Here's How CarMax (KMX) is Placed Ahead of Q1 Earnings

CarMax Inc. KMX is slated to release first-quarter fiscal 2025 results on Jun 21, before the opening bell. The Zacks Consensus Estimate for the to-be-reported quarter’s earnings and revenues is pegged at $1.02 per share and $7.23 billion, respectively.

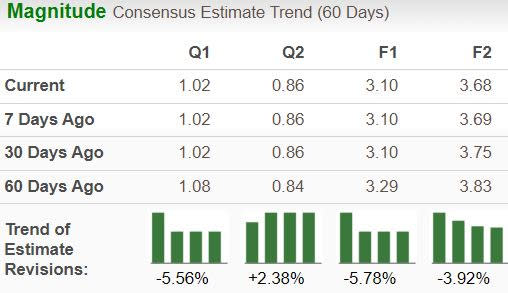

The earnings estimate for the to-be-reported quarter has been revised downward by 6 cents in the past 60 days. The bottom-line projection indicates a year-over-year contraction of 12%. The Zacks Consensus Estimate for quarterly revenues suggests a year-over-year decline of 6%.

For the current fiscal, the Zacks Consensus Estimate for KMX’s revenues is pegged at $25.8 billion, implying a contraction of 3% year over year. The consensus mark for fiscal 2025 EPS at $3.10 implies growth of around 3% on a year-over-year basis.

Image Source: Zacks Investment Research

In the trailing four quarters, CarMax missed EPS estimates just once and beat thrice, with an average earnings surprise of 12.9%.

CarMax, Inc. Price and EPS Surprise

CarMax, Inc. price-eps-surprise | CarMax, Inc. Quote

Earnings Whispers for Q1

Our proven model predicts an earnings beat for CarMax this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat.

CarMax has an Earnings ESP of +0.73% and a Zacks Rank #3. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Factors to Shape KMX’s Q1 Results

CarMax’s fiscal first-quarter (ended on May 31) results are expected to get a boost from higher sales of used vehicles in the United States. Per Cox Automotive, retail used vehicle sales in the country witnessed year-over-year growth of roughly 11%, 5% and 16% in March, April and May, respectively. In a high interest rate environment, affordability becomes crucial for buyers. The lower average transaction prices of used vehicles made them more attractive, thereby boosting sales volumes.

Our model estimates fiscal first-quarter sales volumes of used and wholesale vehicles for KMX to be 228,073 and 161,977 units, indicating an increase of 4.7% and 0.6%, respectively, on a year-over-year basis. However, as the average prices of vehicles have been on the decline, we expect revenues for both segments to decline year over year. However, a reduction in the cost of sales is expected to have offered some respite to the gross margin. We expect gross margins across both used and wholesale vehicle segments to improve on a yearly and sequential basis in the to-be-reported quarter.

Price Performance & Valuation

On a year-to-date basis, shares of KMX have declined 6.8% against its industry’s growth of 9.5%.

Image Source: Zacks Investment Research

From a valuation perspective, KMX is trading at a relatively cheaper level. Going by its price/sales ratio, the company is trading at a forward sales multiple of 0.43, below its median of 0.58 over the last five years. It is also trading at a discount compared to the industry’s 4.61X. The company has a Value Score of B.

Image Source: Zacks Investment Research

Should You Buy KMX Now?

Well, the Zacks proprietary model predicts an earnings beat for KMX for the fiscal first quarter of 2025 and the stock is also looking attractively valued. To investors’ delight, CarMax resumed share buybacks in the third quarter of fiscal 2024, which it had paused since the third quarter of fiscal 2023. In the final two quarters of fiscal 2024, KMX bought back more than 1.3 million shares. Beginning in the first quarter of fiscal 2025, the company plans to slightly increase the rate of its share repurchases. In spite of all this, we don’t think it's worth buying the stock at the moment amid certain headwinds.

Acknowledging market uncertainty, CarMax has adjusted its target to sell more than 2 million combined retail and wholesale units annually. Originally aimed for 2026, the new timeframe extends between 2026 and 2030. Also, increasing competition in the used vehicle market makes it more difficult for CarMax to maintain its market share. Notably, KMX’s nationwide market share of 0-10-year-old used vehicles declined from 4% in calendar year 2022 to 3.7% in 2023. Moreover, the company’s elevated leverage reduces financial flexibility. KMX’s long-term debt to capitalization stands at 74%.

Image Source: Zacks Investment Research

As such, investors are recommended to wait for a better entry point.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CarMax, Inc. (KMX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance