Here's What You Should Know About China Development Bank Financial Leasing Co., Ltd.'s (HKG:1606) 6.8% Dividend Yield

Dividend paying stocks like China Development Bank Financial Leasing Co., Ltd. (HKG:1606) tend to be popular with investors, and for good reason - some research suggests a significant amount of all stock market returns come from reinvested dividends. Unfortunately, it's common for investors to be enticed in by the seemingly attractive yield, and lose money when the company has to cut its dividend payments.

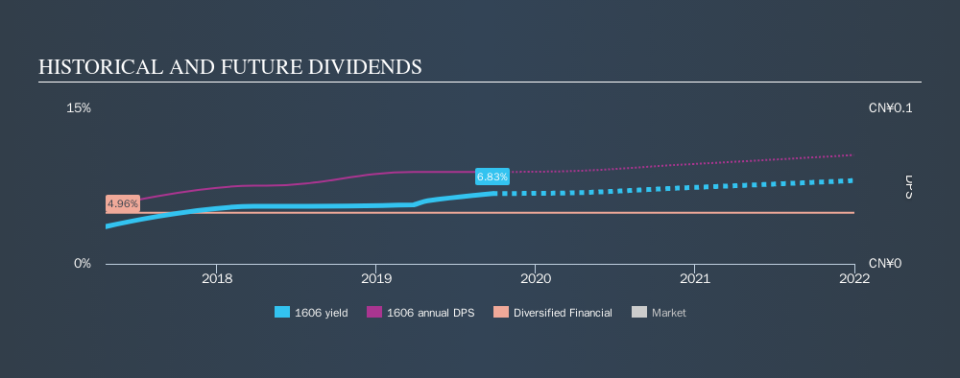

China Development Bank Financial Leasing pays a 6.8% dividend yield, and has been paying dividends for the past two years. It's certainly an attractive yield, but readers are likely curious about its staying power. Some simple analysis can offer a lot of insights when buying a company for its dividend, and we'll go through this below.

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of a company's net income after tax. In the last year, China Development Bank Financial Leasing paid out 41% of its profit as dividends. A medium payout ratio strikes a good balance between paying dividends, and keeping enough back to invest in the business. Besides, if reinvestment opportunities dry up, the company has room to increase the dividend.

We update our data on China Development Bank Financial Leasing every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. The dividend has not fluctuated much, but with a relatively short payment history, we can't be sure this is sustainable across a full market cycle. During the past two-year period, the first annual payment was CN¥0.056 in 2017, compared to CN¥0.089 last year. This works out to be a compound annual growth rate (CAGR) of approximately 27% a year over that time.

China Development Bank Financial Leasing has been growing its dividend quite rapidly, which is exciting. However, the short payment history makes us question whether this performance will persist across a full market cycle.

Dividend Growth Potential

Dividend payments have been consistent over the past few years, but we should always check if earnings per share (EPS) are growing, as this will help maintain the purchasing power of the dividend. While there may be fluctuations in the past , China Development Bank Financial Leasing's earnings per share have basically not grown from where they were five years ago. Over the long term, steady earnings per share is a risk as the value of the dividends can be reduced by inflation. China Development Bank Financial Leasing is paying out less than half of its earnings, which we like. However, earnings per share are unfortunately not growing much. Might this suggest that the company should pay a higher dividend instead?

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. Firstly, we like that China Development Bank Financial Leasing has a low and conservative payout ratio. Second, the company has not been able to generate earnings growth, and its history of dividend payments is shorter than we consider ideal (from a reliability perspective). In summary, we're unenthused by China Development Bank Financial Leasing as a dividend stock. It's not that we think it is a bad company; it simply falls short of our criteria in some key areas.

You can also discover whether shareholders are aligned with insider interests by checking our visualisation of insider shareholdings and trades in China Development Bank Financial Leasing stock.

We have also put together a list of global stocks with a market capitalisation above $1bn and yielding more 3%.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance