Here's How lululemon (LULU) is Poised Ahead of Q4 Earnings

We expect lululemon athletica inc. LULU to witness top- and bottom-line growth when it reports fourth-quarter fiscal 2020 results on Mar 30 after market close. Encouragingly, the Zacks Consensus Estimate for fiscal fourth-quarter sales is pegged at $1.66 billion, indicating a 19.1% increase from the prior-year quarter’s reported figure.

The Zacks Consensus Estimate for the company’s fiscal fourth-quarter earnings is pegged at $2.49, suggesting a rise of 9.2% from the year-ago quarter’s tally. Earnings estimates have been stable in the past 30 days.

The company delivered an earnings surprise of 33.3% in the last-reported quarter. Moreover, its bottom line beat estimates by 12.9%, on average, in the trailing four quarters.

Key Factors to Note

Nearly a couple of months ago, lululemon provided upbeat guidance for fourth-quarter fiscal 2020, owing to solid gains from the holiday season. Management projected sales and earnings at the higher end of the previously issued range. It had earlier predicted sales growth of mid-to-high teens and adjusted earnings growth of mid-single digits for fourth-quarter fiscal 2020.

Markedly, the company witnessed strong sales during the holiday season, driven by ongoing investments in its brand and robust demand during the period. Also, its investments in its digital capabilities, including the buyout of at-home fitness company MIRROR, might have aided sales in the fiscal fourth quarter. At its third-quarter earnings call, lululemon had predicted the MIRROR buyout to contribute more than $150 million to revenues in fiscal 2020. It had also guided gross margin to remain flat to modestly up for the to-be-reported quarter. Further, the company is confident about the execution of its Power of Three growth plan, which should aid growth in 2021.

We note that lululemon has been witnessing momentum in its e-commerce business since the onset of the coronavirus pandemic. The company has been investing in developing sites, building transactional omni functionality and increasing fulfillment capabilities. The company is also leveraging its stores to facilitate omni-channel capabilities, including the buy online pickup in store and ship-from-store. The growing online demand through its accelerated e-commerce investments is likely to have aided the company’s top line in the fiscal fourth quarter.

However, ongoing uncertainties tied to the pandemic cannot be ruled out. Management, at its last earnings call, had forecast lower productivity levels in fourth-quarter fiscal 2020 on COVID-19-led constraints versus the historically high productivity levels witnessed during the holiday season. It had projected productivity to be 70% of the last year’s levels for the to-be-reported quarter. Further, the company had anticipated continued SG&A expense deleverage for the fiscal fourth quarter as store traffic remains below last year’s levels, as along with continued investments in marketing for MIRROR.

What the Zacks Model Unveils

Our proven model predicts an earnings beat for lululemon this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

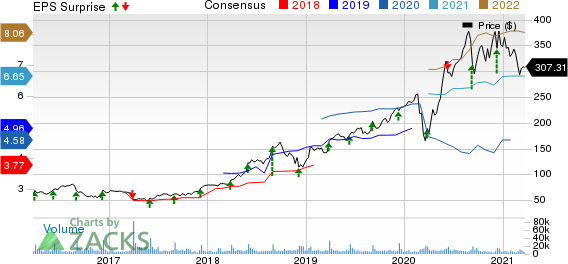

lululemon athletica inc. Price, Consensus and EPS Surprise

lululemon athletica inc. price-consensus-eps-surprise-chart | lululemon athletica inc. Quote

lululemon has a Zacks Rank #3 and an Earnings ESP of +2.28%.

Other Stocks Likely to Beat Earnings Estimates

Here are some other companies that you may want to consider as our model shows that these too have the right combination of elements to post an earnings beat.

The Boston Beer Company SAM currently has an Earnings ESP of +9.58% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Philip Morris International PM has an Earnings ESP of +0.36 % and a Zacks Rank #3, presently.

Levi Strauss LEVI has an Earnings ESP of +0.09% and a Zacks Rank #3, presently.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

You know this company from its past glory days, but few would expect that it’s poised for a monster turnaround. Fresh from a successful repositioning and flush with A-list celeb endorsements, it could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in a little more than 9 months and Nvidia which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

lululemon athletica inc. (LULU) : Free Stock Analysis Report

The Boston Beer Company, Inc. (SAM) : Free Stock Analysis Report

Levi Strauss & Co. (LEVI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance