Here's Why You Should Add HAE Stock in Your Portfolio Now

Haemonetics Corporation HAE is well-poised to grow in the coming quarters, backed by the strong potential of the Plasma franchise. The company’s Hemostasis Management franchise is evolving and helping create new opportunities for growth and diversification. Strong financial stability also buoys optimism.

Meanwhile, headwinds from adverse foreign exchange effects pose concern to Haemonetics’ operations.

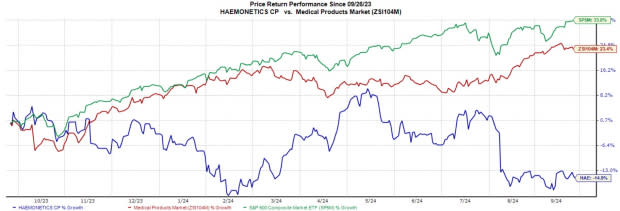

In the past year, this Zacks Rank #2 (Buy) company has lost 14.5% against the industry’s 24.6% growth and the S&P 500 composite’s 33.7% rise.

The global provider of blood and plasma supplies and services has a market capitalization of $3.84 billion. HAE beat on estimates in three of the trailing four quarters and missed once, delivering an average earnings surprise of 3.46%.

Let’s delve deeper.

Haemonetics’ Key Upsides

Potential Upsides of Plasma Franchise: Haemonetics’ Plasma business unit focuses on the collection of source plasma for pharmaceutical manufacturers using apheresis devices that only collect plasma. The demand for source plasma has continued to grow due to an expanding end-user market for plasma-derived biopharmaceuticals. In the second quarter of 2024, the U.S. collection volume growth was robust. Both North America software and Europe disposable revenues witnessed double-digit increases.

Haemonetics is progressing with the full market release of its new Express Plus technology. The company plans to upgrade all remaining NexSys customers to Express Plus and Persona by the end of fiscal 2025, positioning itself to gain more shares both domestically and internationally.

Huge Potential of Hemostasis Management Franchise: One of the principal product lines in the company’s Hospital business is the portfolio of hemostasis diagnostic systems. The company markets four viscoelastic testing systems to hospitals and laboratories as an alternative to routine blood tests, the TEG 5000 hemostasis analyzer system, the TEG 6s hemostasis analyzer system, the ClotPro hemostasis analyzer system and the HAS-100 hemostasis analyzer system.

Hemostasis management witnessed impressive double-digit growth in the fiscal first quarter, driven by robust capital sales and increased disposable utilization on the TEG6s platform. The new heparin neutralization cartridge, which secured the FDA’s approval earlier in the year, is enabling deeper penetration into accounts performing adult cardiovascular surgeries and liver transplantation.

Strong Solvency: Haemonetics exited the first quarter of fiscal 2025 with cash and cash equivalents of $344.4 million and near-term payable debt of $5 million on its balance sheet. The robust solvency level is a positive indicator for the company, indicating sufficient cash to navigate the economic uncertainties. The current ratio, which measures the ability to pay off short-term obligations, improved 1.2% sequentially to 3.76%.

Image Source: Zacks Investment Research

Haemonetics’ Key Downside

Foreign Exchange Translation Impacts Sales: Nearly 26% of the company’s fiscal 2025 first-quarter total sales were generated outside the United States. International sales are primarily conducted in local currencies, mainly the Japanese Yen, Euro and Chinese Yuan. Hence, Haemonetics’ operational results are impacted by changes in foreign exchange rates, particularly in the value of the Yen and Euro relative to the U.S. dollar.

Moreover, a stronger dollar, causing significant currency fluctuations, has been affecting the company’s outcome over the past few quarters, with no respite expected in the near term. The Blood Center revenues in the fiscal first quarter were affected by a 2.2% adverse currency impact.

HAE’s Estimate Trend

The Zacks Consensus Estimate for Haemonetics’ fiscal 2026 earnings has moved north 1.9% to $5.24 per share in the past 30 days.

The consensus estimate for fiscal 2025 revenues is pegged at $1.39 billion, which indicates a 6.4% increase from the year-ago number.

Other Key Picks

Other top-ranked stocks in the broader medical space are TransMedix Group TMDX, AxoGen AXGN and Boston Scientific BSX.

TransMedix Group’s earnings are expected to surge 255.8% in 2024. Its earnings surpassed the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 287.5%. Shares of the company have risen 160.6% in the past year compared with the industry’s 20.7% growth. TMDX sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

AxoGen, carrying a Zacks Rank of 2 at present, has an earning yield of 94.1% compared with the industry’s 12.3%. Shares of the company have risen 183.6% compared with the industry’s 19.6% growth over the past year. AXGN’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 96.46%.

Boston Scientific, carrying a Zacks Rank of 2 at present, has an estimated earnings growth rate of 17.1% for 2024 compared with the industry’s 15.7%. In the past year, shares of BSX have risen 60.2% compared with the industry’s 23.7% growth. BSX’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 7.2%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Boston Scientific Corporation (BSX) : Free Stock Analysis Report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

AxoGen, Inc. (AXGN) : Free Stock Analysis Report

TransMedics Group, Inc. (TMDX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance