If You Had Bought Maui Land & Pineapple Company (NYSE:MLP) Stock Five Years Ago, You Could Pocket A 75% Gain Today

If you buy and hold a stock for many years, you'd hope to be making a profit. Better yet, you'd like to see the share price move up more than the market average. Unfortunately for shareholders, while the Maui Land & Pineapple Company, Inc. (NYSE:MLP) share price is up 75% in the last five years, that's less than the market return. Zooming in, the stock is up just 1.1% in the last year.

View our latest analysis for Maui Land & Pineapple Company

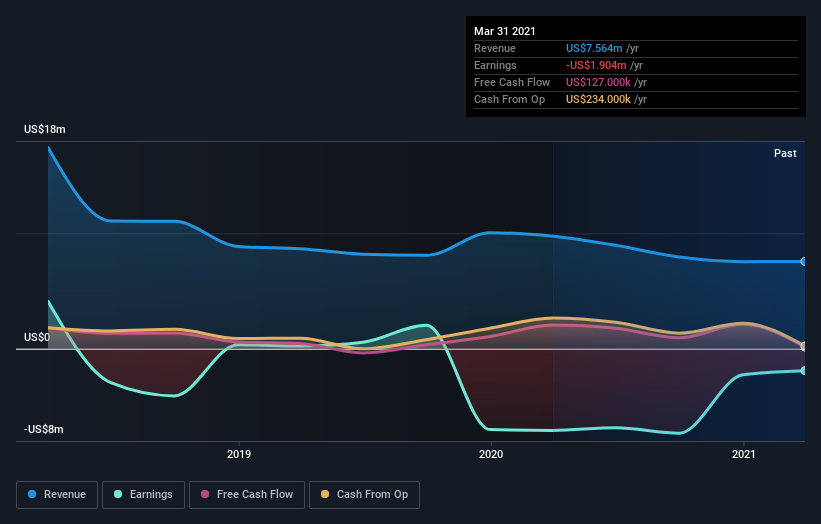

Given that Maui Land & Pineapple Company didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last 5 years Maui Land & Pineapple Company saw its revenue shrink by 39% per year. The falling revenue is arguably somewhat reflected in the lacklustre return of 12% per year over that time. Arguably that's not bad given the soft revenue and loss-making position. We'd keep an eye on changes in the trend - there may be an opportunity if the company returns to growth.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on Maui Land & Pineapple Company's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Maui Land & Pineapple Company shareholders gained a total return of 1.1% during the year. But that was short of the market average. If we look back over five years, the returns are even better, coming in at 12% per year for five years. Maybe the share price is just taking a breather while the business executes on its growth strategy. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should be aware of the 1 warning sign we've spotted with Maui Land & Pineapple Company .

But note: Maui Land & Pineapple Company may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance