If You Had Bought Indiva (CVE:NDVA) Stock A Year Ago, You'd Be Sitting On A 33% Loss, Today

Indiva Limited (CVE:NDVA) shareholders should be happy to see the share price up 15% in the last week. But that doesn't change the fact that the returns over the last year have been less than pleasing. The cold reality is that the stock has dropped 33% in one year, under-performing the market.

See our latest analysis for Indiva

We don't think Indiva's revenue of CA$658,715 is enough to establish significant demand. You have to wonder why venture capitalists aren't funding it. So it seems that the investors focused more on what could be, than paying attention to the current revenues (or lack thereof). It seems likely some shareholders believe that Indiva will significantly advance the business plan before too long.

As a general rule, if a company doesn't have much revenue, and it loses money, then it is a high risk investment. There is almost always a chance they will need to raise more capital, and their progress - and share price - will dictate how dilutive that is to current holders. While some companies like this go on to deliver on their plan, making good money for shareholders, many end in painful losses and eventual de-listing.

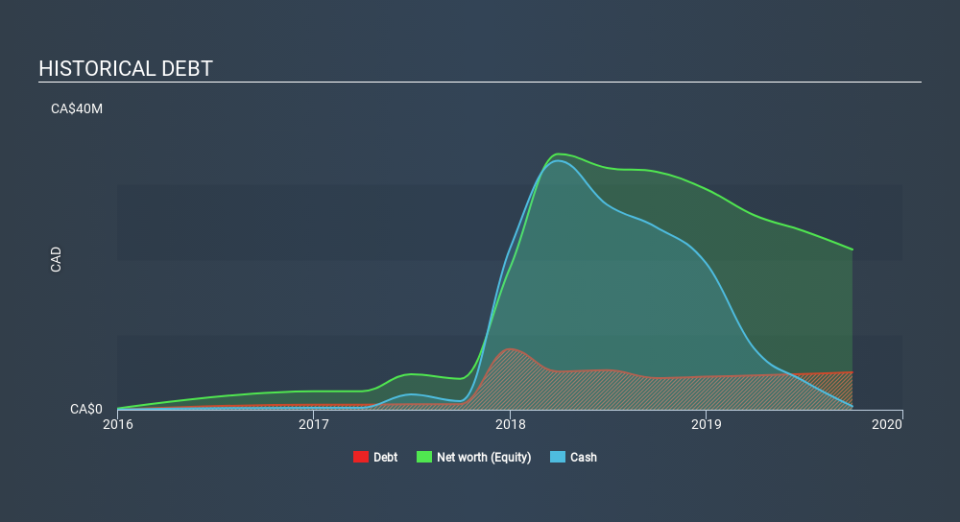

Indiva had liabilities exceeding cash by CA$9.2m when it last reported in September 2019, according to our data. That makes it extremely high risk, in our view. But with the share price diving 33% in the last year , it's probably fair to say that some shareholders no longer believe the company will succeed. You can see in the image below, how Indiva's cash levels have changed over time (click to see the values). The image below shows how Indiva's balance sheet has changed over time; if you want to see the precise values, simply click on the image.

It can be extremely risky to invest in a company that doesn't even have revenue. There's no way to know its value easily. Would it bother you if insiders were selling the stock? I would feel more nervous about the company if that were so. You can click here to see if there are insiders selling.

A Different Perspective

Given that the market gained 14% in the last year, Indiva shareholders might be miffed that they lost 33%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The share price decline has continued throughout the most recent three months, down 5.2%, suggesting an absence of enthusiasm from investors. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Be aware that Indiva is showing 7 warning signs in our investment analysis , and 3 of those are concerning...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance