HD Vs LOW: Which Home Improvement Player Edges Over the Other?

The home improvement industry has long been a witness to the tussle between the market duopoly — The Home Depot Inc. HD and Lowe’s Companies Inc. LOW. Having dominated the U.S. home improvement market for long, Home Depot and Lowe’s have time and again been in competition with each other for the top spot.

Given the situation, choosing between these companies has always turned out to be daunting for investors. While these two big names have impressed investors with stability and growth, picking one stock of the two can be a task. Here, we are going to present an analysis of the growth avenues, earnings outcomes, dividend stability and other factors that can help investors with this tough choice.

HD & LOW - Statistics & Share

While the two heavyweights of the U.S. home improvement industry — Home Depot and Lowe’s have been competing for the same market over decades, there is a stark difference in their sizes, branding, and supply-chain strategies. Commanding market caps of $350.9 billion and $129.8 billion, respectively, Home Depot and Lowe’s are often seen vying for the same group of customers, including retail and professionals.

In terms of market share, Home Depot is much larger than Lowe's and is often referred to as the largest home improvement retailer. However, Lowe's has been growing and has stood by its position of being the second-largest home improvement player for long. Notably, Home Depot has a market share of 62.1%, ahead of the 34.9% claimed by rival Lowe’s.

In 2023, Home Depot's annual sales amounted to more than $152 billion, whereas its main competitor, Lowe's, reached more than $86 billion.

Home Depot has garnered the lead position in the industry, owing to its large store base operating in all 50 states, the District of Columbia, Puerto Rico, the U.S. Virgin Islands, Guam, 10 Canada provinces and Mexico. Notably, the company operated 2,337 retail stores as of Apr 28, 2024. Then again, Lowe's, while also international, has a slightly smaller footprint but remains a strong contender in the U.S. market. Lowe’s has a store base of more than 1,700 as of May 3, 2024.

Undoubtedly, both companies have a strong presence, extensive product ranges and dedicated customer bases. Although both behemoths are attractive long-term buys, it is ideal to evaluate these stocks based on their prospects.

Strategies in Focus

Both Home Depot and Lowe’s look well-poised for long-term growth on their strategic initiatives to expand their customer bases and grow digital presence. Both companies see millions of customers visit their stores each year, with Home Depot generally attracting more due to its larger store count and higher market penetration.

Based in Atlanta, GA, Home Depot’s consistent expansion in both Professional and Do-It-Yourself segments, fortified by an extensive product lineup and digital innovations, underpins its remarkable success. The company mainly emphasizes professional customers (Pro customers) who purchase in larger quantities and more frequently.

Additionally, HD remains on track with its investment in technology and e-commerce to enhance the customer experience. The company's interconnected retail strategy and robust technological infrastructure have amplified web traffic, leading to growth in digital sales.

Meanwhile, Lowe’s demonstrates noteworthy adaptability in responding to evolving consumer behaviors and market dynamics. The company has recalibrated its strategies to focus on smaller, non-discretionary projects and enhance value propositions for customers. Investments in service offerings, operational efficiency and long-term drivers like sustained home improvement demand support growth and profitability.

Lowe's has implemented a comprehensive Pro-focused strategy, emphasizing improved product availability, timely delivery, and an expanded assortment, complemented by a reward program. Strategic growth initiatives, such as store expansion and enhanced customer experiences, aim to position the company as a top omnichannel retailer.

Earnings Estimates

From the outlook perspective, Home Depot continues to project modest growth in revenues and EPS, while Lowe’s expects to witness year-over-year declines. Recent trends reveal softness in the home improvement market as homeowners pull back from big-ticket discretionary project spends due to rising inflation. This trend is well-reflected in analysts’ earnings expectations for both companies.

Home Depot’s fiscal 2024 revenues are projected to grow 1% year over year to $154.2 billion and EPS is expected to increase 1.1% year over year to $15.28. HD’s EPS estimates for fiscal 2024 moved down by a penny in the last 30 days.

Meanwhile, Lowe’s EPS estimates for fiscal 2024 have moved up 0.2% in the past 30 days. LOW’s fiscal 2024 revenues are expected to decline 2.1% year over year to $84.6 billion and EPS is likely to fall 7.4% to $12.23.

Therefore, we can clearly see that Home Depot has seen analysts lowering EPS estimates after the earnings releases, while LOW witnessed an uptrend in estimate revisions. However, HD’s estimates indicate an increase in revenues and earnings for this year, whereas LOW’s estimates suggest year-over-year declines.

Both Home Depot and Lowe’s currently carry a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Dividend Payouts

Despite the recent slowdown in demand, the home improvement industry continues to be an attractive investment place. Apart from stability and growth potential, Home Depot and Lowe’s tend to attract investors with their strong record of paying regular dividends. These companies have consistently raised dividend payouts, reflecting their confidence in their earnings growth potential.

Home Depot pays out a quarterly dividend of $2.25 ($9.00 annualized) per share, giving a 2.54% yield at the current stock price. HD’s payout ratio is 60%, with a five-year dividend growth rate of 11.1%. (Check HD’s dividend history here)

Lowe’s pays out a quarterly dividend of $1.15 ($4.40 annualized) per share, giving a 1.93% yield at the current stock price. LOW’s payout ratio is 35%, with a five-year dividend growth rate of 21.8%. (Check LOW’s dividend history here)

Stock Performance

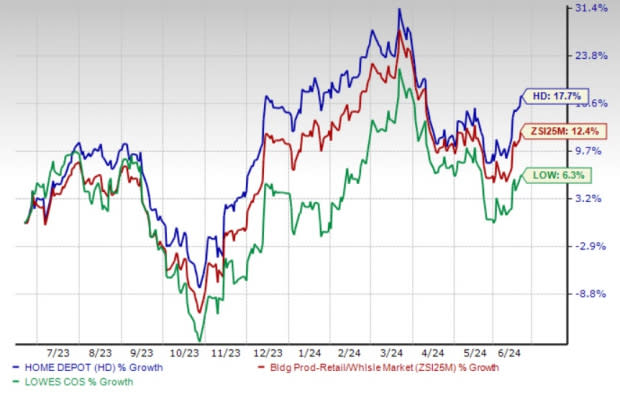

In the past year, we have seen upward share price revision trends for both Home Depot and Lowe’s. While HD has risen well above the Zacks Building Products – Retail industry, LOW stayed below the curve.

Notably, Home Depot and Lowe’s have risen 17.7% and 6.3% in the past year, respectively, compared with the industry’s growth of 12.4%.

Image Source: Zacks Investment Research

Valuation

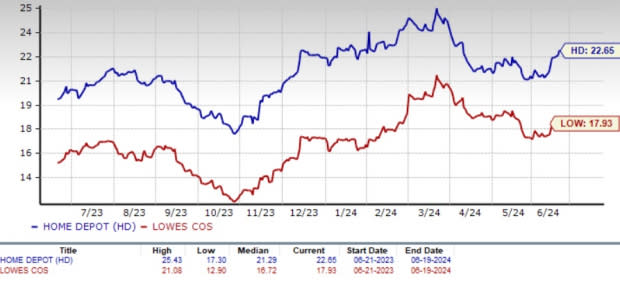

In the valuation chart below, we see that HD and LOW have similar forward price-to-earnings multiples. Home Depot trades at 22.65X, which is above its 5-year median of 21.29X, and Lowe’s is trading at 17.93X, also above its 5-year median of 16.72X. A lower trading multiple than its median indicates that these stocks have good scope for an upside.

Meanwhile, the Zacks Building Products – Retail industry currently trades at a 20.11X forward price-to-earnings multiple, which is essentially below Home Depot’s multiple and above Lowe’s. Hence, Lowe’s looks relatively cheaper than the broader industry.

Image Source: Zacks Investment Research

Conclusion

Both Home Depot and Lowe's are dominant players in the home improvement retail industry. Looking fundamentally, Home Depot stands tall in terms of market share, revenues and profitability, benefiting from its larger scale and efficient operations. Lowe's, while smaller, remains a formidable competitor, continually enhancing its operations and customer offerings.

Ideally, the ongoing investments in technology, supply-chain improvements and customer service by both companies indicate their commitment to maintaining their competitive edge in the evolving retail landscape.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lowe's Companies, Inc. (LOW) : Free Stock Analysis Report

The Home Depot, Inc. (HD) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance