Are Hedge Funds Bullish on Johnson Controls International plc (JCI) Now?

We recently compiled a list of the 10 Best Dividend Stocks of All Time. In this article, we are going to take a look at where Johnson Controls International plc (NYSE:JCI) stands against the other dividend stocks.

Dividend stocks aren’t a quick fix for investing; they offer lasting rewards over time. Unfortunately, many investors miss the boat on this and expect to strike it rich overnight. When that doesn’t pan out, they chase the latest stock market trends, ignoring the steady gains that dividend stocks can provide. This trend has been evident over the past year, with AI stocks taking the spotlight and leaving income stocks in the dust. However, there’s a silver lining: many tech companies have begun offering dividends this year, highlighting their long-term potential.

The current yields of these tech stocks might be small, which leads many income investors to overlook their impressive growth records. This is unfortunate because dividend growth can significantly boost both long-term income and capital gains. Analysts believe that dividend growth and sustainability are more crucial than just the yield. For instance, Microsoft’s roughly 864% return over a decade far outpaces the returns from non-tech stocks like AT&T and Chevron, despite their higher yields. The tech giant currently pays $0.75 per quarter and offers a dividend yield of 0.7%. However, you need to keep in mind that its quarterly dividend was $0.28 a decade ago and its dividend yield was 2.5%. Despite the nearly tripling its quarterly dividend, the stock's yield went down to 0.7% and that was a great thing for its dividend investors.

Dividend stocks are often compared not just with high-yield stocks but also with those that don’t pay dividends to provide investors with a comprehensive view. According to data from Hartford Funds, from 1973 to 2023, dividend-paying companies offered an average annual return of 9.17%, while stocks without dividends only returned 4.27%. The report also noted that companies with stable dividends had an average return of 6.74%, which lagged behind the performance of companies that increased their dividends.

While regularly increasing dividends is challenging, maintaining consistent payouts year after year is also no easy feat for companies. Analysts warn against yield traps—stocks with high yields but unstable dividend policies. Brian Bollinger, president of Simply Safe Dividends, shared his views on dividend investing in a CNBC interview. He recommended focusing on top-quality companies, which often provide dividend yields of around 3% to 4%. These firms usually show steady growth in their dividend payments, boosting the annual income stream and helping to counteract inflation. He also pointed out that stocks with lower yields tend to be safer investments with more reliable payout structures.

In this article, we will take a look at some of the best dividend stocks of all time that have consistent records of paying dividends to shareholders.

Our Methodology:

For this article, we scanned the list of companies that have paid dividends to shareholders for at least 75 years. From that list, we picked companies with dividend yields of above 2%, as of July 23. We analyzed these companies through their balance sheets and overall financial health to determine their dividend stability. Additionally, we assessed the sentiment of hedge funds for each stock using Insider Monkey’s Q1 2024 database. The stocks are arranged in ascending order based on the number of hedge funds that hold stakes in these companies. Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 275% since May 2014, beating its benchmark by 150 percentage points. (see more details here).

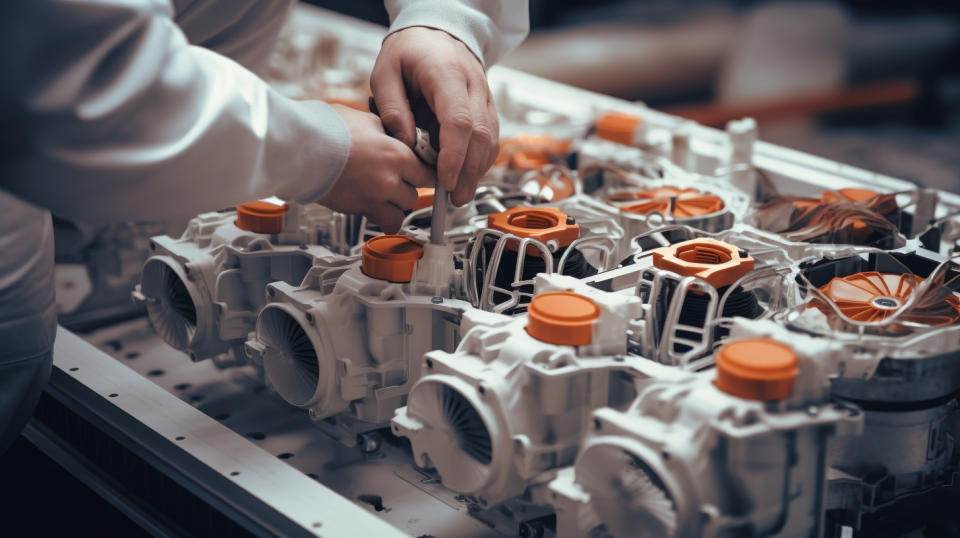

A team of workers wearing white hardhani and safety goggles assembling a complex HVAC system.

Johnson Controls International plc (NYSE:JCI)

Number of Hedge Fund Holders: 39

Dividend Yield as of July 23: 2.16%

Johnson Controls International plc (NYSE:JCI) is a multinational conglomerate company that specializes in building technologies and solutions and also offers energy storage solutions. The company has faced pressures recently as activist investors Elliott Investment Management and Soroban Capital Partners each amassed stakes worth over $1 billion in the company. In response, it decided in June to sell its air distribution technologies business to private equity firm Truelink Capital. In addition, the company announced plans to establish a new unit to capitalize on the growing demand for data center solutions. Since the start of 2024, the stock has gained over 21%.

In one of the recent developments, Robert Bosch GmbH intends to purchase Johnson Controls International plc (NYSE:JCI)'s heating and ventilation assets for $8 billion, marking its largest acquisition to date as it shifts focus from automotive supplies. As part of the transaction, Bosch will acquire the company's air-conditioning joint venture with Hitachi, including Hitachi’s 40% stake. All parties have signed binding agreements, and the deal is expected to be finalized within 12 months, pending regulatory approval. Through this transaction, Johnson Controls International plc (NYSE:JCI) will significantly streamline its portfolio, sharpening its strategic focus to align with its goal of becoming a dedicated provider of comprehensive solutions for commercial buildings.

Analysts have expressed concern about the stock's performance over the past 12 months. Nevertheless, they remain positive about its future prospects and valuation, noting that it is currently trading at an attractive forward P/E ratio of 16.8. Diamond Hill Capital also highlighted Johnson Controls International plc (NYSE:JCI)'s valuation in its Q1 2024 investor letter. Here is what the firm has to say:

“Though valuations have increased, we continue identifying high-quality companies we believe the market is overlooking. We accordingly initiated four new positions in Q1: Generac Holdings, Diamondback Energy (FANG), Johnson Controls International plc (NYSE:JCI) and Humana. We initiated a position in Johnson Controls (JCI), a leading provider of HVAC, security and fire detection/suppression and building management systems as we believe the company is well-positioned to benefit from the secular trend toward smart buildings and a shift to high-margin services. While JCI has not executed particularly well recently, we believe the market has overreacted to these issues while also underappreciating the potential magnitude of the aforementioned secular tailwinds. We accordingly capitalized on the opportunity to establish a position at a steep discount to JCI’s HVAC peers and our estimate of intrinsic value.”

On June 12, Johnson Controls International plc (NYSE:JCI) declared a quarterly dividend of $0.37 per share, which was consistent with its previous dividend. The company has never missed a single dividend since 1887, which makes JCI one of the best dividend stocks of all time. The stock's dividend yield on July 23 came in at 2.16%.

As of the end of the March quarter of 2024, 39 hedge funds owned stakes in Johnson Controls International plc (NYSE:JCI), as per Insider Monkey's database. These stakes have a consolidated value of over $2.1 billion.

Overall JCI ranks 3rd on our list of the best dividend stocks to buy. You can visit 10 Best Dividend Stocks of All Time to see the other dividend stocks that are on hedge funds’ radar. While we acknowledge the potential of JCI as an investment, our conviction lies in the belief that some deeply undervalued dividend stocks hold greater promise for delivering higher returns, and doing so within a shorter timeframe. If you are looking for a deeply undervalued dividend stock that is more promising than JCI but that trades at less than 7 times its earnings and yields nearly 10%, check out our report about the dirt cheap dividend stock.

READ NEXT: Analyst Sees a New $25 Billion “Opportunity” for NVIDIA and 10 Best of Breed Stocks to Buy For The Third Quarter of 2024 According to Bank of America.

Disclosure: None. This article is originally published at Insider Monkey.

Yahoo Finance

Yahoo Finance