Hedge Fund’s Secret Adani Short Revealed in Blow-by-Blow Account

(Bloomberg) -- An activist short-seller, a New York hedge fund, a Mauritius-based investment vehicle and a broker tied to a big Indian bank: All played a role in one of the world’s most damaging short-seller attacks.

Most Read from Bloomberg

China Can End Russia’s War in Ukraine With One Phone Call, Finland Says

Democrats Weigh Mid-July Vote to Formally Tap Biden as Nominee

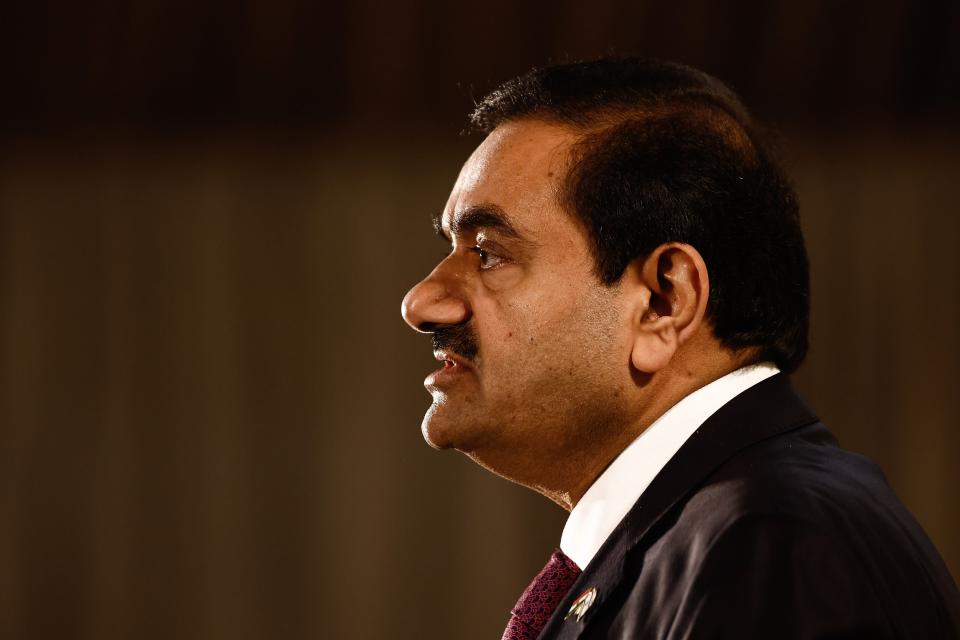

A fresh war of words between the short seller — Hindenburg Research — and India’s markets regulator has thrown up an intriguing cast of characters behind the scathing report and related bets against the Adani Group that wiped out as much as $153 billion in market value last year.

The Hindenburg missive sent the Securities and Exchange Board of India, or Sebi, knocking on the door of the US research firm, seeking answers about its “misleading” report. While posting an aggressive rebuttal on its website on Monday, Hindenburg added a link to Sebi’s “show cause notice” — a 46-page letter detailing the innards of a well-planned transaction that shook India’s capital markets for months.

Among the new revelations, Sebi’s letter showed for the first time that Hindenburg shared its Adani research exclusively with Kingdon Capital Management LLC before it was published, and that the two firms had a profit-sharing deal. In the end, the New York hedge fund made three times more money on the short bets than Hindenburg itself. What’s more, Kingdon enlisted help from one of India’s biggest banks to carry out the trades.

The extensive notice — sent to Hindenburg, its founder Nathan Anderson, Kingdon’s founder-owner Mark Kingdon and Mauritius-based investor K India Opportunities Fund — is part of Sebi’s investigation into the trading activities surrounding Adani Enterprises Ltd., the flagship company for the billionaire Adani family.

Though Adani repeatedly denied Hindenburg’s allegations, the ensuing stock rout at one point wiped out billions in market value from its listed companies. Adani Group, whose sprawling empire ranges from energy and mining to ports, has since recovered the bulk of the stock losses.

The Indian markets regulator didn’t respond to a request for comment, nor did the Adani Group or Hindenburg. Kingdon declined to comment.

‘Pre-Release Sharing’

The regulatory investigation examined communication from Hindenburg starting from November 2022 — nearly a month before the report was shared with Kingdon and three months before it was published.

“Pre-release sharing of research with select investors is not uncommon industry practice, particularly among short-sellers,” said Kher Sheng Lee, Asia-Pacific co-head of the Alternative Investment Management Association. “The legality of such sharing is fact-sensitive, with a focus on whether there was intent to manipulate markets or engage in insider trading.”

Kingdon, which had a controlling stake in the K India fund, had a profit-sharing pact with Hindenburg, with the latter receiving 30% of any gains from trading securities based on its research, according to the Sebi letter. For the Adani short bet, the cut was pared to 25% due to the extra time and effort needed to route trades via the K India fund.

By the end of December, Kingdon begun subscribing into the shares of the fund, and in January transferred $43 million in two tranches to build short positions in Adani Enterprises. Kingdon Capital also signed an agreement with India lender Kotak Mahindra (International) Ltd., or KMIL, to help execute the trades.

The K India fund built short positions for 850,000 shares between Jan. 10 and 20 — just days ahead of the report’s release — through futures contracts and squared-off these positions between Feb. 1 and Feb. 22. The bets yielded gains of $22.3 million, Sebi said in the notice. As part of its deal with the short-seller, Kingdon owed Hindenburg $5.5 million. About $4.1 million of that had been paid as of June 1, according to the Sebi note.

Regulatory Crosshairs

While Hindenburg has called out Sebi for going after those who are exposing fraud in India, the face-off underscores an escalating tussle globally as short-sellers themselves increasingly find themselves in the regulatory crosshairs.

A sweeping US effort to examine relationships between hedge funds and skeptical researchers began rattling the industry three years ago as investigators set out to gather intelligence on money managers and activists.

The US Justice Department was collecting a trove of information on dozens of investment firms and researchers engaged in short selling to hunt for potential trading abuses. The probe recently yielded its first notable punishment, offering a rare glimpse into controversial collaborations between bearish researchers and hedge funds that place big bets against companies.

“Short-selling, when grounded in diligent research, plays a crucial role in price discovery, market efficiency and identifying potential corporate governance issues,” AIMA’s Lee said.

Kingdon Capital said it had legal advice that it could receive draft reports and make investments before these were publicly disseminated, without violating US laws, according to the Sebi notice.

Kingdon is one of the oldest hedge funds in the industry. Started by Mark Kingdon in 1983 with $2 million, its assets grew to $7 billion in 2007. Kingdon’s Brooklyn-born founder started penning investment newsletters as early as his high school years. He took sole control of running the main fund in 2018 after investment losses and investor withdrawals prompted the liquidation of its credit pool.

Masking Kotak

In its July 1 statement, Hindenburg also shot back at Sebi for papering over the links between the transaction and prominent Indian lender, Kotak Mahindra Bank Ltd.

“Its notice conspicuously failed to name the party that has an actual tie to India: Kotak Bank,” one of India’s largest banks and brokerage firms founded by Uday Kotak, which oversaw the offshore fund structure used by Kingdon, the short-seller said.

Instead, it named the K-India Opportunities fund and “masked the Kotak name with the acronym “KMIL,”” Hindenburg said.

Hindenburg has never been a client of Kotak Mahindra International nor has it ever been an investor in the K India Opportunities Fund, the Indian lender said in a statement Tuesday. The fund was never aware that Hindenburg was a partner of any of its investors, it added.

Much of the Sebi notice is also devoted to what the regulator considers misleading aspects of Hindenburg’s initial report alleging fraud at the ports-to-power Adani Group.

Violated Laws

“These misrepresentations built a convenient narrative through selective disclosures, reckless statements and catchy headlines in order to mislead readers of the report and cause panic in Adani group stocks, thereby deflating prices to the maximum extent possible,” Sebi noted.

Hindenburg also violated local security laws by publishing the report, since it wasn’t registered as a research firm in India, it added.

On its part, Hindenburg thinks Sebi is muzzling those cautioning the investors.

“We are sharing the entirety of this notice, frankly because we think it is nonsense, concocted to serve a pre-ordained purpose: an attempt to silence and intimidate those who expose corruption and fraud perpetrated by the most powerful individuals in India,” the short-seller said in the July 1 statement.

--With assistance from Advait Palepu and Saikat Das.

Most Read from Bloomberg Businessweek

China’s Investment Bankers Join the Communist Party as Morale (and Paychecks) Shrink

The Fried Chicken Sandwich Wars Are More Cutthroat Than Ever Before

Dragons and Sex Are Now a $610 Million Business Sweeping Publishing

For Tesla, a Smaller Drop in Sales Is Something to Celebrate

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance