Hasbro (HAS) Dips 25% in 6 Months: What's Hurting the Stock?

Are you still holding shares of Hasbro, Inc. HAS and waiting for a miracle to take the stock higher in the near term? If yes, then you may end up losing more money, as chances of a turnaround appear bleak in the near term. This is quite apparent from the stock’s decline of 24.7% in the past six months. On the contrary, the industry has gained 5.6% in the same period.

Let’s delve deeper and try to find out the factors behind this Zacks Rank #4 (Sell) company’s dismal performance.

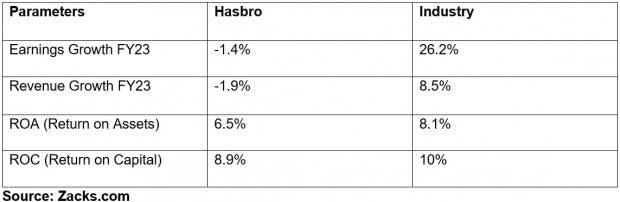

Hasbro Vs Industry Scorecard

Image Source: Zacks Investment Research

Disappointing Performance in 2022

The company’s 2022 revenues were $5.9 billion, down 9% year over year. Foreign exchange movement negatively impacted revenues by 3% year over year. Consumer Products and Entertainment revenues were $3.6 billion and $959 million, down 10% and 17% year over year, respectively. However, revenues of Wizards of the Coast and Digital Gaming increased 3% year over year to $1.3 billion.

The company’s 2022 results show operating profit margin of 7%, which declined 490 basis points (bps) from the previous year. The adjusted operating profit margin declined 20 bps to 15.7% from the previous year.

Higher Costs to Hurt Profits

Hasbro's initiatives, including product launches and a shift toward more technology-driven toys for reviving its brands and boosting sales, are likely to drive profits in the long term. However, costs related to those initiatives may prove detrimental to the company in the near term. The company has shouldered high expenses with respect to freight, product costs, sales allowances, and various toy and gaming product closeouts.

The company anticipates inflationary pressures to persist for the majority of 2023. In fourth-quarter fiscal 2022, Hasbro's cost of sales (as a percentage of net revenues) was 34.6% compared with 33.9% in the prior-year quarter. Selling, distribution and administration expenses as a percentage of net revenues were 39.7% compared with 21.3% in the prior-year quarter.

Stocks to Consider

Some better-ranked stocks in the Zacks Consumer Discretionary sector are Wynn Resorts, Limited WYNN, Hilton Grand Vacations Inc. HGV and Crocs, Inc. CROX.

Wynn Resorts currently sports a Zacks Rank #1 (Strong Buy). The WYNN stock has gained 46.8% in the past year.

You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for WYNN’s 2023 sales and EPS indicates a rise of 43.3% and 118.8%, respectively, from the year-ago period’s reported levels.

Hilton Grand Vacations currently flaunts a Zacks Rank #1. HGV has a trailing four-quarter earnings surprise of 12.1%, on average. Shares of HGV have declined 21.1% in the past year.

The Zacks Consensus Estimate for HGV’s 2023 sales and EPS indicates a rise of 7.1% and 10.8%, respectively, from the year-ago period’s reported levels.

Crocs carries a Zacks Rank #2 (Buy) at present. The company has a trailing four-quarter earnings surprise of 21.8%, on average. Shares of Crocs have gained 40.7% in the past year.

The Zacks Consensus Estimate for CROX’s 2023 sales and EPS indicates a rise of 12.5% and 2.5%, respectively, from the year-ago period’s reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hasbro, Inc. (HAS) : Free Stock Analysis Report

Wynn Resorts, Limited (WYNN) : Free Stock Analysis Report

Crocs, Inc. (CROX) : Free Stock Analysis Report

Hilton Grand Vacations Inc. (HGV) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance