Hamilton Lane (HLNE) Rewards Investors With 9% Dividend Hike

Hamilton Lane Incorporated HLNE announced a sequential increase in its quarterly dividend payment. The company declared a quarterly cash dividend per share of 49 cents, reflecting a 9% increase from its previous payout. The dividend will be paid out on Jul 5 to shareholders of record as of Jun 14.

The bank increased its dividend six times during the last five years. Prior to the recent hike, HLNE raised its dividend by 12.5% to 45 cents per share in May 2023.

Considering the company’s closing price of $124.22 on May 23, its dividend yield is currently pegged at 1.6% and its payout ratio is 51% of earnings.

Apart from regular dividend payouts, HLNE has a share repurchase program in place. The board of directors approved a stock repurchase program in December 2023. The plan expires a year after the date of the first repurchase under the authorization. HLNE hasn’t bought back any shares as of date, leaving the complete purchase authority available under this program.

As of Mar 31, 2024, the company had a total cash and cash equivalents of $114 million, which increased from $99.7 million from the prior year. Further, its total debt declined to $196 million from $213.5 million year over year. Given the company’s improving liquidity position, HLNE is expected to sustain its capital distribution activities in the long run. Through this, HLNE will keep enhancing shareholder value.

A dividend hike of the company was announced along with the earnings update of the fourth quarter and fiscal year 2024 results. The company reported earnings per share (GAAP) for the fiscal 2024 of $3.69, up from $3.01 in the fiscal 2023.

Also, the company recorded total revenues of $451.9 million, which increased 22% from the prior year. Its net income for fiscal 2024 was $140.9, up 22.6% from fiscal 2023.

HLNE’S total assets under management were $124 billion, up 11% year over year.

The fiscal 2024 result shows strength in HLNE’s core business, which will allow the firm to sustain itself in the current rapidly changing economy.

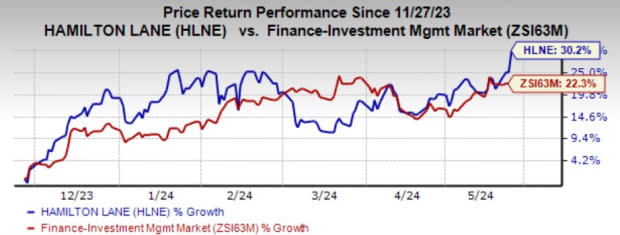

In the past six months, Hamilton Lane’s shares have rallied 30.2% compared with the industry’s growth of 22.3%.

Image Source: Zacks Investment Research

Currently, HLNE carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Companies Taking Similar Steps

Earlier this week, M&T Bank Corporation MTB announced a sequential increase in its quarterly dividend payment. The company declared a quarterly cash dividend per share of $1.35, reflecting a 4% increase from its previous payout. The dividend will be paid out on Jun 28 to shareholders of record as of Jun 3.

MTB increased its dividend three times during the last five years. Prior to the recent hike, MTB raised its dividend by 8.3% to $1.30 per share in February 2023.

Similarly, Nicolet Bankshares, Inc. NIC announced a quarterly cash dividend of 28 cents per share. This marks a 12% hike from the prior payout. The dividend will be paid out on Jun 14, 2024, to shareholders of record as of Jun 3.

NIC raised its dividend payout for the first time since its inception. It announced its first quarterly cash dividend in May 2023. Currently, NIC’s payout ratio is 15% of earnings. This indicates that it retains adequate earnings for reinvestment and future growth initiatives while still delivering decent returns to its shareholders.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

M&T Bank Corporation (MTB) : Free Stock Analysis Report

Hamilton Lane Inc. (HLNE) : Free Stock Analysis Report

Nicolet Bankshares Inc. (NIC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance