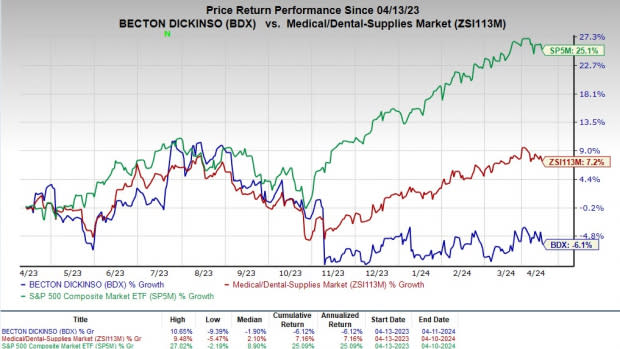

Over the past year, this Zacks Rank #2 (Buy) stock has lost 6.1% against the 7.2% rise of the industry and 25.1% growth of the S&P 500.

The renowned medical technology company has a market capitalization of $69.62 billion. It projects 9.4% growth for the next five years and expects to maintain its strong performance. BD’s earnings surpassed estimates in three of the trailing four quarters and broke even once, with the average surprise being 4.6%.

Image Source: Zacks Investment Research

Let’s delve deeper.

Strategic Deals: BD has inked a few strategic agreements for its products over the past few months, raising our optimism. Recently, it announced a strategic partnership with Camtech Health to advance cervical cancer screening by offering the first-ever option for women in Singapore to self-collect a sample privately in their homes.

In January, BD announced a strategic collaboration agreement with Techcyte to offer an artificial intelligence-based algorithm that guides cytologists and pathologists to efficiently and effectively identify evidence of cervical cancer and pre-cancer using whole-slide imaging.

Product Launches: We are upbeat about BD’s slew of product launches in recent times. BD recently announced the global commercial release of new cell sorters, the new BD FACSDiscover S8 Cell Sorters. The new BD FACSDiscover S8 Cell Sorters feature BD CellView Image Technology and BD SpectralFX Technology.

On the first quarter of fiscal 2024 earnings call in February, BD’s management confirmed that its PureWick program is progressing well. The company also remains on track to launch its next-generation Female External Catheter later in fiscal 2024. On the same call, management confirmed that the new BD MiniDraw Capillary Blood Collection System and the NextGen PureWick are on track to launch later in fiscal 2024.

Strong Q1 Results: BD’s solid first-quarter fiscal 2024 results buoy our optimism. The company registered solid top-line results, along with improvements in organic revenues. Robust performances by its Medical and Interventional segments and both geographic regions were also recorded. Strength in most of BD’s segment’s business units during the reported quarter was also seen.

Downsides

Macroeconomic Concerns: Risks affecting the demand for and cost of BD's goods and services include growing inflation and unstable capital markets, among other global economic issues. These circumstances could impair its business by upsetting its supply chain, hurting output, and raising its financing costs.

Stiff Competition: BD competes in the tough and complicated medical technology industry. While scientific discoveries and technological advancements have quickened the pace of development in medical technology, the regulatory landscape for medical devices is ever more intricate and demanding. Acquisitions and joint ventures by businesses striving for a competitive edge also have an impact on the competitive landscape.

Estimate Trend

BD is witnessing a positive estimate revision trend for fiscal 2024. In the past 90 days, the Zacks Consensus Estimate for its earnings has moved 0.8% north to $12.94.

The Zacks Consensus Estimate for the company’s second-quarter fiscal 2024 revenues is pegged at $5.02 billion, suggesting a 4.2% improvement from the year-ago quarter’s reported number.

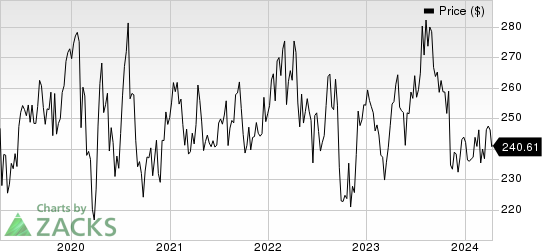

Becton, Dickinson and Company Price

Becton, Dickinson and Company price | Becton, Dickinson and Company Quote

Other Key Picks

Some other top-ranked stocks in the broader medical space are DaVita Inc. DVA, Cardinal Health, Inc. CAH and LeMaitre Vascular, Inc. LMAT.

DaVita, flaunting a Zacks Rank #1 (Strong Buy) at present, has an estimated long-term growth rate of 12.1%. DVA’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 35.6%. You can see the complete list of today’s Zacks #1 Rank stocks here.

DaVita’s shares have gained 61.6% compared with the industry’s 17.6% rise in the past year.

Cardinal Health, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 14.2%. CAH’s earnings surpassed estimates in each of the trailing four quarters, with the average being 15.6%.

Cardinal Health has gained 38.1% compared with the industry’s 9.7% rise in the past year.

LeMaitre Vascular, sporting a Zacks Rank of 1 at present, has an estimated long-term growth rate of 14%. LMAT’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 8.9%.

LeMaitre Vascular’s shares have rallied 20.8% compared with the industry’s 2.6% rise in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Becton, Dickinson and Company (BDX) : Free Stock Analysis Report

DaVita Inc. (DVA) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

LeMaitre Vascular, Inc. (LMAT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance