If You Had Bought Digital Turbine (NASDAQ:APPS) Shares A Year Ago You'd Have Made 447%

While some are satisfied with an index fund, active investors aim to find truly magnificent investments on the stock market. When you find (and hold) a big winner, you can markedly improve your finances. For example, the Digital Turbine, Inc. (NASDAQ:APPS) share price is up a whopping 447% in the last year, a handsome return in a single year. Also pleasing for shareholders was the 65% gain in the last three months. Also impressive, the stock is up 427% over three years, making long term shareholders happy, too.

See our latest analysis for Digital Turbine

Digital Turbine isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Digital Turbine grew its revenue by 37% last year. We respect that sort of growth, no doubt. Arguably it's more than reflected in the truly wondrous share price gain of 447% in the last year. While we are always careful about jumping on a hot stock too late, there's certainly good reason to keep an eye on Digital Turbine.

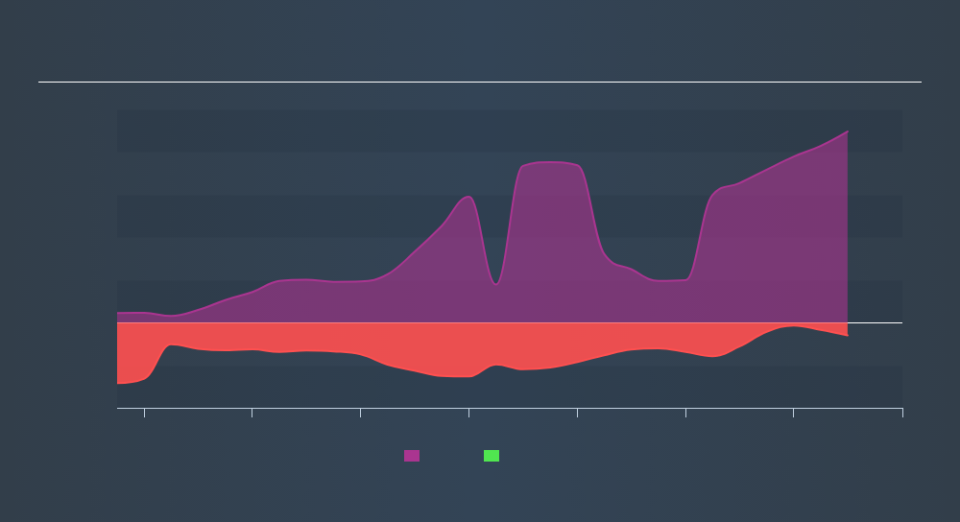

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. So it makes a lot of sense to check out what analysts think Digital Turbine will earn in the future (free profit forecasts).

A Different Perspective

It's nice to see that Digital Turbine shareholders have received a total shareholder return of 447% over the last year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 6.1% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance