Here we go again? FOMO pushing up detached home prices in the GTA

It’s had to play second fiddle to Toronto’s resilient condo market, but detached home prices in Canada’s biggest city are bouncing back in a big way.

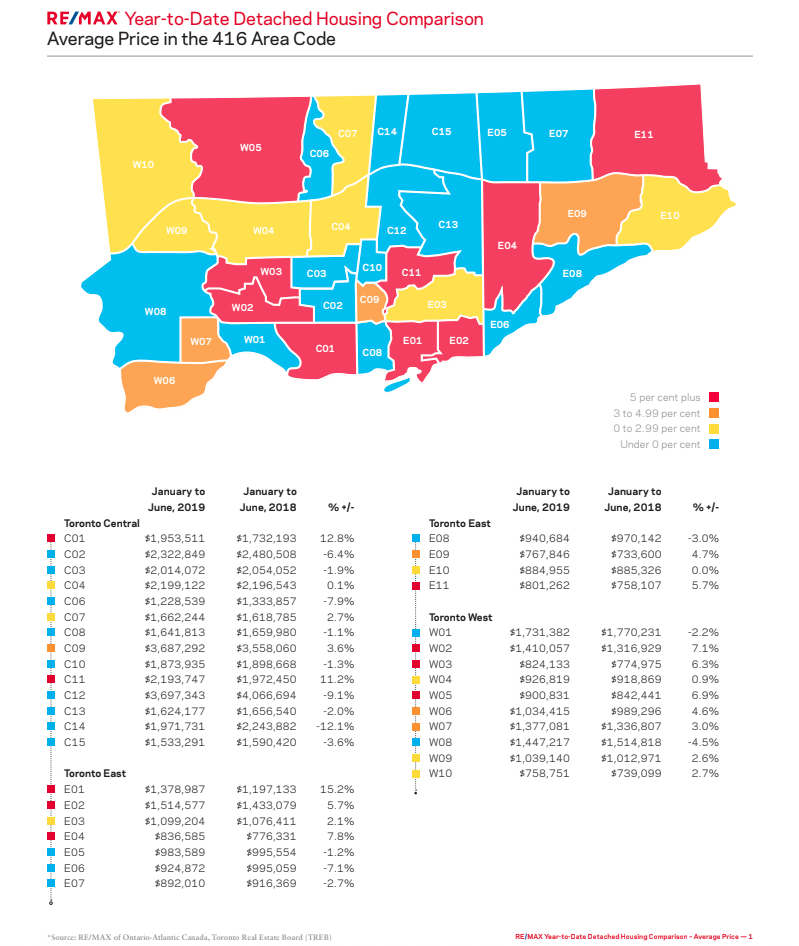

A new RE/MAX report looked at 65 Toronto Real Estate Board (TREB) districts and found that detached home sales were up in almost 88 per cent of markets over the first half of 2019, while prices were up in 51 per cent of sectors.

Detached home sales in the 905 increased in all 30/30 areas included, but prices rose in only 43 per cent of them. On the other hand, prices were up in 57 per cent of 416 districts despite sales rising in only 20 out of 35 communities.

The rebound was meant to happen sooner or later considering how strong sales have been recently. It follows something of a cooldown on the heels of new federal policies, including the mortgage stress test, meant to keep the market on stable footing.

“Detached housing is finally back on track, with year-to-date sales almost 17 per cent ahead of last year’s levels, signalling a return to more normal levels of homebuying activity,” said Christopher Alexander, executive VP and regional director of RE/MAX Ontario-Atlantic Canada, in the report.

“Market share is also climbing, with detached homes now representing 45.7 per cent of all home sales in the Greater Toronto Area, up from 43.1 per cent one year ago.”

RE/MAX says a fear of missing out before prices really take off is a major catalyst. Location is important because first-time buyers and trade-up buyers want to lock down a home in their desired neighbourhoods.

North Riverdale, South Riverdale, Blake-Jones, Greenwood-Coxwell led the way for price jumps, with a 15.2 per cent rise from $1,197,133 to $1,378,987. Trinity-Bellwoods, Palmerston-Little Italy, Little Portugal, Dufferin Grove, Kensington-Chinatown, Niagara was second with a 12.8 per cent bump from $1,732,193 to $1,953,511. Leaside, Thorncliffe Park was third with an 11.2 per cent increase from $1,972,450 to $2,193,747.

“With recovery well underway in the detached housing segment, the residential real estate market is starting to fire on all cylinders,” said Alexander.

“The possibility of more relaxed mortgage rules down the road – in conjunction with today’s low interest rate environment – may serve to spark up the GTA housing market yet again.”

Jessy Bains is a senior reporter at Yahoo Finance Canada. Follow him on Twitter @jessysbains

Download the Yahoo Finance app, available for Apple and Android.

Yahoo Finance

Yahoo Finance