Can Halliburton (HAL) Pull Off a Strong Show in Q1 Earnings?

Halliburton Company HAL is set to release first-quarter results on Apr 23. The current Zacks Consensus Estimate for the to-be-reported quarter is a profit of 74 cents per share on revenues of $5.7 billion.

Let’s delve into the factors that might have influenced the oilfield service firm’s performance in the March quarter. But it’s worth taking a look at HAL’s previous-quarter performance first.

Highlights of Q4 Earnings & Surprise History

In the last reported quarter, this Houston, TX-based provider of technical products and services to drillers of oil and gas wells beat the consensus mark due to strength in the international markets. Halliburton had reported adjusted net income per share of 86 cents, surpassing the Zacks Consensus Estimate of 80 cents. However, revenues of $5.7 billion came below the Zacks Consensus Estimate by some $47 million on weak performance in the North American region.

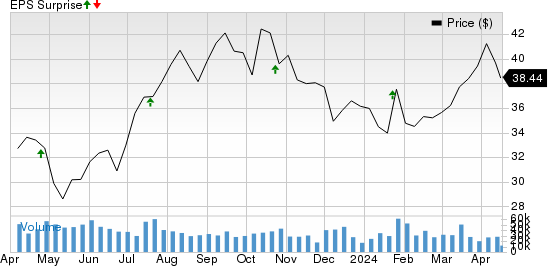

HAL beat the Zacks Consensus Estimate in each of the last four quarters, which resulted in an average earnings surprise of 5.1%. This is depicted in the graph below:

Halliburton Company Price and EPS Surprise

Halliburton Company price-eps-surprise | Halliburton Company Quote

Trend in Estimate Revision

The Zacks Consensus Estimate for the first-quarter bottom line has remained unchanged in the past seven days. The estimated figure indicates a 2.8% improvement year over year. The Zacks Consensus Estimate for revenues, meanwhile, suggests a 0.1% increase from the year-ago period.

Factors to Consider

Our expectation for the first-quarter operating income of the Drilling & Evaluation segment is pegged at $398.8 million, indicating an 8.1% improvement from the year-ago quarter on the back of the rollout of Halliburton’s Zeus fleet and the strength of its well construction business. This should have supported the company’s revenues and cash flows.

On a further bullish note, the decrease in HAL’s costs might have buoyed the company’s to-be-reported bottom line. Going by our model, the company’s first-quarter cost of sales is likely to have totaled $4.6 billion, down 0.5% from the year-ago period. The downward cost trajectory, despite the prevailing inflationary environment, could have been attributed to Halliburton’s prudent expense management policies.

Why a Likely Positive Surprise?

Our proven model predicts an earnings beat for Halliburton this season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

HAL has an Earnings ESP of +0.81% and a Zacks Rank #3.

Other Stocks to Consider

Halliburton is not the only company looking up this earnings cycle. Here are some other firms that you may want to consider on the basis of our model:

Valero Energy Corporation VLO has an Earnings ESP of +2.00% and a Zacks Rank #2. The firm is scheduled to release earnings on Apr 25.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Valero Energy’s expected EPS growth rate for three to five years is currently 6%, which compares favorably with the industry's growth rate of 5.6%. It has a trailing four-quarter earnings surprise of 10.7%, on average. Valued at around $56.7 billion, VLO has gained 32.9% in a year.

Marathon Petroleum MPC has an Earnings ESP of +7.68% and a Zacks Rank #3. The firm is scheduled to release earnings on Apr 30.

Marathon Petroleum beat the Zacks Consensus Estimate for earnings in each of the last four quarters. It has a trailing four-quarter earnings surprise of 24%, on average. Valued at around $74.6 billion, MPC has surged 58% in a year.

Diamondback Energy FANG has an Earnings ESP of +1.60% and a Zacks Rank #3. The firm is scheduled to release earnings on Apr 30.

The 2024 Zacks Consensus Estimate for Diamondback Energy indicates 3.9% year-over-year earnings per share growth. It has a trailing four-quarter earnings surprise of 0.7%, on average. Valued at around $36.6 billion, FANG has gone up 41% in a year.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Halliburton Company (HAL) : Free Stock Analysis Report

Valero Energy Corporation (VLO) : Free Stock Analysis Report

Marathon Petroleum Corporation (MPC) : Free Stock Analysis Report

Diamondback Energy, Inc. (FANG) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance