Here's Why You Should Add AmEx (AXP) to Your Portfolio Now

American Express Company AXP is well poised to grow on the back of strategic acquisitions, increasing business volumes and investments in digital technology. The ongoing recovery in travel-related spending can also be a major boon for AmEx.

AmEx — with a market cap of $103.1 billion — is a diversified financial services company, offering charge and credit payment card products, and travel-related services worldwide. It operates a global payments network that processes and settles card transactions, acquires merchants and provides fraud-prevention tools. Courtesy of solid prospects, this presently Zacks Rank #2 (Buy) stock is worth investing in at the moment.

Trend in Estimates

The Zacks Consensus Estimate for AXP’s current-year earnings is pegged at $9.88 per share, which rose 0.6% in the past 60 days. The stock has witnessed five upward estimate revisions during this period against none in the opposite direction. American Express beat on earnings in each of the last four quarters, the average being 17.7%.

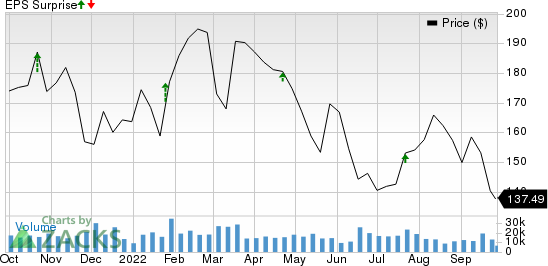

American Express Company Price and EPS Surprise

American Express Company price-eps-surprise | American Express Company Quote

The consensus mark for current-year revenues is $52.8 billion, indicating a 24.7% rise from the prior-year reported number.

Key Markers

AmEx is likely to hire about 1,500 new people in technology-related jobs, at a time when financial companies are either freezing their hiring process or cutting jobs due to economic uncertainty. The move reflects AmEx’s confidence in its capabilities to navigate through any downturns and the economy’s resilience. Of the total hiring target, 60% will likely be in the United States, 33.3% in India and the rest in Europe.

Accelerating the tech hiring process is in line with AXP’s strategy to focus on intensifying technology investments, which is expected to boost its long-term growth. The company has already hired more than 3,600 technical workers this year. The company is expected to keep investing in technology as income opportunities keep growing. Spendings on travel and entertainment are likely to go up in the coming days, especially as the holiday season approaches.

The Reserve Bank of India (“RBI”) lifting the 15-month ban on AmEx after it complied with the data storage policy is a major positive. Being the second largest country by population in the world, India possesses a massive payment market. Per the RBI data, at the second quarter-end, AmEx had only 1.4 million credit cards in the country, which is 1.7% of the overall cards in circulation. Following the decision from RBI, AmEx can tap into its enhanced infrastructure in the country to capitalize on the growing demand for digital payments.

Our estimate for AmEx’s total network volumes for 2022 suggests a 28.4% year-over-year increase. While we expect network volumes in the United States to increase by 29.2%, the same in the international market is likely to rise by 26.6%. Also, our estimate for total cards in force indicates 9.9% year-over-year growth.

Strategic acquisitions and alliances are expected to boost the company’s profits in the days ahead. Acquisitions like Kabbage and strategic partnerships with Delta, Hilton, Amazon and others are likely to rapidly grow its business in the domestic market and diversify revenue sources. AXP also has robust cash-generating abilities in place through which business investment and prudent shareholder-friendly moves are undertaken.

Risks

There are a few factors that investors should keep an eye on. For instance, AXP’s rising expenses are putting pressure on margins. The increase in reward expenses and card member services will weigh on the bottom line.

Nevertheless, we believe that a systematic and strategic plan of action will drive AmEx’s growth in the long term.

Other Top-Ranked Players

Some other top-ranked stocks in the broader finance space are CI Financial Corp. CIXX, Owl Rock Capital Corporation ORCC and Primis Financial Corp. FRST, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Based in Toronto, CI Financial is a leading asset management holding company. The Zacks Consensus Estimate for CIXX’s 2022 earnings has increased 1.2% in the past 60 days.

Headquartered in New York, Owl Rock Capital is a business development company. The Zacks Consensus Estimate for ORCC’s 2022 earnings indicates a 6.4% year-over-year increase.

Based in McLean, VA, Primis Financial offers multiple financial services to businesses and individuals. The Zacks Consensus Estimate for FRST’s 2022 earnings has improved 8.8% in the past 60 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Express Company (AXP) : Free Stock Analysis Report

Owl Rock Capital Corporation (ORCC) : Free Stock Analysis Report

Primis Financial Corp. (FRST) : Free Stock Analysis Report

CI Financial Corp. (CIXX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance