Here's why Ferrari thinks it's so special

REUTERS/Yuya Shino

Ferrari plans to sell 17.2 million shares for as much as $52 each, according to an SEC filing.

That would raise a total of $894 million and values the company at $9.8 billion.

At $9.8 billion, Ferrari would be valued at nearly 35 times its annualized profits for the first six months of the year.

That may sound like a high multiple for a car company.

Here's the thing: Ferrari does not see itself as a car company. It sees itself as a luxury company.

As Business insider's Jim Edwards noted earlier this month:

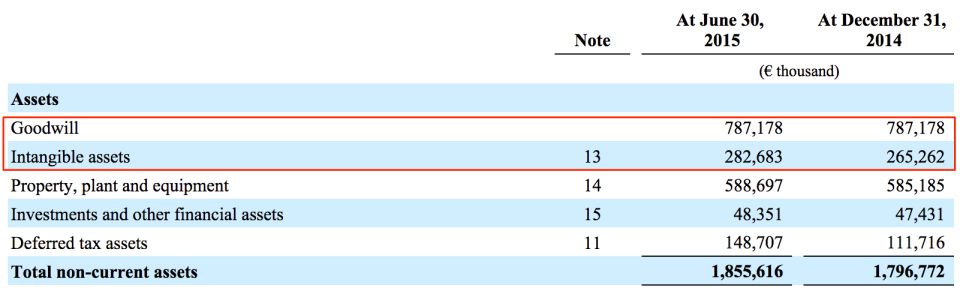

The word "luxury" is the reason Ferrari thinks it can command such a price. About half of Ferrari's current assets consist of its brand value. "Goodwill" and "intangible assets" are literally that: assets that don't exist, except as concepts (although they're backed with powerful intellectual property and copyright claims).

Here's the balance sheet:

REUTERS/Yuya Shino

Carmakers like Daimler and Audi trade at below 10 times earnings, according to data from Bloomberg. But luxury retailers fetch double digit price-to-earnings multiples. Hermes is trading at about 38 times profits.

As Jim Edwards explained, sales growth at Ferrari, while existent, is slow. There just aren't that many new Ferrari customers each year.

Normally, that would mean a low valuation for the company. Revenues are only growing at 5% per quarter.

But the luxury brand is a whole other beat, and something that investors cannot ignore.

And Ferrari seems to understand that. The word "luxury" appears in Ferrari's amended IPO filing 151 times.

NOW WATCH: The secrets of Wall Street: slavery, terrorism, and hidden vaults

See Also:

Ferrari's IPO will value the automaker at nearly $10 billion

Fiat Chrysler's workers won't strike, keeping Ferrari IPO on track

SEE ALSO: Ferrari is trying a massive brand repositioning right before its IPO

Yahoo Finance

Yahoo Finance