Here's Why You Should Add Immunovant (IMVT) to Your Portfolio

Immunovant, Inc. IMVT is a New York-based biopharmaceutical company, which develops monoclonal antibodies for the treatment of autoimmune diseases. The company currently has no marketed products in its commercial portfolio.

Immunovant’s clinical-stage pipeline comprises its lead product candidate, batoclimab (formerly known as IMVT-1401), and a new candidate, IMVT-1402, which are being developed as a subcutaneous injection for the treatment of IgG-mediated autoimmune diseases.

Let’s delve deeper to discuss four reasons why adding IMVT stock to your portfolio may prove beneficial in 2024.

Batoclimab, a Promising Candidate: Immunovant is developing its lead candidate, batoclimab, for several diseases with an initial focus on the treatment of myasthenia gravis (MG), an autoimmune disease associated with muscle weakness, and thyroid eye disease (TED), an autoimmune inflammatory disorder that affects the muscles and other tissues around the eyes, which can threaten sight.

Top-line data from the pivotal study evaluating batoclimab for the treatment of MG is expected in the second half of 2024. Initial data readouts from two additional phase III studies evaluating batoclimab for treating TED are expected in the first half of 2025.

Batoclimab is also being studied to treat other indications, which include chronic inflammatory demyelinating polyneuropathy (CIDP) and Graves’ disease (GD). Top-line results from the pivotal phase IIb study evaluating batoclimab to treat CIDP are expected in the second or third quarter of 2024.

We remind the investors that in December 2023, Immunovant announced positive initial data from the mid-stage study of batoclimab in patients with GD, witnessing more than 50% clinically meaningful response rates. Notably, treatment with the higher dose of batoclimab (640 mg) in the study was more effective across several clinical parameters than treatment with the 340 mg dose.

The successful development of the candidate in any of these indications will give Immunovant its first approved product.

Differentiated Profile of Batoclimab Makes it Favorable: Batoclimab is a fully human, monoclonal antibody that selectively binds to and inhibits neonatal fragment crystallizable receptor (FcRn). Notably, FcRn plays a major role in preventing the degradation of IgG antibodies. The company is developing batoclimab as a subcutaneously-administered regimen. If approved, the company will market batoclimab as a fixed-dose pre-filled syringe, which would allow convenient self-administration, eliminating the need for frequent and costly clinic visits, and reducing complexity and errors associated with measuring individual doses.

Thus, batoclimab is a unique and promising asset within the FcRn drug class. The company believes that, if approved, the candidate will become a cornerstone therapy for treating many auto-antibody-driven diseases and would be a unique treatment, different from the currently available ones that are more invasive for advanced IgG-mediated autoimmune diseases.

Pipeline Progress Encouraging: Immunovant is also studying its new candidate, IMVT-1402, a next-generation FcRn inhibitor, in an early-stage study for the treatment of IgG-mediated autoimmune diseases. The phase I study is evaluating the safety, tolerability and pharmacodynamic profiles of subcutaneously administered IMVT-1402.

In September 2023, the company announced positive initial results from both cohorts, the single-ascending dose portion and the 300 mg multiple-ascending dose (MAD) portion, of its early-stage study of IMVT-1402. In November 2023, Immunovant again reported positive initial data from the 600 mg MAD portion of the phase I study of IMVT-1402.

Management believes that such initial findings reaffirm IMVT-1402’s potential to become a best-in-class FcRn inhibitor.

In the fiscal third-quarter earnings release, Immunovant stated that it plans to initiate four to five potentially registrational programs for IMVT-1402 over the next fiscal year (by Mar 31, 2025). Over the next two fiscal years, Immunovant plans to initiate studies in 10 indications for IMVT-1402 (10 indications inclusive of the four to five potentially registrational programs by Mar 31, 2026).

The recent U.S. patent grant for the candidate also reaffirms the company’s innovation in developing novel therapies for diseases with high unmet medical needs. The patent protects IMVT-1402 against generic competition.

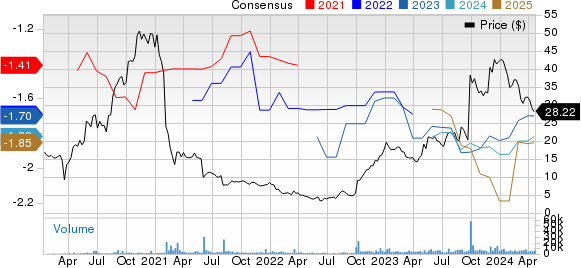

Rising Share Price and Estimates: In the past year, shares of Immunovant have surged 77% against the industry’s 19.2% decline. IMVT carries a Zacks Rank #2 (Buy) at present.

Image Source: Zacks Investment Research

In the past 30 days, the Zacks Consensus Estimate for Immunovant’s 2024 loss per share has narrowed from $1.79 to $1.78. During the same time frame, the consensus estimate for the company’s 2025 loss per share has narrowed from $1.84 to $1.82.

Immunovant, Inc. Price and Consensus

Immunovant, Inc. price-consensus-chart | Immunovant, Inc. Quote

Other Stocks to Consider

Some other top-ranked stocks from the drug/biotech industry worth mentioning are ADMA Biologics ADMA, FibroGen FGEN and Annovis Bio ANVS. While ADMA sports a Zacks Rank #1 (Strong Buy), FGEN and ANVS carry a Zacks Rank #2 each at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 30 days, the Zacks Consensus Estimate for ADMA Biologics’ 2024 earnings per share (EPS) has remained constant at 30 cents. During the same period, the estimate for ADMA’s 2025 EPS has remained constant at 50 cents. In the past year, shares of ADMA have soared 82.3%.

ADMA beat estimates in three of the trailing four quarters and matched in one, delivering an average earnings surprise of 85%.

In the past 30 days, the Zacks Consensus Estimate for FibroGen’s 2024 loss per share has remained constant at $1.09. During the same period, the estimate for FibroGen’s 2025 loss per share has remained constant at 6 cents. In the past year, shares of FGEN have plummeted 93.2%.

FGEN beat estimates in two of the trailing four quarters and missed the mark on the other two occasions, delivering an average negative surprise of 2.26%.

In the past 30 days, the Zacks Consensus Estimate for Annovis’ 2024 loss per share has narrowed from $3.49 to $3.35. The estimate for Annovis’ 2025 loss per share is currently pegged at $2.82. In the past year, shares of ANVS have plunged 32.1%.

ANVS’ beat estimates in two of the trailing four quarters and missed the mark on the other two occasions, delivering an average negative surprise of 15.70%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ADMA Biologics Inc (ADMA) : Free Stock Analysis Report

FibroGen, Inc (FGEN) : Free Stock Analysis Report

Immunovant, Inc. (IMVT) : Free Stock Analysis Report

Annovis Bio, Inc. (ANVS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance