Here's Why Charles River Associates (CRAI) Stock Is a Great Pick

Charles River Associates CRAI is one of the leading global consulting firms that has performed extremely well over the past year and has the potential to sustain momentum in the near term. Consequently, if you haven’t taken advantage of the share price appreciation yet, it’s time you add the stock to your portfolio.

What Makes CRAI an Attractive Pick?

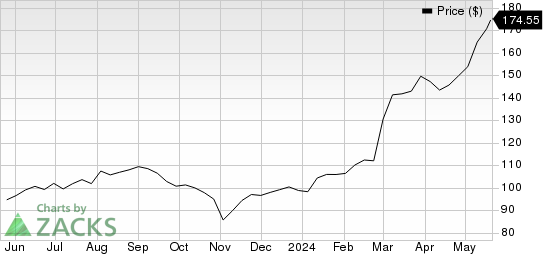

An Outperformer: A glimpse at the company’s price trend reveals that the stock has had an impressive run over the year. Shares of Charles River Associates have returned 77.5% compared with the 10.8% growth of the industry it belongs to and the 26.6% decline of the Zacks S&P 500 composite.

Charles River Associates Price

Charles River Associates price | Charles River Associates Quote

Solid Zacks Rank: CRAI currently sports a Zacks Rank #1 (Strong Buy). Our research shows that stocks with a Zacks Rank #1 or 2 (Buy) offer attractive investment opportunities for investors. You can see the complete list of today’s Zacks #1 Rank stocks here.

Northward Estimate Revisions: Three estimates for 2024 have moved north in the past 60 days versus one southward revision, reflecting analysts’ confidence in the company. The Zacks Consensus Estimate for 2024 earnings has moved up 5.8% in the past 60 days.

Positive Earnings Surprise History: CRAI has an impressive earnings surprise history. The company outpaced the Zacks Consensus Estimate in three of the trailing four quarters and missed once, delivering an earnings surprise of 19.1%, on average.

Strong Growth Prospects: The Zacks Consensus Estimate for Charles River Associates’ 2024 earnings is pegged at $6, which implies 9.7% year-over-year growth. Moreover, earnings are expected to register an 11.2% increase in 2025.

Growth Factors: Charles River Associates operates through a global network across North America and Europe, collaborating with leading professionals worldwide to enhance its expertise and serve multinational clients, contributing to revenue growth. The company’s revenues increased 12.4% year over year in the first quarter of 2024.

CRAI's highly educated professional team, including officers and senior consultants, maintains its solid reputation for top-tier consulting services. Key focus areas include balanced growth, strengthened client relationships and streamlined internal processes, positioning for long-term success.

Charles River Associates consistently rewards shareholders through dividends and share repurchases. In 2023, 2022 and 2021, the company paid $10.8 million, $9.58 million and $8.29 million as dividends and repurchased shares worth $24.8 million, $27.6 million and $44.9 million, respectively.

Other Stocks to Consider

A couple of better-ranked stocks in the broader Zacks Business Services sector are Aptiv APTV and Booz Allen Hamilton BAH.

Aptivcurrently carries a Zacks Rank #2. APTV has a long-term earnings growth expectation of 16.4%. You can see the complete list of today’s Zacks #1 Rank stocks here.

The company has an encouraging track record with respect to earnings surprise, having surpassed the Zacks Consensus Estimate in each of the last four quarters. The average beat is 12.18%. Shares of APTV have surged 17% in the past month.

Booz Allen Hamilton carries a Zacks Rank #2 at present. BAH has a long-term earnings growth expectation of 12.6%.

The company delivered an earnings surprise of 12.7%, on average, surpassing the Zacks Consensus Estimate in three of the trailing four quarters and missing once. Shares of BAH have risen 7.7% in the past month.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Charles River Associates (CRAI) : Free Stock Analysis Report

Booz Allen Hamilton Holding Corporation (BAH) : Free Stock Analysis Report

Aptiv PLC (APTV) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance