Helvetia Holding And 2 Other Top Dividend Stocks On SIX Swiss Exchange

Swiss stocks recently showcased robust performance, with the benchmark SMI index climbing by 0.95% amid positive sentiment surrounding earnings forecasts and interest rate expectations. This upward trend underscores a healthy economic backdrop that can be favorable for investors looking at dividend-yielding stocks in Switzerland. In such an optimistic market environment, identifying stocks that offer sustainable dividends is crucial, as these can provide both steady income and potential for capital appreciation.

Top 10 Dividend Stocks In Switzerland

Name | Dividend Yield | Dividend Rating |

Vontobel Holding (SWX:VONN) | 5.48% | ★★★★★★ |

Cembra Money Bank (SWX:CMBN) | 5.12% | ★★★★★★ |

Banque Cantonale Vaudoise (SWX:BCVN) | 4.44% | ★★★★★★ |

St. Galler Kantonalbank (SWX:SGKN) | 4.36% | ★★★★★★ |

Novartis (SWX:NOVN) | 3.29% | ★★★★★☆ |

Roche Holding (SWX:ROG) | 3.86% | ★★★★★☆ |

CPH Group (SWX:CPHN) | 5.80% | ★★★★★☆ |

Julius Bär Gruppe (SWX:BAER) | 5.07% | ★★★★★☆ |

Helvetia Holding (SWX:HELN) | 5.05% | ★★★★★☆ |

Basellandschaftliche Kantonalbank (SWX:BLKB) | 4.71% | ★★★★★☆ |

Let's uncover some gems from our specialized screener.

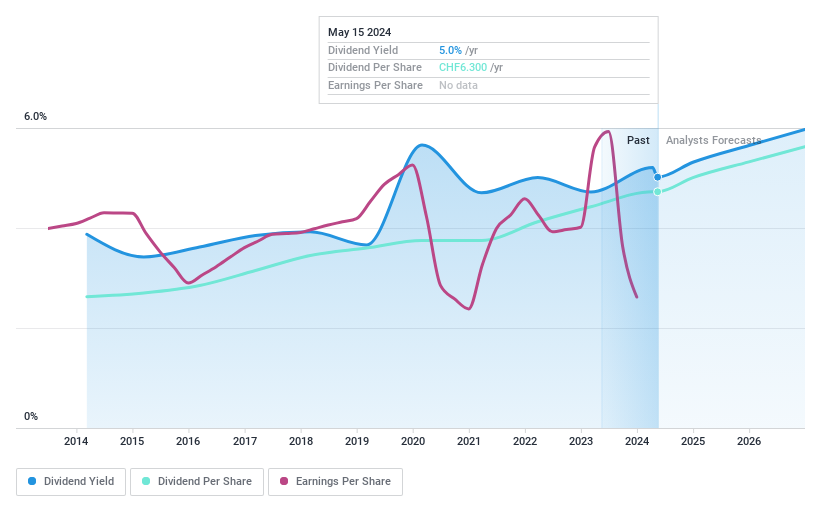

Helvetia Holding

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Helvetia Holding AG operates in the life and non-life insurance and reinsurance sectors across Switzerland, Germany, Austria, Spain, Italy, France, and other international markets with a market capitalization of CHF 6.59 billion.

Operations: Helvetia Holding AG generates CHF 1.81 billion from its life insurance segment and CHF 7.09 billion from non-life insurance operations.

Dividend Yield: 5%

Helvetia Holding AG recently proposed a dividend increase to CHF 6.3, reflecting a nearly 7% hike, signaling confidence despite its dividends not being well-covered by earnings, with a payout ratio of 120.3%. While the company maintains a stable and reliable dividend history over the past decade, concerns arise from its low profit margins which dropped from 5.1% to 3%. Nonetheless, dividends are reasonably supported by cash flows with a cash payout ratio of 36.5%, and earnings are expected to grow by 14.23% annually.

Navigate through the intricacies of Helvetia Holding with our comprehensive dividend report here.

Our valuation report here indicates Helvetia Holding may be overvalued.

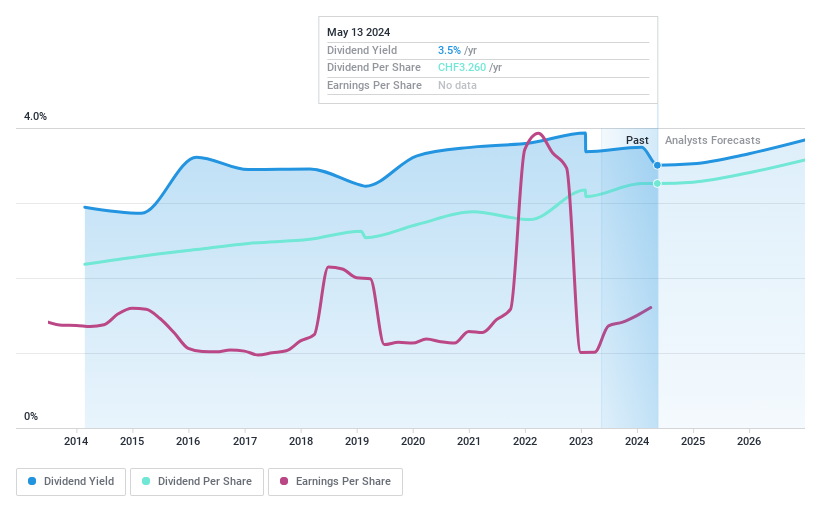

Novartis

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Novartis AG is a global healthcare company based in Switzerland, specializing in the research, development, manufacture, and marketing of a wide range of healthcare products, with a market capitalization of approximately CHF 200.57 billion.

Operations: Novartis AG's revenue from its Innovative Medicines segment totals $47.73 billion.

Dividend Yield: 3.3%

Novartis AG's recent CHF 470 million in fixed-income offerings underscores its financial management aimed at sustaining operations and potential dividends. Despite a modest dividend yield of 3.29%, which is below the top quartile of Swiss dividend payers, Novartis has maintained stable and reliable payouts over the past decade. The company's dividends are adequately covered by earnings with an 88.7% payout ratio and by cash flows at 60.7%. Recent advancements in treatments like Fabhalta for C3 glomerulopathy, which showed a significant reduction in proteinuria, highlight its ongoing commitment to innovation and market presence, supporting long-term value for dividend investors despite some earnings volatility due to one-off items.

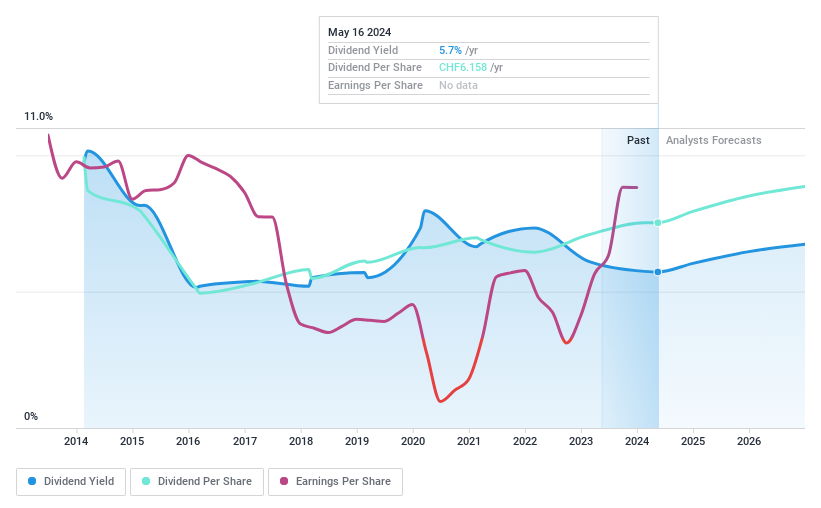

Swiss Re

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Swiss Re AG operates globally, offering wholesale reinsurance, insurance, and other risk transfer services, with a market capitalization of approximately CHF 32.15 billion.

Operations: Swiss Re AG's revenue is primarily generated from three segments: Corporate Solutions at $6.06 billion, Life & Health Reinsurance at $18.09 billion, and Property & Casualty Reinsurance at $23.74 billion.

Dividend Yield: 5.5%

Swiss Re's dividend history shows variability, with a decrease over the past decade. Despite this, its current dividend yield of 5.53% ranks in the top 25% of Swiss payers. The dividends are supported by a payout ratio of 53.9% and a cash payout ratio of 48.3%, suggesting sustainability from earnings and cash flow perspectives. Recent strategic developments include launching Connected Underwriting Life Workbench across multiple regions, potentially enhancing operational efficiencies and profitability which could support future dividends despite leadership changes such as Ivan Gonzalez becoming CEO Corporate Solutions.

Turning Ideas Into Actions

Navigate through the entire inventory of 26 Top SIX Swiss Exchange Dividend Stocks here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SWX:HELN SWX:NOVN and SWX:SREN.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance