Here's Why Cenovus (CVE) is an Attractive Investment Bet

Cenovus Energy Inc. CVE has witnessed upward earnings estimate revisions for 2022 and 2023 in the past 60 days.

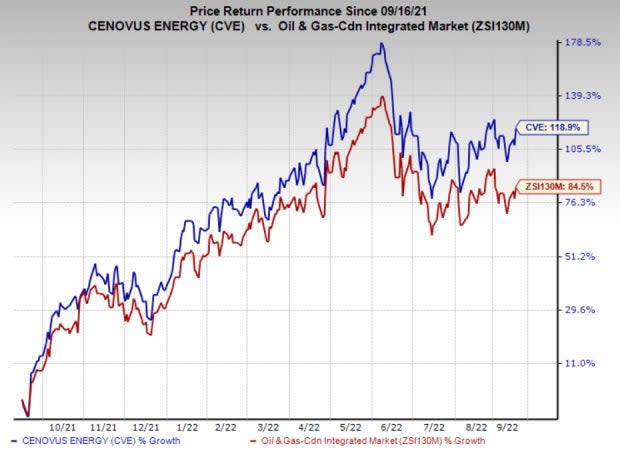

The company, with a Zacks Rank #1 (Strong Buy), has surged 118.9% over the past year, outpacing the 84.5% improvement of the composite stocks belonging to the industry.

Image Source: Zacks Investment Research

Factors Favoring the Stock

Global crude oil prices have risen substantially over the past year. The positive trajectory in oil prices is a boon for Cenovus’ upstream operations.

For 2022, CVE expects upstream production of 780,000-810,000 barrels of oil equivalent per day (Boe/d), the mid-point of which suggests an increase from 791,500 Boe/d reported last year. With the recent surge in commodity prices, higher production is likely to boost the company’s bottom line.

Like upstream businesses, Cenovus benefits from its strong refinery utilization. The company expects downstream throughput volumes of 530,000-580,000 barrels per day for 2022, indicating an increase from 508,000 barrels per day reported last year.

Between 2020 and 2024, Cenovus expects compound annual production growth of 2-3%. The integrated energy player’s moves, including the Terra Nova asset life expansion project and restarting the West White Rose project, can enable it to attain the target. With disciplined capital investment and production growth, it expects consistent growth in earnings and fund flows during the period.

Cenovus is restructuring its stakes in the Atlantic region with respective partners in Terra Nova and White Rose projects. The move is expected to improve CVE’s economics in the region. It will make Cenovus’ upstream portfolio more profitable and release some capital to allocate to producing assets. These steps are likely to boost shareholder value.

The company continues to reduce debt through free funds flow generation and asset divestments. In the first half of 2022, it generated $4,113 million in free funds flow, reflecting a major improvement from the year-ago free funds flow of $1,877 million. Cenovus intends to allocate some of the free funds for increasing shareholder returns.

Other Key Picks

Investors interested in the energy sector can look at the following companies that also presently sport a Zacks Rank #1. You can see the complete list of today's Zacks #1 Rank stocks here.

Marathon Petroleum Corporation MPC is a leading independent refiner, transporter and marketer of petroleum products. The company repurchased shares worth $4.1 billion in the May-July 2022 period and completed more than 80% of its target to buy back common stock worth $15 billion.

Marathon Petroleum has witnessed upward earnings estimate revisions for 2022 and 2023 in the past 30 days. The company currently has a Zacks Style Score of A for Value and Growth. MPC is expected to see earnings growth of 763.3% in 2022.

Schlumberger Limited SLB is the largest oilfield services player, with a presence in every energy market across the globe. For 2022, SLB revised its revenue outlook upward to at least $27 billion.

Schlumberger has witnessed upward earnings estimate revisions for 2022 and 2023 in the past 30 days. The company beat the Zacks Consensus Estimate for earnings in the prior four quarters, delivering an earnings surprise of 9.1%. SLB is expected to see earnings growth of 57.8% in 2022.

Murphy USA Inc. MUSA is a leading independent retailer of motor fuel and convenience merchandise in the United States. MUSA remains committed to returning excess cash to its shareholders through continued share buyback programs. The fuel retailer approved a repurchase authorization of up to $1 billion, which will commence once the existing $500-million authorization expires and be completed by Dec 31, 2026.

Murphy USA has witnessed upward earnings estimate revisions for 2022 and 2023 in the past 30 days. The company currently has a Zacks Style Score of A for Momentum, and B for Value and Growth. MUSA is expected to see earnings growth of 62.7% in 2022.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Schlumberger Limited (SLB) : Free Stock Analysis Report

Cenovus Energy Inc (CVE) : Free Stock Analysis Report

Murphy USA Inc. (MUSA) : Free Stock Analysis Report

Marathon Petroleum Corporation (MPC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance