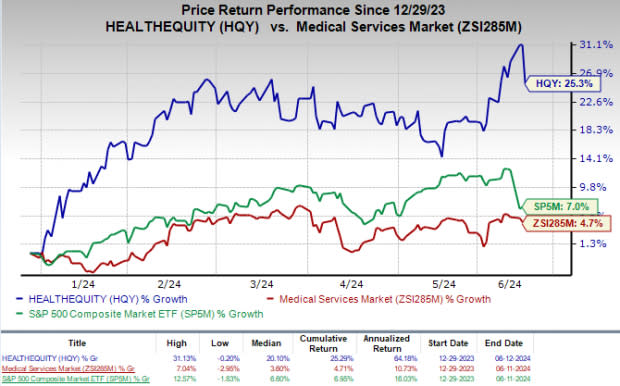

HealthEquity (HQY) Gains 25.3% YTD: What's Driving the Rally?

HealthEquity, Inc. HQY witnessed strong momentum in the year-to-date period. Shares of the company rallied 25.3% compared with 4.7% growth of the industry. The S&P 500 Composite has risen 7% during the same time frame.

With healthy fundamentals and strong growth opportunities, this Zacks Rank #2 (Buy) company appears to be a solid wealth creator for its investors at the moment.

Draper, UT-headquartered HealthEquity provides integrated solutions for healthcare account management, health reimbursement arrangements and flexible spending accounts for health plans, insurance companies and third-party administrators in the United States. HealthEquity uses its innovative technology to manage consumers' tax-advantaged Heath Saving Accounts (HSAs) and other consumer-directed benefits (CDBs) offered by employers, including flexible spending accounts and health reimbursement arrangements (FSAs and HRAs).

Catalysts Driving Growth

The rally in the company’s share price can be attributed to the sustained strength in its HSAs management business. The optimism led by a solid first-quarter fiscal 2025 performance and robust business potential are expected to contribute further.

HealthEquity exited first-quarter fiscal 2025 with better-than-expected results. The company witnessed solid top-line and bottom-line performances in the reported quarter, which is likely to have aided in the price growth. The top line benefited from robust contributions from all its revenue sources. Solid growth in HSAs also drove the top line.

HQY has upped its revenue and earnings projections for fiscal 2025, which are also likely to have interested investors. For fiscal 2025, revenues are now projected to be between $1.16 billion and $1.18 billion, up from the previous outlook of $1.14 billion and $1.16 billion. For the same fiscal year, adjusted earnings per share (EPS) are now expected to be in the range of $2.93-$3.10, up from the earlier guidance of $2.79-$2.96.

During the first quarter of fiscal 2025, apart from expanding its claims automation for FSA members, HealthEquity introduced more AI-driven support technology and made its stacked account card for iOS and Android mobile wallets available to a limited number of enterprise clients. In order to handle the higher-than-expected uptake, the business has expanded the capacity and insurer partners in the Enhanced Rates program. These are likely to have favored the stock’s growth.

HealthEquity has also historically acquired HSA portfolios and businesses that strengthen its service offerings. In May 2024, the company completed the acquisition of the BenefitWallet HSA portfolio from Conduent Business Services, LLC. The agreement contemplated a transfer of approximately 665,000 customer accounts and their approximately $2.8 billion of HSA Assets.

HealthEquity transitioned two of the three tranches of BenefitWallet in the fiscal first quarter, adding approximately 400,000 HSAs and $1.6 billion of HSA Assets. The final BenefitWallet transfer occurred at the beginning of the fiscal second quarter.

Image Source: Zacks Investment Research

Risk Factors

HealthEquity’s business, including HSAs and many of the CDBs it administers, along with investment advisers and trust company subsidiaries, is subject to complex and frequently changing federal and state laws and regulations. These regulatory requirements could result in additional claims or class action litigation brought on behalf of HealthEquity’s members, Clients or Network Partners, any of which could result in substantial costs to the company and divert management’s attention and other resources away from operations.

HealthEquity also faces stiff competition in the Medical Services market, which is a rapidly evolving and fragmented one. The company’s direct competitors are HSA custodians that include state or federally chartered banks, such as Webster Bank and Optum Bank, along with non-bank custodians approved by the U.S. Treasury, such as Payflex Systems USA, Inc.

A Look at Estimates

HQY’s EPS for fiscal 2025 and 2026 is projected to grow 30.2% and 23.3%, respectively, to $2.93 and $3.61 on a year-over-year basis. The Zacks Consensus Estimate for earnings has expanded 3 cents for 2025 and a cent for 2026 in the past 30 days.

Revenues for fiscal 2025 and 2026 are anticipated to rise 16.3% and 14.3%, respectively, to $1.16 billion and $1.33 billion on a year-over-year basis.

Other Stocks to Consider

Some other top-ranked stocks in the broader medical space that have announced quarterly results are DaVita DVA, Ecolab ECL and Boston Scientific Corporation BSX.

DaVita, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 13.6%. DVA’s earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 29.4%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

DaVita’s shares have gained 44% compared with the industry’s 20.4% rise in the past year.

Ecolab, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 13.3%. ECL’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 1.7%.

Ecolab’s shares have rallied 33.8% against the industry’s 9.3% decline in the past year.

Boston Scientific reported first-quarter 2024 adjusted EPS of 56 cents, which beat the Zacks Consensus Estimate by 9.8%. Revenues of $3.86 billion surpassed the Zacks Consensus Estimate by 4.9%. It currently carries a Zacks Rank #2.

Boston Scientific has a long-term estimated growth rate of 12.5%. BSX’s earnings surpassed estimates in the trailing four quarters, the average surprise being 7.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Boston Scientific Corporation (BSX) : Free Stock Analysis Report

Ecolab Inc. (ECL) : Free Stock Analysis Report

DaVita Inc. (DVA) : Free Stock Analysis Report

HealthEquity, Inc. (HQY) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance