Hawthorn Bancshares Inc Reports Notable First Quarter 2024 Financial Results

Net Income: $4.5M, an increase of 36.2% from the prior year quarter.

Earnings Per Share: $0.63, up from $0.47 in the prior year quarter.

Net Interest Margin: 3.39%, up from 3.16% in the prior year quarter.

Loans: Decreased by $20.3M or 1.3% compared to the linked quarter.

Investments: Decreased by $5.3M or 2.7% compared to the linked quarter.

Deposits: Decreased by $43.0M or 2.7% compared to the linked quarter.

Non-Performing Loans to Total Loans: 0.56%, improved from 1.27% in the prior year quarter.

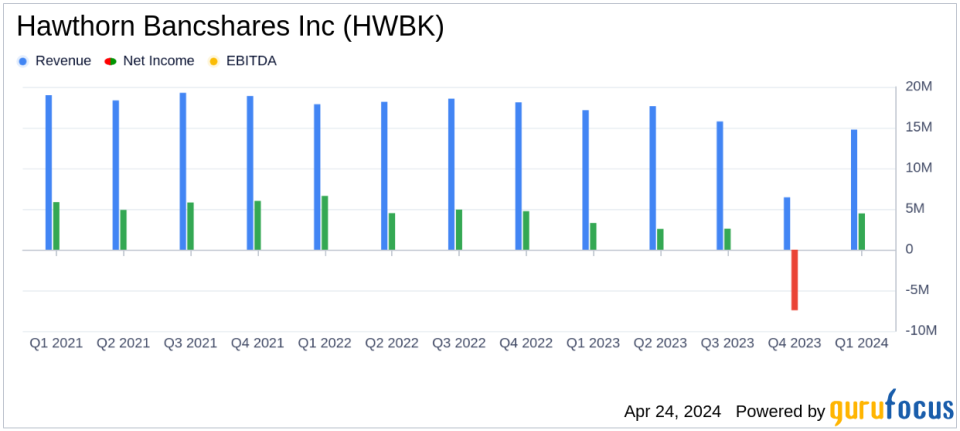

Hawthorn Bancshares Inc (NASDAQ:HWBK), a prominent financial holding company, announced its first quarter results for 2024 on April 24, showcasing significant improvements in net income and earnings per share. The company reported a net income of $4.5 million, translating to earnings per diluted share of $0.63, marking a substantial increase from the previous year. The detailed financial outcomes are accessible in the company's 8-K filing.

Hawthorn Bancshares operates through its subsidiary, Hawthorn Bank, offering a wide range of banking services including checking and savings accounts, internet banking, and various loan options. The bank is headquartered in Jefferson City, Missouri, with several locations across the state.

Financial Performance Insights

The first quarter of 2024 saw Hawthorn Bancshares increase its net income by 36.2% compared to the first quarter of 2023, with earnings per share up by 34.0%. This growth is attributed to improved profitability and efficient expense management as noted by CEO Brent Giles. He remarked,

We are pleased with our first quarter results as we posted improvement in net income, efficiency and margin over the same quarter last year. These results reflect our focus on improving profitability from our core businesses while also managing expenses."

The bank's net interest margin was reported at 3.39%, slightly down from the previous quarter but up from 3.16% in the prior year. This indicates a more profitable earning asset base despite a challenging interest rate environment. The efficiency ratio improved significantly to 70.78%, reflecting better cost management compared to previous periods.

Balance Sheet and Income Statement Analysis

As of March 31, 2024, total assets were slightly decreased to $1.83 billion from the previous quarter. The bank saw a reduction in loans and investments, which is aligned with its strategy to optimize its asset base. Deposits also saw a decrease, which was part of a strategic shift to reduce exposure to public funds.

Non-interest income for the quarter was $3.0 million, a slight decrease from the prior year, but an improvement from the previous quarter. This was mainly due to adjustments in the mortgage servicing rights valuation. Non-interest expenses were down by 13.8% from the linked quarter, showcasing effective cost control measures.

Asset Quality and Capital Adequacy

The bank maintained strong credit quality with non-performing loans to total loans at just 0.56%. This is a significant improvement from the prior year, demonstrating the bank's effective risk management strategies. The allowance for credit losses was robust, covering 276.93% of non-performing loans as of the end of the quarter.

Capital ratios remained solid with the bank maintaining its "well capitalized" status. The tier 1 leverage ratio stood at 10.71%, indicating a strong capital base to support future growth and withstand potential losses.

Looking Ahead

With a strong start to 2024, Hawthorn Bancshares appears well-positioned to continue its growth trajectory. The bank's strategic decisions, such as optimizing its balance sheet and enhancing its capital structure, are expected to support sustained profitability and shareholder value in the upcoming quarters.

For more detailed financial information and future updates, investors and interested parties are encouraged to refer to the official filings and announcements from Hawthorn Bancshares Inc.

Explore the complete 8-K earnings release (here) from Hawthorn Bancshares Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance