Here's Why Green Dot (GDOT) Stock Is a Great Pick Right Now

Green Dot GDOT has performed extremely well over the past year and has the potential to sustain momentum in the near term. Consequently, if you have not taken advantage of the share price appreciation yet, this is time for you to add the stock to your portfolio.

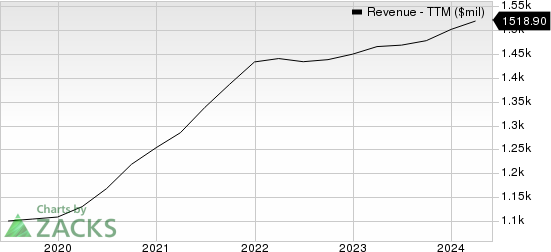

Green Dot Corporation Revenue (TTM)

Green Dot Corporation revenue-ttm | Green Dot Corporation Quote

What Makes BAH an Attractive Pick?

An Outperformer: A glimpse at the financial technology and registered bank holding company’s price trend reveals that the stock has had an impressive run over the past six months. Shares of Booz Allen Hamilton have gained 17.1% compared with the 4.6% rally of the industry it belongs to and the 15.1% rise of the Zacks S&P 500 composite.

Solid Rank: GDOT currently flaunts a Zacks Rank #1 (Strong Buy) and has a VGM Score of A. Our research shows that stocks with a VGM Score of A or B, when combined with a Zacks Rank #1 or 2 (Buy), offer the best investment opportunities for investors. Thus, the company appears to be a compelling investment proposition at the moment.

Strong Growth Prospects: The Zacks Consensus Estimate for GDOT’s 2024 revenues is pegged at $1.58 billion, indicating 6.4% year-over-year growth. For 2025, the consensus mark for revenues is pegged at $1.68 billion, suggesting a 6.6% year-over-year rise.

Growth Factors: GDOT’s top line is largely supported by BaaS partners. The addition of partners and growth of existing partners are aiding revenues. The company signed more than 300 clients in its PayCard division and four partners in the Green Dot Network. GDOT launched PLS, a new financial services center customer, which is expected to aid the metrics in the retail division. The company is investing in infrastructure to assist the efficient launch of new partners, expand its capabilities and product offerings and money movement, and drive enhancements to the core product suite to improve monetization and engagement.

Other Stocks to Consider

Some other top-ranked stocks in the broader Zacks Business Services sector are SPX Technologies, Inc. SPXC and Aptiv APTV.

SPX Technologies sports a Zacks Rank of 1 (Strong Buy). It has a long-term earnings growth expectation of 18%. You can see the complete list of today’s Zacks #1 Rank stocks here.

SPXC delivered a trailing four-quarter earnings surprise of 13.9%, on average.

Aptiv currently flaunts a Zacks Rank of 1. It has a long-term earnings growth expectation of 20.7%.

APTV delivered a trailing four-quarter earnings surprise of 12.2%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Green Dot Corporation (GDOT) : Free Stock Analysis Report

SPX Technologies, Inc. (SPXC) : Free Stock Analysis Report

Aptiv PLC (APTV) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance