If You Had Bought Excellon Resources (TSE:EXN) Stock Three Years Ago, You'd Be Sitting On A 57% Loss, Today

The truth is that if you invest for long enough, you're going to end up with some losing stocks. But long term Excellon Resources Inc. (TSE:EXN) shareholders have had a particularly rough ride in the last three year. Regrettably, they have had to cope with a 57% drop in the share price over that period. More recently, the share price has dropped a further 22% in a month.

Check out our latest analysis for Excellon Resources

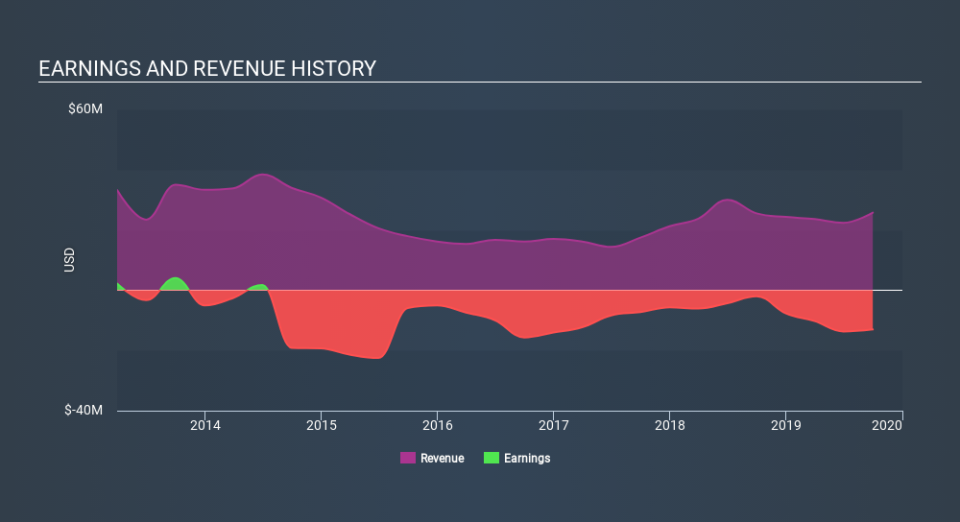

Excellon Resources wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over three years, Excellon Resources grew revenue at 17% per year. That's a fairly respectable growth rate. That contrasts with the weak share price, which has fallen 25% compounded, over three years. To be frank we're surprised to see revenue growth and share price growth diverge so strongly. It would be well worth taking a closer look at the company, to determine growth trends (and balance sheet strength).

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

While the broader market gained around 9.6% in the last year, Excellon Resources shareholders lost 18%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 0.2% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Excellon Resources better, we need to consider many other factors. Take risks, for example - Excellon Resources has 5 warning signs we think you should be aware of.

Excellon Resources is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance