The Hartford Financial Services Group Inc (HIG) Surpasses Analyst Earnings Estimates in Q1 2024

Net Income: Reported $748 million, up 41% from $530 million in the previous year, surpassing the estimate of $738.5 million.

Earnings Per Share (EPS): Achieved $2.47 per diluted share, exceeding the estimated $2.45 per share.

Revenue: Property & Casualty (P&C) written premiums rose to $3.4 billion, marking a 9% increase year-over-year.

Core Earnings: Increased by 32% to $709 million, with core earnings per diluted share rising to $2.34 from $1.68 in the prior year.

Return on Equity (ROE): Net income ROE reached 18.5%, showing significant growth from 12.8% the previous year.

Shareholder Returns: Returned $491 million to shareholders through $350 million in share repurchases and $141 million in dividends.

Combined Ratio: Improved in Commercial Lines to 90.1 from 92.7, indicating better profitability in underwriting activities.

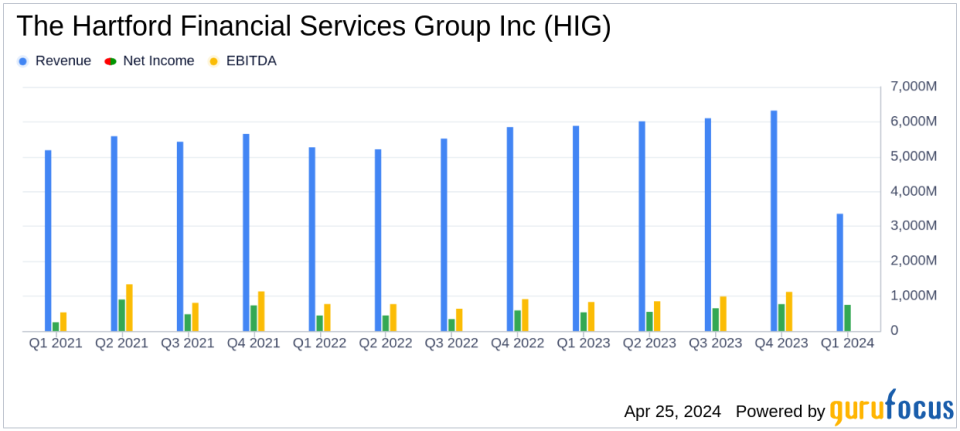

The Hartford Financial Services Group Inc (NYSE:HIG) released its 8-K filing on April 25, 2024, reporting a robust financial performance for the first quarter of 2024. The company's net income available to common stockholders reached $748 million, translating to $2.47 per diluted share, which notably surpassed the analyst's estimated earnings per share of $2.45. This represents a significant 41% increase from the $530 million, or $1.66 per diluted share, recorded in the same period in 2023.

The Hartford Financial Services Group Inc offers a diverse range of property and casualty insurance, group benefits, and mutual funds services. Operating across five segments including Commercial Lines, Personal Lines, Property & Casualty Other Operations, Group Benefits, and Hartford Funds, the company is a well-established entity in the insurance industry, known for its robust service offerings and financial stability.

Key Financial Highlights

The first quarter results demonstrated strong premium growth and underwriting gains, particularly in the Commercial and Personal Lines, which saw premium growth of 8% and 13% respectively. The Property & Casualty (P&C) segment's written premiums rose by 9% overall. The Group Benefits segment also showed resilience with a fully insured ongoing premium growth of 2%.

Significantly, the Commercial Lines achieved an exceptional quarter with an underlying combined ratio of 88.4, indicating strong profitability margins. This was supported by pricing adjustments and a favorable underwriting environment, which outpaced loss cost trends. Moreover, the company returned $491 million to stockholders in the form of share repurchases and dividends, highlighting its commitment to shareholder value.

Investment and Core Earnings Growth

Core earnings for the quarter stood at $709 million, or $2.34 per diluted share, up 32% from $536 million, or $1.68 per diluted share in the prior-year period. This increase was primarily driven by a 10% growth in P&C earned premium and higher net investment income, which rose to $593 million from $515 million in the first quarter of 2023. The Group Benefits segment also contributed positively with a core earnings margin of 6.1%.

Strategic Business Movements

The Hartford's strategic initiatives have positioned it well for sustainable growth. The company's focus on pricing strategies, especially in the auto insurance sector where written price increases reached nearly 26%, reflects its proactive approach to managing market dynamics and enhancing profitability. Furthermore, the company's effective capital management, as evidenced by significant shareholder returns, underscores its strong financial health and operational efficiency.

Outlook and Management Commentary

Christopher Swift, Chairman and CEO of The Hartford, expressed confidence in the company's trajectory, citing the consistent performance and stability of margins as key drivers for future growth and shareholder value. CFO Beth Costello highlighted the success in Commercial Lines and the solid results in Group Benefits, emphasizing the company's robust start to 2024.

In conclusion, The Hartford Financial Services Group Inc's first-quarter results for 2024 not only surpassed analyst expectations but also showcased a solid foundation for continued financial health and strategic growth. With a strong focus on underwriting discipline, strategic capital management, and proactive market positioning, HIG is well-poised to maintain its leadership in the insurance sector.

Additional Resources

For more detailed financial information and future updates, investors and interested parties are encouraged to visit The Hartford's Investor Relations website at https://ir.thehartford.com.

Explore the complete 8-K earnings release (here) from The Hartford Financial Services Group Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance