Here's Why Colgate's (CL) Strategic Efforts Appear Good

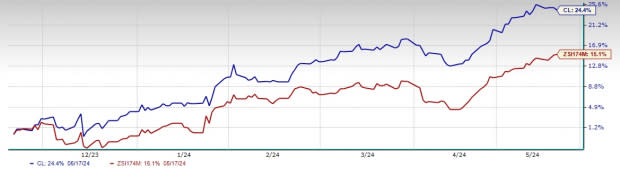

Colgate-Palmolive Company CL stock is doing well on the bourses, thanks to its robust strategic efforts. The company has been gaining from pricing and productivity initiatives for a while now. Its innovation strategy and shareholder-friendly moves also bode well. Shares of this renowned consumer goods company have increased 24.4% in the past six months compared with the industry’s 15.1% upside. A Growth Score of A adds strength to this current Zacks Rank #2 (Buy) company.

Let’s Delve Deeper

Colgate’s innovation strategy is focused on growing in adjacent categories and product segments. It is focused on the premiumization of its Oral Care portfolio through major innovations. Backed by premium innovation, products including CO. by Colgate, Colgate Elixir toothpaste and Colgate enzyme whitening toothpaste have been performing well.

Also, at-home whitening and professional whitening products bode well. Its Oral Care business has also been performing well. Some other notable efforts include the continued expansion of the Naturals and Therapeutics divisions, as well as the Hello Products LLC buyout.

Colgate has been gaining from strong pricing and the benefits of funding-the-growth program and other productivity initiatives. The company has been implementing aggressive pricing for the last few quarters, which boosted margins in the first quarter. The gross profit margin expanded 310 basis points (bps) to 60% on both GAAP basis and adjusted basis. As a result, adjusted basis earnings advanced 18% from the prior-year period.

The company is experiencing solid momentum in its business, which led to a robust top-line performance in the first quarter. Also, accelerated revenue-growth management plans aided Colgate’s organic sales in the quarter. Net sales jumped 6.2% year over year while the metric advanced 9.8% on an organic basis. The sales momentum was mainly driven by organic sales growth in each of the six divisions and across all four categories. Further, total volumes were up 1.3% year over year on an organic and reported basis, attributed to sequential growth in North America and Europe. Meanwhile, pricing improved 8.5%, backed by positive pricing across all six divisions.

Image Source: Zacks Investment Research

Driven by the impressive results, management raised its view for 2024. It anticipates net sales growth in the range of 2-5% compared with 1-4% growth mentioned earlier. The company expects organic sales growth in the band of 5-7% compared with 3-5% mentioned earlier. Colgate expects adjusted earnings per share to grow in the mid to high-single digits. CL foresees gross profit margin expansion on both GAAP and adjusted basis, driven by continued pricing gains, benefits from revenue growth management initiatives and strength in the funding-the-growth program.

Regarding its shareholder-friendly efforts, Colgate is committed to rewarding shareholders with share buybacks and dividend payouts. Recently, it paid a dividend of 50 cents a share. On an annualized basis, the dividend rate is $2.00 per share, up from $1.92 paid previously. Markedly, the company has paid uninterrupted dividends since 1895.

Other Stocks to Consider

The Chef’s Warehouse CHEF, which engages in the distribution of specialty food products, currently carries a Zacks Rank of 2. CHEF has a trailing four-quarter earnings surprise of 3.2%, on average. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for The Chef’s Warehouse’s current fiscal year sales and earnings suggests growth of 8.7% and 4.7%, respectively, from the year-ago reported numbers.

Vital Farms Inc. VITL offers a range of produced pasture-raised foods. It currently carries a Zacks Rank of 2. VITL has a trailing four-quarter average earnings surprise of 155.4%.

The consensus estimate for Vital Farms’ current financial-year sales and earnings suggests growth of 18.6% and 35.6%, respectively, from the year-ago reported numbers.

Utz Brands Inc. UTZ, which manufactures a diverse portfolio of salty snacks, currently carries a Zacks Rank of 2. UTZ has a trailing four-quarter earnings surprise of 2.6%, on average.

The Zacks Consensus Estimate for Utz Brands’ current financial-year earnings suggests growth of 15.8% from the year-ago reported numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Colgate-Palmolive Company (CL) : Free Stock Analysis Report

The Chefs' Warehouse, Inc. (CHEF) : Free Stock Analysis Report

Vital Farms, Inc. (VITL) : Free Stock Analysis Report

Utz Brands, Inc. (UTZ) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance