Here's Why You Should Add Lantheus (LNTH) to Your Portfolio Now

Lantheus Holdings, Inc. LNTH has been gaining from its focus on pipeline development. The optimism, led by a solid first-quarter 2024 performance and strength in radiopharmaceuticals, is expected to contribute further. However, the company’s dependence on third parties and macroeconomic concerns are major downsides.

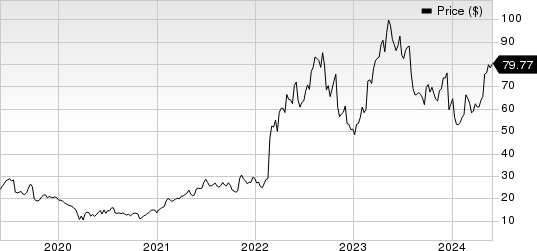

Over the past year, the Zacks Rank #2 (Buy) stock has lost 7.9% against the 2.9% growth of the industry. The S&P 500 has witnessed 26% growth in the said time frame.

The renowned radiopharmaceutical-focused player has a market capitalization of $5.51 billion. It projects 14.1% growth for 2024 and expects to witness continued improvements in its business. Lantheus’ earnings surpassed the Zacks Consensus Estimate in the trailing four quarters, delivering an average surprise of 13.6%.

Image Source: Zacks Investment Research

Let us delve deeper.

Pipeline Development: We are optimistic about Lantheus actively developing its pipeline with promising assets like PNT2002, PNT2003 and MK-6240. The company is co-developing POINT Biopharma Global Inc.’s (POINT) PNT2002 and PNT2003 under a set of strategic collaborations with POINT Biopharma signed in 2022. Lantheus is responsible for the development and commercialization of these candidates.

The company’s regulatory application seeking FDA approval for PNT2003 as a potential treatment for neuroendocrine tumors is under review. The company expects to launch the therapy in 2026, following a potential approval.

The company completed a phase III study in December 2023, evaluating its another pipeline candidate, Lu-PNT2002, which is a PSMA-targeted radioligand therapy. The study was conducted in patients with mCRPC after progression on an androgen receptor pathway inhibitor. PNT2002 enjoys Fast Track designation. The company will likely provide an update on the development path forward for the candidate soon.

Lantheus is likely to share more on the regulatory path for its Alzheimer’s disease candidate, MK-6240, later this year. The company continues to make progress as the product has been adopted within Alzheimer’s disease therapeutic clinical trials. It is developing another candidate, LNTH-1363S, in collaboration with Ratio Therapeutics. The company plans to initiate a Phase 1/2a study in patients in 2024 based on data from a recently completed Phase I study.

Strength in Radiopharmaceuticals: Lantheus has established itself as a leader in the radiopharmaceutical sector, particularly in prostate-specific membrane antigen (PSMA) positron emission tomography (PET) imaging, wherein its product, PYLARIFY, has a strong demand. Lantheus’ commercial products in its Precision Diagnostics category include DEFINITY, an injectable ultrasound-enhancing agent with perflutren-containing lipid microspheres, or microbubbles, that is used in echocardiography examinations.

Based on estimates from third-party sources regarding the incidence of prostate cancer in men in the United States, Lantheus believes that the market potential for PSMA PET imaging agents in the country could be up to 350,000 annual scans, comprising 125,000 scans for patients with an intermediate, unfavorable or high or very high risk of suspected metastases of prostate cancer and 195,000 scans for patients with suspected recurrence of prostate cancer, among others.

Year-over-year revenue growth in the first quarter of 2024 was primarily driven by an uptick in PYLARIFY and DEFINITY sales volumes.

In March, the FDA approved the label expansion for DEFINITY (Perflutren Lipid Microsphere) as an ultrasound-enhancing agent for use in pediatric patients with suboptimal echocardiograms. This should continue to drive sales, going forward.

Strong Q1 Results: Lantheus ended the first quarter of 2024 with better-than-expected results. Its robust top and bottom-line results, and strong performances in the majority of its segments were impressive. The continued strength in PYLARIFY and DEFINITY was also promising. The gross margin expansion bodes well. Management also confirmed its strategic partnership with Perspective Therapeutics, which provides Lantheus with options to add radioligand therapy assets to its pipeline and expand into alpha therapeutics. These raise our optimism.

Downsides

Macroeconomic Concerns: Lantheus’ operational and financial success is significantly influenced by various factors, many of which are beyond its control. The current economic environment and financial market conditions present unpredictable challenges to the business. There is a risk of reduced demand for healthcare services and pharmaceuticals due to various factors, which could affect revenues. This, in turn, might result in delayed or canceled orders, hurting the company's financial stability and liquidity.

Dependence on Third Parties: PYLARIFY is produced by a network of PET manufacturing facilities (PMFs) across the nation, each requiring separate FDA approval. Despite ongoing efforts to qualify additional PMFs, there is uncertainty regarding the FDA's continued approvals and the PMFs' manufacturing capabilities, which could adversely impact Lantheus’ operations and financial health.

Estimate Trend

Lantheus has been witnessing an increase in its estimate revision trend for 2024. Over the past 30 days, the Zacks Consensus Estimate for its earnings per share has increased 55 cents to $7.11.

The Zacks Consensus Estimate for second-quarter revenues is pegged at $382 million.

Lantheus Holdings, Inc. Price

Lantheus Holdings, Inc. price | Lantheus Holdings, Inc. Quote

Other Stocks to Consider

Some other top-ranked stocks in the broader medical space that have announced quarterly results are Align Technology, Inc. ALGN, Ecolab ECL and Boston Scientific Corporation BSX.

Align Technology, currently carrying a Zacks Rank of 2, reported first-quarter 2024 adjusted earnings per share (EPS) of $2.14, beating the Zacks Consensus Estimate by 8.1%. Revenues of $997.4 million outpaced the consensus mark by 2.6%.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Align Technology has a long-term estimated growth rate of 6.9%. ALGN’s earnings surpassed estimates in three of the trailing four quarters and missed once, the average surprise being 5.9%.

Ecolab, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 13.3%. ECL’s earnings surpassed estimates in the trailing four quarters, the average surprise being 1.7%.

Ecolab’s shares have rallied 33.8% against the industry’s 9.3% decline in the past year.

Boston Scientific reported first-quarter 2024 adjusted EPS of 56 cents, beating the Zacks Consensus Estimate by 9.8%. Revenues of $3.86 billion surpassed the Zacks Consensus Estimate by 4.9%. It currently carries a Zacks Rank #2.

Boston Scientific has a long-term estimated growth rate of 12.5%. BSX’s earnings surpassed estimates in the trailing four quarters, the average surprise being 7.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Boston Scientific Corporation (BSX) : Free Stock Analysis Report

Ecolab Inc. (ECL) : Free Stock Analysis Report

Align Technology, Inc. (ALGN) : Free Stock Analysis Report

Lantheus Holdings, Inc. (LNTH) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance