Which Hedge Fund Manager Holds 7% of 1 of the World's Largest Analog Chipmakers?

- By Omar Venerio

Analog Devices Inc. (ADI), a $29.18 billion market cap company, manufactures high-performance integrated circuits used in analog and digital signal processing applications.

The U.S. semiconductors industry is known for its technological advancements as well as a positive correlation to global GDP. Apart from this, the company faces several challenges such as various competitors with strong expertise in the market and a highly cyclical semiconductor industry.

Warning! GuruFocus has detected 4 Warning Signs with ADI. Click here to check it out.

The intrinsic value of ADI

Strong fiscal second-quarter results

Looking at profitability, revenues rose by 54.1% year over year and earnings per share increased in the second quarter compared to the same quarter a year ago to $1.03 and beat estimates by $100 million and 19 cents. These good numbers were obtained, among others, with the acquisition of Linear Technology Corp. (LLTC). The acquisition creates a high-performance analog industry powerhouse, apart from contributing $147.5 million of the $1.1 billion in revenues. Looking ahead to the next quarter, estimates for revenue will be in the range of $1.34 billion to $1.42 billion on a GAAP basis.

Moreover, the company has declared a quarterly cash dividend of 45 cents per share, representing an annual dividend per share of $1.80 and a dividend yield of 2.18%, which is close to a five-year low. The company?s operating margin is at high levels, at more than 25%, as well as its net profit margin of almost 21%, which is ranked higher than 92% of the 861 companies in the Global Semiconductors industry.

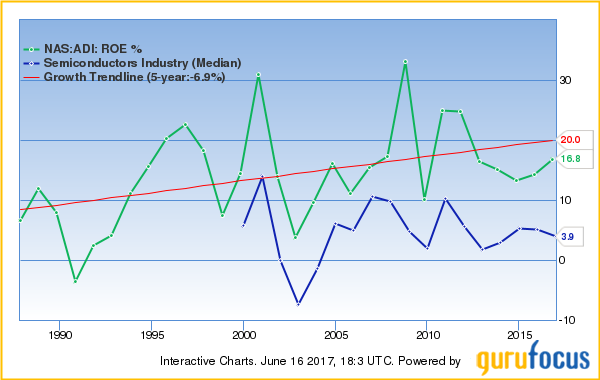

Now, let's compare the best measure of performance for a firm's management: the return on equity. The ROE is useful for comparing the profitability of a company to that of other firms in the same industry.

Ticker | Company | ROE (%) |

ADI | Analog Devices | 4 . 9 |

TXN | Texas Instruments | 37 . 7 8 |

MU | Micron Technology | 2 6 . 88 |

Industry Me dian | 4 . 91 |

The company has a current ROE of 4.9% which is lower than the one exhibit by its industry peers. In general, analysts consider ROE ratios in the 15% to 20% range as representing attractive levels for investment. For investors looking for those levels or more, Texas Instruments (TXN) and Micron Technology (MU) should be attractive options. It is very important to understand this metric before investing, and it is important to look at the trend in ROE over time.

Relative valuation

In terms of valuation, the stock sells at a trailing price-earnings (P/E) of 30.08x, trading at a premium compared to an average of 23.1x for the industry. To use another metric, its price-book (P/B) ratio of 2.93x indicates a premium versus the industry average of 1.97x while the price-sales (P/S) ratio of 6.38x is above the industry average of 1.8x. These ratios indicate that the stock is overvalued, which is not surprising because the price is close to a 10-year high.

As we can see in the next chart, the stock price has an upward trend in the five-year period. If you had invested $10,000 five years ago, today you could have $23,389, which represents an 18.52% compound annual growth rate (CAGR).

Hedge fund sentiment

William Von Mueffling's Cantillon Capital Management is the largest shareholder of the company with 6.7 million shares valued at $549.2 million and 7.02% of his 13F portfolio. Jean-Marie Eveillard upped his stake by 85% in the last trimester to 6.52 million shares and Jim Simons (Trades, Portfolio) did the same with an increase of 160% to 2.11 million shares.

Final comment

Although Analog Devices has achieved appealing results, the major risk is the highly cyclical semiconductor industry to which the firm is exposed. Based on the past results, the company should report good revenue growth in the future as Linear Tech added positive synergies. Moreover, Analog Devices benefits from increased electronics content, especially in the industrial and automotive end markets, but we must take into account that a downturn in those sectors could affect the company.

Disclosure: Author holds no position in any stocks mentioned

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 4 Warning Signs with ADI. Click here to check it out.

The intrinsic value of ADI

Yahoo Finance

Yahoo Finance