Here's Why Carter's (CRI) Stock Looks Well Poised for Growth

Carter's, Inc. CRI appears well-poised for growth, thanks to its robust business strategies. The company is benefiting from its pricing strategy, inventory-management efforts and improved product offerings. Also, gains from favorable ocean freight rates, lower inventory provisions, and decreased distribution and freight costs have been contributing to its margins and overall profitability.

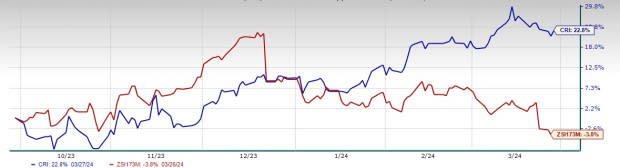

Buoyed by such strengths, shares of this apparel and related products dealer have gained 22.8% against the industry’s 3.8% drop over the past six months. A VGM Score of A further adds strength to this current Zacks Rank #3 (Hold) company.

Analysts seem quite optimistic about the company. The Zacks Consensus Estimate for 2024 sales and earnings per share (EPS) is currently pegged at $3 billion and $6.45, respectively. These estimates reflect corresponding growth of 1.6% and 4.2% year over year. The consensus mark for 2025 sales and EPS is $3.1 billion and $6.81, respectively, showing year-over-year increases of 3.5% and 5.7%.

Delving Deeper

Carter's has made significant efforts in pricing to address the market conditions and enhance profitability. The company is seeing improved price realization and profit margins primarily due to the strength of its product offerings and lower ocean freight rates, along with better inventory management.

Image Source: Zacks Investment Research

Additionally, the company is focused on essential core products, especially in the inflationary markets. This focus, coupled with a compelling value proposition, wherein average retail price points are around $11, makes Carter's an attractive option for budget-conscious consumers. The company’s pricing strategy involves keeping its brands competitively priced, usually within $1 or $2 of private label brands, which has proven effective in maintaining competitiveness in the market.

Although Carter’s has been witnessing the impacts of inflation and consequently reduced consumer spending, the demand trends in the wholesale segment have been showing improvement. Its wholesale segment has been gaining from leaner inventories with wholesale customers since the start of 2023. As a result, CRI experienced higher-than-planned demand in its wholesale business for the fifth consecutive quarter in the fourth quarter of 2023.

Looking ahead, Carter's anticipates lower product costs, which are expected to enable it to strengthen its product offerings and sharpen price points, thereby improving profitability. Management envisions an improved demand trend and a better macroeconomic landscape as the year progresses, with sales and earnings increases weighted to the second half. CRI anticipates continued conservative inventory commitments by wholesale customers and gross margin expansion on lower ocean freight rates and product costs, and higher margin retail sales.

On a concluding note, Carter’s seems to be a decent investment bet given the aforementioned positives.

Eye These Solid Picks

Some better-ranked companies are Ralph Lauren RL, Royal Caribbean RCL and lululemon athletica LULU.

Ralph Lauren, a footwear and accessories dealer, sports a Zacks Rank #1 (Strong Buy), at present. RL has a trailing four-quarter earnings surprise of 18.7%, on average.

The Zacks Consensus Estimate for Ralph Lauren’s current financial-year sales and EPS suggests growth of 2.7% and 22.7%, respectively, from the year-ago corresponding figures. You can see the complete list of today’s Zacks #1 Rank stocks here.

Royal Caribbean sports a Zacks Rank of 1, at present. RCL has a trailing four-quarter earnings surprise of 26.4%, on average.

The Zacks Consensus Estimate for RCL’s 2024 sales and EPS indicates increases of 14.7% and 47.9%, respectively, from the year-ago period’s reported levels.

lululemon athletica is a yoga-inspired athletic apparel company. LULU carries a Zacks Rank #2 (Buy), at present.

The Zacks Consensus Estimate for lululemon athletica’s current financial-year sales and EPS suggests growth of 12.1% and 11.2%, respectively, from the year-ago corresponding figures. LULU has a trailing four-quarter earnings surprise of 9.7%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Ralph Lauren Corporation (RL) : Free Stock Analysis Report

lululemon athletica inc. (LULU) : Free Stock Analysis Report

Carter's, Inc. (CRI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance